NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Strategic <strong>Report</strong><br />

19<br />

Financial review<br />

(continued)<br />

Taxation<br />

The tax charge of £43.4m (2014: £28.2m) was at an<br />

effective rate of 21.7% (2014: 17.9%). This is higher than<br />

the headline rate of 21%, mainly reflecting the goodwill<br />

impairment charge, which is not tax deductible, partly offset<br />

by a patent box claim relating to air traffic control software.<br />

The prior year also included the deferred tax impact of the<br />

reduction in the corporation tax rate to 20% from April<br />

<strong>2015</strong>.<br />

<strong>NATS</strong> taxes generally arise in the UK, though it undertakes<br />

business in other countries. Wherever we operate we<br />

organise our operations to pay the correct and appropriate<br />

amount of tax at the right time, according to relevant<br />

national laws, and ensure compliance with the group’s tax<br />

policies and guidelines. The group’s tax strategy is reviewed<br />

annually by a Tax Committee and covers the application<br />

of all direct and indirect taxes to our business including<br />

corporation tax, payroll taxes and value added tax.<br />

The Tax Committee comprises the Finance Director, the<br />

Head of Tax and other senior finance professionals and<br />

takes advice from a professional firm.<br />

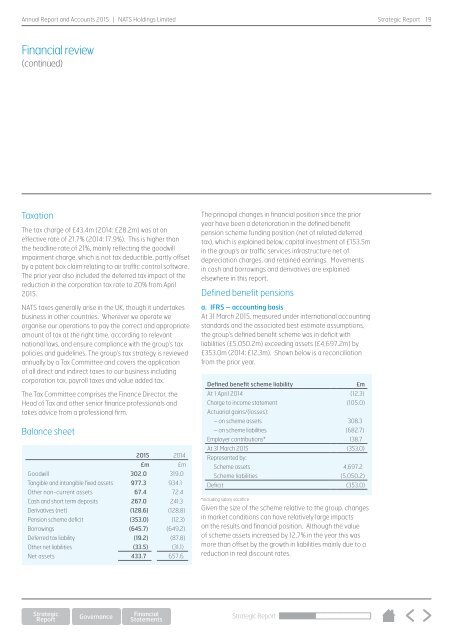

Balance sheet<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Goodwill 302.0 319.0<br />

Tangible and intangible fixed assets 977.3 934.1<br />

Other non-current assets 67.4 72.4<br />

Cash and short term deposits 267.0 241.3<br />

Derivatives (net) (128.6) (128.8)<br />

Pension scheme deficit (353.0) (12.3)<br />

Borrowings (645.7) (649.2)<br />

Deferred tax liability (19.2) (87.8)<br />

Other net liabilities (33.5) (31.1)<br />

Net assets 433.7 657.6<br />

The principal changes in financial position since the prior<br />

year have been a deterioration in the defined benefit<br />

pension scheme funding position (net of related deferred<br />

tax), which is explained below, capital investment of £153.5m<br />

in the group’s air traffic services infrastructure net of<br />

depreciation charges, and retained earnings. Movements<br />

in cash and borrowings and derivatives are explained<br />

elsewhere in this report.<br />

Defined benefit pensions<br />

a. IFRS – accounting basis<br />

At 31 March <strong>2015</strong>, measured under international accounting<br />

standards and the associated best estimate assumptions,<br />

the group’s defined benefit scheme was in deficit with<br />

liabilities (£5,050.2m) exceeding assets (£4,697.2m) by<br />

£353.0m (2014: £12.3m). Shown below is a reconciliation<br />

from the prior year.<br />

Defined benefit scheme liability £m<br />

At 1 April 2014 (12.3)<br />

Charge to income statement (105.0)<br />

Actuarial gains/(losses):<br />

– on scheme assets 308.3<br />

– on scheme liabilities (682.7)<br />

Employer contributions* 138.7<br />

At 31 March <strong>2015</strong> (353.0)<br />

Represented by:<br />

Scheme assets 4,697.2<br />

Scheme liabilities (5,050.2)<br />

Deficit (353.0)<br />

*including salary sacrifice<br />

Given the size of the scheme relative to the group, changes<br />

in market conditions can have relatively large impacts<br />

on the results and financial position. Although the value<br />

of scheme assets increased by 12.7% in the year this was<br />

more than offset by the growth in liabilities mainly due to a<br />

reduction in real discount rates.<br />

Strategic <strong>Report</strong>