NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 128<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

19. Financial instruments (continued)<br />

Liquidity risk management<br />

The responsibility for liquidity risk management, the risk that the group will have insufficient funds to meet its obligations as they fall due,<br />

rests with the Board with oversight provided by the Treasury Committee. The group manages liquidity by maintaining adequate reserves<br />

and borrowing facilities by monitoring actual and forecast cash flows, including contributions to the defined benefit pension scheme,<br />

and ensuring funding is diversified by source and maturity and available at competitive cost. Specific liquidity policies are maintained for<br />

NERL. <strong>NATS</strong> Services and <strong>NATS</strong> Limited had no debt at the year end.<br />

With regard to NERL, the group’s policy is to:<br />

a. maintain free cash equal to between one and two months of UK en route services revenues (see below). Free cash is defined as cash<br />

and cash equivalents and short term investments, excluding a debt service reserve account of £29.7m used to fund interest, fees and<br />

bond amortisation payments scheduled in the next six months and a liquidity reserve account of £21.3m held to provide liquidity in the<br />

event of certain pre-defined circumstances, particularly to ensure compliance with financial covenants;<br />

b. ensure access to bank facilities sufficient to meet 110% of forecast requirements that are not otherwise covered by operating cash<br />

flows or other sources of finance through the period of the business plan. At 31 March <strong>2015</strong> NERL had access to bank facilities<br />

totalling £275m available until 21 December 2016. The facilities comprise a £245m revolving term loan facility and a £30m revolving<br />

credit facility;<br />

c. ensure access to long term funding to finance its long term assets. This is achieved in the form of a £600m amortising sterling bond<br />

with a final maturity date of 2026;<br />

d. ensure that the ratio of bank funding to total gross borrowings does not exceed 75%; and<br />

e. maintain a portfolio of debt diversified by source and maturity. This is achieved through the issuance of a £600m sterling bond that<br />

started to amortise in 2012 and has a final maturity date of 2026 and by having available shorter dated committed bank facilities.<br />

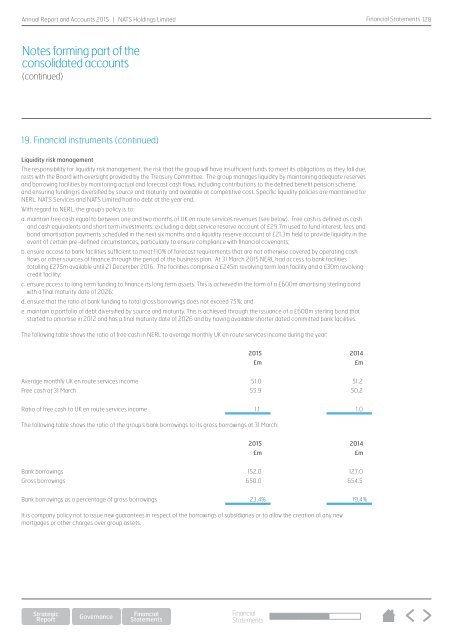

The following table shows the ratio of free cash in NERL to average monthly UK en route services income during the year:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Average monthly UK en route services income 51.0 51.2<br />

Free cash at 31 March 55.9 50.2<br />

Ratio of free cash to UK en route services income 1.1 1.0<br />

The following table shows the ratio of the group’s bank borrowings to its gross borrowings at 31 March:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Bank borrowings 152.0 127.0<br />

Gross borrowings 650.0 654.5<br />

Bank borrowings as a percentage of gross borrowings 23.4% 19.4%<br />

It is company policy not to issue new guarantees in respect of the borrowings of subsidiaries or to allow the creation of any new<br />

mortgages or other charges over group assets.<br />

Financial<br />

Statements