NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 117<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

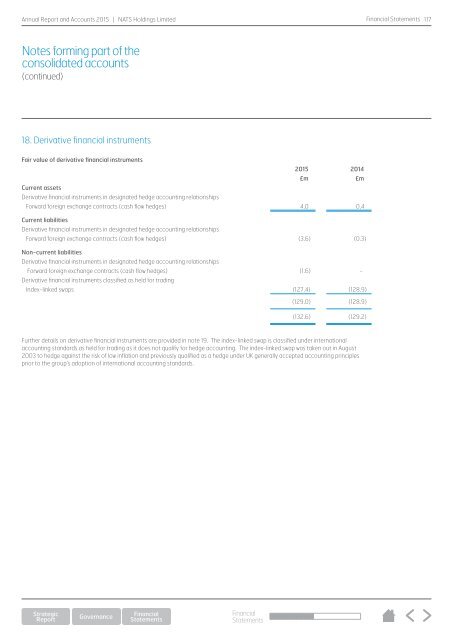

18. Derivative financial instruments<br />

Fair value of derivative financial instruments<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Current assets<br />

Derivative financial instruments in designated hedge accounting relationships<br />

Forward foreign exchange contracts (cash flow hedges) 4.0 0.4<br />

Current liabilities<br />

Derivative financial instruments in designated hedge accounting relationships<br />

Forward foreign exchange contracts (cash flow hedges) (3.6) (0.3)<br />

Non-current liabilities<br />

Derivative financial instruments in designated hedge accounting relationships<br />

Forward foreign exchange contracts (cash flow hedges) (1.6) -<br />

Derivative financial instruments classified as held for trading<br />

Index-linked swaps (127.4) (128.9)<br />

(129.0) (128.9)<br />

(132.6) (129.2)<br />

Further details on derivative financial instruments are provided in note 19. The index-linked swap is classified under international<br />

accounting standards as held for trading as it does not qualify for hedge accounting. The index-linked swap was taken out in August<br />

2003 to hedge against the risk of low inflation and previously qualified as a hedge under UK generally accepted accounting principles<br />

prior to the group’s adoption of international accounting standards.<br />

Financial<br />

Statements