NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 139<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

28. Retirement benefit schemes<br />

Defined contribution scheme<br />

The group provides a defined contribution scheme to all qualifying employees who are not members of the defined benefit scheme.<br />

The assets of the scheme are held separately from those of the group in funds under the control of a board of Trustees.<br />

The group operates a salary sacrifice arrangement whereby employees sacrifice an element of their salary in favour of contributions<br />

to the pension scheme. <strong>NATS</strong> operates a number of contribution structures. In general, <strong>NATS</strong> matches employee contributions to the<br />

scheme in a ratio of 2:1, up to a maximum employer contribution of 18%. For the year ended 31 March <strong>2015</strong> employer contributions of<br />

£5.0m (2014: £3.9m), excluding employee salary sacrifice contributions of £2.4m (2014: £2.0m), represented 14.1% of pensionable pay<br />

(2014: 13.6%).<br />

The defined contribution scheme had 737 members at 31 March <strong>2015</strong> (2014: 672).<br />

Defined benefit scheme<br />

<strong>NATS</strong> Limited (formerly National Air Traffic Services Limited), the company’s wholly-owned subsidiary, entered into a deed of adherence<br />

with the CAA and the Trustees of the Civil Aviation Authority Pension Scheme (CAAPS) whereby the company was admitted to participate<br />

in CAAPS from 1 April 1996. CAAPS is a fully funded defined benefit scheme providing benefits based on final pensionable salaries. At 31<br />

March 2001, the business of <strong>NATS</strong> was separated from the CAA. As a consequence, <strong>NATS</strong> became a ‘non associated employer’ which<br />

requires the assets relating to the liabilities of <strong>NATS</strong> active employees at 31 March 2001 to be separately identified within the CAAPS.<br />

CAAPS was divided into two sections to accommodate this, namely the CAA section and the <strong>NATS</strong> section, and a series of common<br />

investment funds was established in which both sections participate for investment purposes. The assets and membership of the scheme<br />

prior to transfer were allocated between these sections in accordance with Statutory Instrument 2001 Number 853, Transport Act 2000<br />

(Civil Aviation Authority Pension Scheme) Order 2001. The assets of the scheme are held in a separate trustee administered fund. CAAPS<br />

is governed by a board of Trustees which is responsible for implementing the funding and investment strategy. The board comprises 6<br />

employer (<strong>NATS</strong> and CAA) and 6 member-nominated trustees, as well as an independent chairman.<br />

During 2009 the group introduced a number of reforms to manage the cost and risk of pensions. The defined benefit pension scheme<br />

was closed to new joiners with effect from 31 March 2009. In addition, from 1 January 2009, annual increases in pensionable salaries<br />

were limited to a maximum increase in the retail prices index (RPI) plus 0.5%. A defined contribution scheme was also introduced for new<br />

joiners (see above). Finally, pension salary sacrifice arrangements were introduced with effect from 1 April 2009.<br />

During 2013 the group consulted on further pension reforms to mitigate rising pension costs. These included a change to the limit on<br />

annual increases in pensionable salaries to a maximum of the consumer prices index (CPI) plus 0.25%. In addition, the Trustees consulted<br />

members of the scheme on a change to the indexation of future service at CPI, rather than RPI. These reforms were agreed by staff.<br />

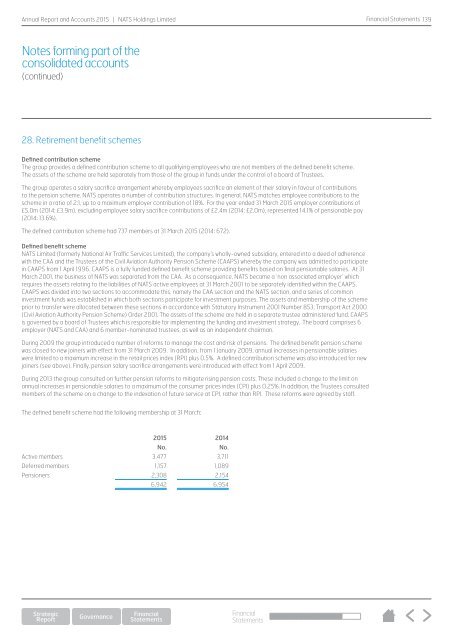

The defined benefit scheme had the following membership at 31 March:<br />

<strong>2015</strong> 2014<br />

No.<br />

No.<br />

Active members 3,477 3,711<br />

Deferred members 1,157 1,089<br />

Pensioners 2,308 2,154<br />

6,942 6,954<br />

Financial<br />

Statements