NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Strategic <strong>Report</strong><br />

15<br />

Financial review<br />

(continued)<br />

Regulatory return<br />

We assess the performance of NERL’s regulated activities<br />

by reference to the regulatory settlement. For the four<br />

years of CP3, NERL achieved a pre-tax real return of just<br />

over 8% compared with the regulatory return of 6.76%<br />

assumed in the regulatory settlement. This was mainly<br />

achieved through service performance incentives and<br />

operating cost efficiencies which offset the impact of lower<br />

traffic volumes.<br />

The cost of capital for RP2 has been set at 5.86% (pretax<br />

real) which, together with challenging cost efficiency<br />

targets, will result in a reduction in NERL’s revenue and is<br />

also very likely to result in lower regulatory profit in RP2.<br />

Comparison between reported profit<br />

and regulatory return<br />

The profits reported in these financial statements are<br />

prepared in accordance with International Financial<br />

<strong>Report</strong>ing Standard (IFRS) and policies described in note 2<br />

to these accounts. As described above, the CAA applies an<br />

economic regulatory building block model which is mainly<br />

cash-based. It can give rise to some significant differences<br />

between reported operating profit and regulatory return,<br />

mainly due to:<br />

> lower historical cost depreciation compared with<br />

regulatory depreciation which is indexed to inflation; and<br />

> lower accounting pension costs using best estimate<br />

assumptions prescribed by accounting standards<br />

compared with the cash contributions agreed with<br />

Trustees, which include a margin for prudence.<br />

This difference in basis explains why NERL’s reported<br />

operating profit is some £78m higher than its regulatory<br />

profit. This regulatory view is set out in NERL’s audited<br />

published regulatory accounts.<br />

Revenue<br />

Revenue increased by £4.8m to £922.4m (2014: £917.6m).<br />

The RP2 settlement, which applied from January <strong>2015</strong>, is<br />

reducing UK en route revenue allowances but during the<br />

year this was offset by the combined effects of air traffic<br />

volume growth, service quality incentives, airport contract<br />

indexation and the benefit of Project Marshall.<br />

These and other factors are described in the Review<br />

of service line performance.<br />

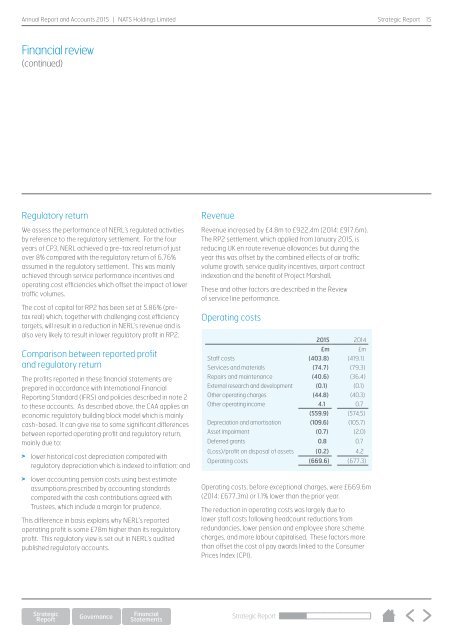

Operating costs<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Staff costs (403.8) (419.1)<br />

Services and materials (74.7) (79.3)<br />

Repairs and maintenance (40.6) (36.4)<br />

External research and development (0.1) (0.1)<br />

Other operating charges (44.8) (40.3)<br />

Other operating income 4.1 0.7<br />

(559.9) (574.5)<br />

Depreciation and amortisation (109.6) (105.7)<br />

Asset impairment (0.7) (2.0)<br />

Deferred grants 0.8 0.7<br />

(Loss)/profit on disposal of assets (0.2) 4.2<br />

Operating costs (669.6) (677.3)<br />

Operating costs, before exceptional charges, were £669.6m<br />

(2014: £677.3m) or 1.1% lower than the prior year.<br />

The reduction in operating costs was largely due to<br />

lower staff costs following headcount reductions from<br />

redundancies, lower pension and employee share scheme<br />

charges, and more labour capitalised. These factors more<br />

than offset the cost of pay awards linked to the Consumer<br />

Prices Index (CPI).<br />

Strategic <strong>Report</strong>