NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements<br />

111<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

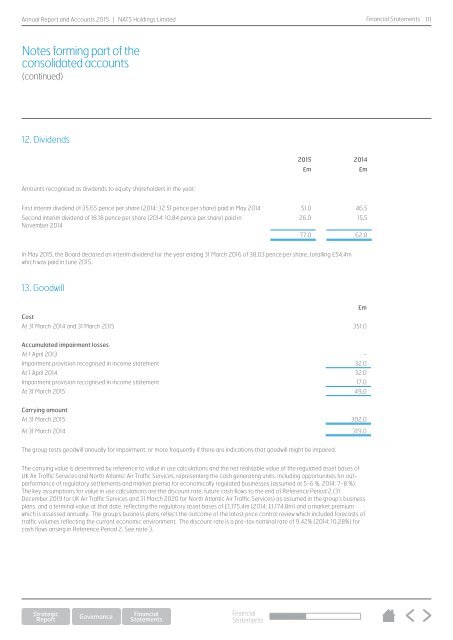

12. Dividends<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Amounts recognised as dividends to equity shareholders in the year:<br />

First interim dividend of 35.65 pence per share (2014: 32.51 pence per share) paid in May 2014 51.0 46.5<br />

Second interim dividend of 18.18 pence per share (2014: 10.84 pence per share) paid in<br />

26.0 15.5<br />

November 2014<br />

77.0 62.0<br />

In May <strong>2015</strong>, the Board declared an interim dividend for the year ending 31 March 2016 of 38.03 pence per share, totalling £54.4m<br />

which was paid in June <strong>2015</strong>.<br />

13. Goodwill<br />

£m<br />

Cost<br />

At 31 March 2014 and 31 March <strong>2015</strong> 351.0<br />

Accumulated impairment losses<br />

At 1 April 2013 -<br />

Impairment provision recognised in income statement 32.0<br />

At 1 April 2014 32.0<br />

Impairment provision recognised in income statement 17.0<br />

At 31 March <strong>2015</strong> 49.0<br />

Carrying amount<br />

At 31 March <strong>2015</strong> 302.0<br />

At 31 March 2014 319.0<br />

The group tests goodwill annually for impairment, or more frequently if there are indications that goodwill might be impaired.<br />

The carrying value is determined by reference to value in use calculations and the net realisable value of the regulated asset bases of<br />

UK Air Traffic Services and North Atlantic Air Traffic Services, representing the cash generating units, including opportunities for outperformance<br />

of regulatory settlements and market premia for economically regulated businesses (assumed at 5-6 %, 2014: 7-8 %).<br />

The key assumptions for value in use calculations are the discount rate, future cash flows to the end of Reference Period 2 (31<br />

December 2019 for UK Air Traffic Services and 31 March 2020 for North Atlantic Air Traffic Services) as assumed in the group’s business<br />

plans, and a terminal value at that date, reflecting the regulatory asset bases of £1,175.4m (2014: £1,174.8m) and a market premium<br />

which is assessed annually. The group’s business plans reflect the outcome of the latest price control review which included forecasts of<br />

traffic volumes reflecting the current economic environment. The discount rate is a pre-tax nominal rate of 9.42% (2014: 10.28%) for<br />

cash flows arising in Reference Period 2. See note 3.<br />

Financial<br />

Statements