recent developments in high frequency financial ... - Index of

recent developments in high frequency financial ... - Index of

recent developments in high frequency financial ... - Index of

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A multivariate <strong>in</strong>teger count hurdle model 45<br />

The unconditional bivariate histogram <strong>of</strong> the simulated time series is presented<br />

<strong>in</strong> Fig. 9. Although the positive dependence between the marg<strong>in</strong>al processes is<br />

reflected, the shape <strong>of</strong> the histogram does not correspond to the empirical one<br />

<strong>in</strong> full (see Fig. 1). In particular the <strong>frequency</strong> <strong>of</strong> the outcome (0, 0) has been<br />

considerably underestimated. We compute the differences between the histograms<br />

<strong>of</strong> the empirical and the simulated data to <strong>in</strong>fer <strong>in</strong> which po<strong>in</strong>ts (i,j) the observed<br />

and the estimated probabilities disagree. To assess these differences graphically,<br />

we plotted <strong>in</strong> Fig. 10 only positive differences and <strong>in</strong> Fig. 11 only absolute negative<br />

differences. Besides the outcome probability <strong>of</strong> (0, 0), the probabilities for po<strong>in</strong>ts<br />

(i,j) concentrated around (0,0) are a little bit underestimated (positive differences<br />

<strong>in</strong> Fig. 10) as well, and the probabilities for po<strong>in</strong>ts (i,j) which are a little further<br />

away from (0,0) are a little overestimated (negative differences <strong>in</strong> Fig. 11). Thus,<br />

we conclude that we underestimate the kurtosis <strong>of</strong> the empirical distribution. The<br />

real data is much more concentrated <strong>in</strong> the outcome (0,0), as well as evidenc<strong>in</strong>g<br />

much fatter tails. There is a clear signal for a tail dependency <strong>in</strong> the data generat<strong>in</strong>g<br />

process, as the extreme positive or negative movements <strong>of</strong> the exchange rates take<br />

place much more <strong>of</strong>ten than could be expla<strong>in</strong>ed by a standard Gaussian copula<br />

function (see Fig. 10).<br />

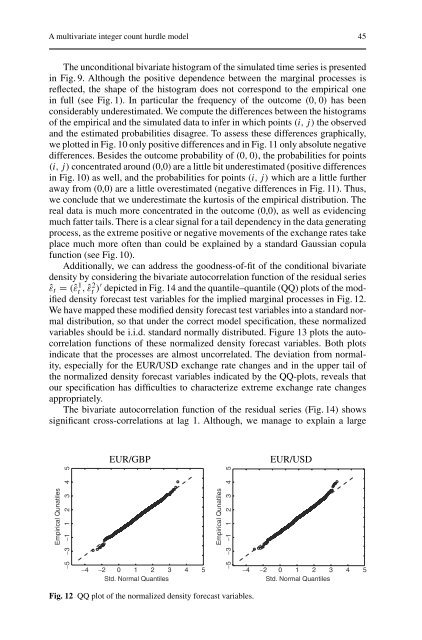

Additionally, we can address the goodness-<strong>of</strong>-fit <strong>of</strong> the conditional bivariate<br />

density by consider<strong>in</strong>g the bivariate autocorrelation function <strong>of</strong> the residual series<br />

ˆεt = (ˆε 1 t , ˆε2 t )′ depicted <strong>in</strong> Fig. 14 and the quantile–quantile (QQ) plots <strong>of</strong> the modified<br />

density forecast test variables for the implied marg<strong>in</strong>al processes <strong>in</strong> Fig. 12.<br />

We have mapped these modified density forecast test variables <strong>in</strong>to a standard normal<br />

distribution, so that under the correct model specification, these normalized<br />

variables should be i.i.d. standard normally distributed. Figure 13 plots the autocorrelation<br />

functions <strong>of</strong> these normalized density forecast variables. Both plots<br />

<strong>in</strong>dicate that the processes are almost uncorrelated. The deviation from normality,<br />

especially for the EUR/USD exchange rate changes and <strong>in</strong> the upper tail <strong>of</strong><br />

the normalized density forecast variables <strong>in</strong>dicated by the QQ-plots, reveals that<br />

our specification has difficulties to characterize extreme exchange rate changes<br />

appropriately.<br />

The bivariate autocorrelation function <strong>of</strong> the residual series (Fig. 14) shows<br />

significant cross-correlations at lag 1. Although, we manage to expla<strong>in</strong> a large<br />

Empirical Qunatiles<br />

−5 −3 −1 1 2 3 4 5<br />

−4<br />

EUR/GBP EUR/USD<br />

Empirical Qunatiles<br />

−5 −3 −1 1 2 3 4 5<br />

−2 0 1 2 3 4 5 −4<br />

Std. Normal Quantiles<br />

Fig. 12 QQ plot <strong>of</strong> the normalized density forecast variables.<br />

−2 0 1 2 3 4 5<br />

Std. Normal Quantiles