DTL Manual of TA/DA Rules - Delhi

DTL Manual of TA/DA Rules - Delhi

DTL Manual of TA/DA Rules - Delhi

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

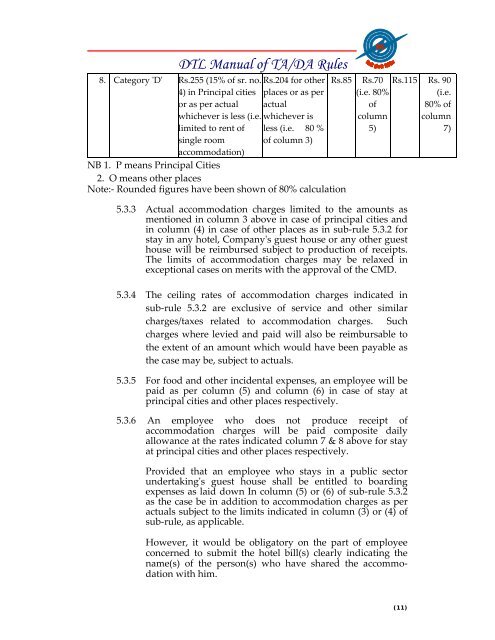

<strong>DTL</strong> <strong>Manual</strong> <strong>of</strong> <strong>TA</strong>/<strong>DA</strong> <strong>Rules</strong>8. Category ʹDʹ Rs.255 (15% <strong>of</strong> sr. no.4) in Principal citiesor as per actualwhichever is less (i.e.limited to rent <strong>of</strong>single roomaccommodation)Rs.204 for otherplaces or as peractualwhichever isless (i.e. 80 %<strong>of</strong> column 3)Rs.85NB 1. P means Principal Cities2. O means other placesNote:‐ Rounded figures have been shown <strong>of</strong> 80% calculationRs.70(i.e. 80%<strong>of</strong>column5)5.3.3 Actual accommodation charges limited to the amounts asmentioned in column 3 above in case <strong>of</strong> principal cities andin column (4) in case <strong>of</strong> other places as in sub‐rule 5.3.2 forstay in any hotel, Companyʹs guest house or any other guesthouse will be reimbursed subject to production <strong>of</strong> receipts.The limits <strong>of</strong> accommodation charges may be relaxed inexceptional cases on merits with the approval <strong>of</strong> the CMD.5.3.4 The ceiling rates <strong>of</strong> accommodation charges indicated insub‐rule 5.3.2 are exclusive <strong>of</strong> service and other similarcharges/taxes related to accommodation charges. Suchcharges where levied and paid will also be reimbursable tothe extent <strong>of</strong> an amount which would have been payable asthe case may be, subject to actuals.5.3.5 For food and other incidental expenses, an employee will bepaid as per column (5) and column (6) in case <strong>of</strong> stay atprincipal cities and other places respectively.5.3.6 An employee who does not produce receipt <strong>of</strong>accommodation charges will be paid composite dailyallowance at the rates indicated column 7 & 8 above for stayat principal cities and other places respectively.Provided that an employee who stays in a public sectorundertakingʹs guest house shall be entitled to boardingexpenses as laid down In column (5) or (6) <strong>of</strong> sub‐rule 5.3.2as the case be in addition to accommodation charges as peractuals subject to the limits indicated in column (3) or (4) <strong>of</strong>sub‐rule, as applicable.However, it would be obligatory on the part <strong>of</strong> employeeconcerned to submit the hotel bill(s) clearly indicating thename(s) <strong>of</strong> the person(s) who have shared the accommodationwith him.Rs.115 Rs. 90(i.e.80% <strong>of</strong>column7)(11)