You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Portuguese Banks II<br />

Banks<br />

200<br />

vvdsvdvsdy<br />

190<br />

180<br />

170<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

---------- Stoxx Banks,<br />

Analyst(s):<br />

DJ Stoxx TMI rebased on sector<br />

André Rodrigues Caixa-Banco de Investimento<br />

andre.rodrigues@caixabi.pt<br />

+351 21 389 68 39<br />

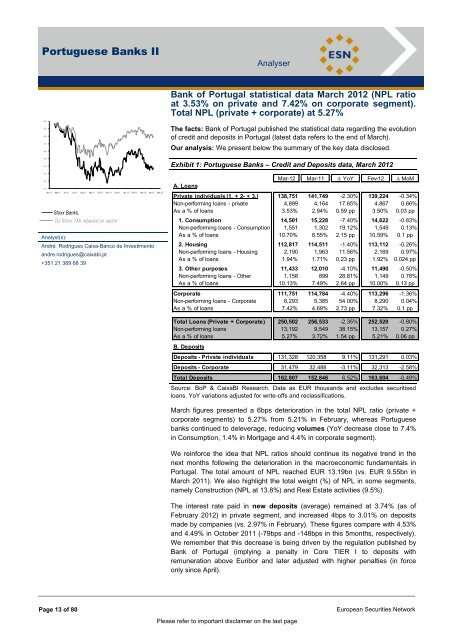

A. Loans<br />

Page 13 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

Mar-12 Mar-11 YoY Fev-12 MoM<br />

Private individuals (1. + 2- + 3.) 138,751 141,749 -2.30% 139,224 -0.34%<br />

Non-performing loans - private 4,899 4,164 17.65% 4,867 0.66%<br />

As a % of loans 3.53% 2.94% 0.59 pp 3.50% 0.03 pp<br />

1. Consumption 14,501 15,228 -7.40% 14,622 -0.83%<br />

Non-performing loans - Consumption 1,551 1,302 19.12% 1,549 0.13%<br />

As a % of loans 10.70% 8.55% 2.15 pp 10.59% 0.1 pp<br />

2. Housing 112,817 114,511 -1.40% 113,112 -0.26%<br />

Non-performing loans - Housing 2,190 1,963 11.56% 2,169 0.97%<br />

As a % of loans 1.94% 1.71% 0.23 pp 1.92% 0.024 pp<br />

3. Other purposes 11,433 12,010 -4.10% 11,490 -0.50%<br />

Non-performing loans - Other 1,158 899 28.81% 1,149 0.78%<br />

As a % of loans 10.13% 7.49% 2.64 pp 10.00% 0.13 pp<br />

Corporate 111,751 114,784 -4.40% 113,296 -1.36%<br />

Non-performing loans - Corporate 8,293 5,385 54.00% 8,290 0.04%<br />

As a % of loans 7.42% 4.69% 2.73 pp 7.32% 0.1 pp<br />

Total Loans (Private + Corporate) 250,502 256,533 -2.35% 252,520 -0.80%<br />

Non-performing loans 13,192 9,549 38.15% 13,157 0.27%<br />

As a % of loans 5.27% 3.72% 1.54 pp 5.21% 0.06 pp<br />

B. Deposits<br />

Analyser<br />

Bank of Portugal statistical data March 2012 (NPL ratio<br />

at 3.53% on private and 7.42% on corporate segment).<br />

Total NPL (private + corporate) at 5.27%<br />

The facts: Bank of Portugal published the statistical data regarding the evolution<br />

of credit and deposits in Portugal (latest data refers to the end of March).<br />

Our analysis: We present below the summary of the key data disclosed.<br />

Exhibit 1: Portuguese Banks – Credit and Deposits data, March 2012<br />

Deposits - Private individuals 131,328 120,358 9.11% 131,291 0.03%<br />

Deposits - Corporate 31,479 32,488 -3.11% 32,313 -2.58%<br />

Total Deposits 162,807 152,846 6.52% 163,604 -0.49%<br />

Source: BoP & CaixaBI Research. Data as EUR thousands and excludes securitised<br />

loans. YoY variations adjusted for write-offs and reclassifications.<br />

March figures presented a 6bps deterioration in the total NPL ratio (private +<br />

corporate segments) to 5.27% from 5.21% in February, whereas Portuguese<br />

banks continued to deleverage, reducing volumes (YoY decrease close to 7.4%<br />

in Consumption, 1.4% in Mortgage and 4.4% in corporate segment).<br />

We reinforce the idea that NPL ratios should continue its negative trend in the<br />

next months following the deterioration in the macroeconomic fundamentals in<br />

Portugal. The total amount of NPL reached EUR 13.19bn (vs. EUR 9.55bn in<br />

March 2011). We also highlight the total weight (%) of NPL in some segments,<br />

namely Construction (NPL at 13.8%) and Real Estate activities (9.5%).<br />

The interest rate paid in new deposits (average) remained at 3.74% (as of<br />

February 2012) in private segment, and increased 4bps to 3.01% on deposits<br />

made by companies (vs. 2.97% in February). These figures compare with 4.53%<br />

and 4.49% in October 2011 (-79bps and -148bps in this 5months, respectively).<br />

We remember that this decrease is being driven by the regulation published by<br />

Bank of Portugal (implying a penalty in Core TIER I to deposits with<br />

remuneration above Euribor and later adjusted with higher penalties (in force<br />

only since April).