You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LANXESS<br />

Germany/Chemicals Analyser<br />

LANXESS (Hold)<br />

Hold<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

58.99<br />

62.00<br />

LXSG.DE/LXS GY<br />

Market capitalisation (EURm) 4,908<br />

Current N° of shares (m) 83<br />

Free float 83%<br />

Daily avg. no. trad. sh. 12 mth 588,968<br />

Daily avg. trad. vol. 12 mth (m) 29<br />

Price high 12 mth (EUR) 63.05<br />

Price low 12 mth (EUR) 32.97<br />

Abs. perf. 1 mth -1.24%<br />

Abs. perf. 3 mth 9.28%<br />

Abs. perf. 12 mth -3.18%<br />

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 8,775 9,112 9,401<br />

EBITDA (m) 1,101 1,124 1,204<br />

EBITDA margin 12.5% 12.3% 12.8%<br />

EBIT (m) 776 672 741<br />

EBIT margin 8.8% 7.4% 7.9%<br />

Net Profit (adj.)(m) 538 458 517<br />

ROCE 11.9% 9.9% 10.8%<br />

Net debt/(cash) (m) 1,570 1,394 952<br />

Net Debt/Equity 0.8 0.6 0.3<br />

Debt/EBITDA 1.4 1.2 0.8<br />

Int. cover(EBITDA/Fin. int) 11.8 9.4 10.9<br />

EV/Sales 0.6 0.8 0.7<br />

EV/EBITDA 5.1 6.2 5.5<br />

EV/EBITDA (adj.) 4.9 6.0 5.3<br />

EV/EBIT 7.2 10.4 8.9<br />

P/E (adj.) 6.2 10.7 9.5<br />

P/BV 1.6 2.0 1.7<br />

OpFCF yield 12.7% 12.4% 15.4%<br />

Dividend yield 1.4% 1.5% 1.7%<br />

EPS (adj.) 6.46 5.51 6.22<br />

BVPS 24.73 29.06 34.04<br />

DPS 0.85 0.90 1.00<br />

65 vvdsvdvsdy<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

LANXESS MDAX (Rebased)<br />

Shareholders: Dodge & Cox 8%; JPMorgan 4%;<br />

Analyst(s):<br />

Nadeshda Demidova, Equinet Bank<br />

nadeshda.demidova@equinet-ag.de<br />

+49 69 58997 434<br />

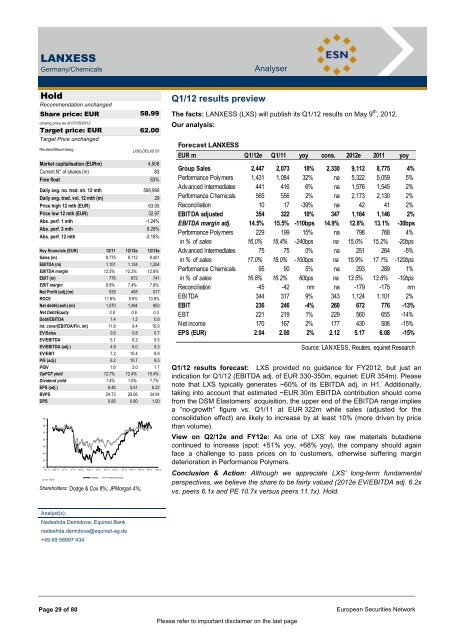

Q1/12 results preview<br />

The facts: LANXESS (LXS) will publish its Q1/12 results on May 9 th , 2012.<br />

Our analysis:<br />

Forecast LANXESS<br />

EUR m Q1/12e Q1/11 yoy cons. 2012e 2011 yoy<br />

Group Sales 2,447 2,073 18% 2,330 9,112 8,775 4%<br />

Performance Polymers 1,431 1,084 32% na 5,322 5,059 5%<br />

Advanced Intermediates 441 416 6% na 1,576 1,545 2%<br />

Performance Chemicals 565 556 2% na 2,173 2,130 2%<br />

Reconciliation 10 17 -39% na 42 41 2%<br />

EBITDA adjusted 354 322 10% 347 1,164 1,146 2%<br />

EBITDA margin adj. 14.5% 15.5% -110bps 14.9% 12.8% 13.1% -30bps<br />

Performance Polymers 229 199 15% na 798 768 4%<br />

in % of sales 16.0% 18.4% -240bps na 15.0% 15.2% -20bps<br />

Advanced Intermediates 75 75 0% na 251 264 -5%<br />

in % of sales 17.0% 18.0% -100bps na 15.9% 17.1% -120bps<br />

Performance Chemicals 95 90 5% na 293 289 1%<br />

in % of sales 16.8% 16.2% 60bps na 13.5% 13.6% -10bps<br />

Reconciliation -45 -42 nm na -179 -175 nm<br />

EBITDA 344 317 9% 343 1,124 1,101 2%<br />

EBIT 236 246 -4% 260 672 776 -13%<br />

EBT 221 219 1% 229 560 655 -14%<br />

Net income 170 167 2% 177 430 506 -15%<br />

EPS (EUR) 2.04 2.00 2% 2.12 5.17 6.08 -15%<br />

Q1/12 results forecast: LXS provided no guidance for FY2012, but just an<br />

indication for Q1/12 (EBITDA adj. of EUR 330-350m, equinet: EUR 354m). Please<br />

note that LXS typically generates ~60% of its EBITDA adj. in H1. Additionally,<br />

taking into account that estimated ~EUR 30m EBITDA contribution should come<br />

from the DSM Elastomers‟ acquisition, the upper end of the EBITDA range implies<br />

a “no-growth” figure vs. Q1/11 at EUR 322m while sales (adjusted for the<br />

consolidation effect) are likely to increase by at least 10% (more driven by price<br />

than volume).<br />

View on Q2/12e and FY12e: As one of LXS‟ key raw materials butadiene<br />

continued to increase (spot: +51% yoy, +68% yoy), the company should again<br />

face a challenge to pass prices on to customers, otherwise suffering margin<br />

deterioration in Performance Polymers.<br />

Conclusion & Action: Although we appreciate LXS‟ long-term fundamental<br />

perspectives, we believe the share to be fairly valued (2012e EV/EBITDA adj. 6.2x<br />

vs. peers 6.1x and PE 10.7x versus peers 11.1x). Hold.<br />

Page 29 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

Source: LANXESS, Reuters, equinet Research