Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Recordati<br />

Italy/Healthcare Analyser<br />

Recordati (Accumulate)<br />

Accumulate<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

5.21<br />

7.20<br />

RECI.MI/REC IM<br />

Market capitalisation (EURm) 1,088<br />

Current N° of shares (m) 209<br />

Free float 44%<br />

Daily avg. no. trad. sh. 12 mth 380,689<br />

Daily avg. trad. vol. 12 mth (m) 2<br />

Price high 12 mth (EUR) 7.81<br />

Price low 12 mth (EUR) 5.14<br />

Abs. perf. 1 mth -6.30%<br />

Abs. perf. 3 mth -13.97%<br />

Abs. perf. 12 mth -28.31%<br />

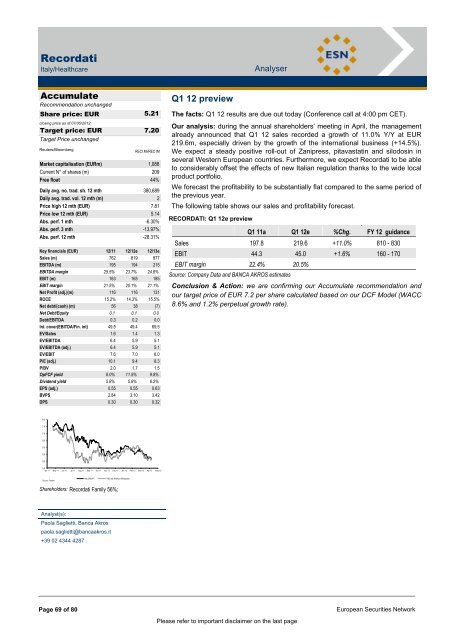

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 762 819 877<br />

EBITDA (m) 195 194 215<br />

EBITDA margin 25.5% 23.7% 24.6%<br />

EBIT (m) 163 165 185<br />

EBIT margin 21.5% 20.1% 21.1%<br />

Net Profit (adj.)(m) 116 116 131<br />

ROCE 15.2% 14.3% 15.5%<br />

Net debt/(cash) (m) 56 38 (7)<br />

Net Debt/Equity 0.1 0.1 0.0<br />

Debt/EBITDA 0.3 0.2 0.0<br />

Int. cover(EBITDA/Fin. int) 49.5 49.4 69.5<br />

EV/Sales 1.6 1.4 1.3<br />

EV/EBITDA 6.4 5.9 5.1<br />

EV/EBITDA (adj.) 6.4 5.9 5.1<br />

EV/EBIT 7.6 7.0 6.0<br />

P/E (adj.) 10.1 9.4 8.3<br />

P/BV 2.0 1.7 1.5<br />

OpFCF yield 8.0% 11.5% 9.8%<br />

Dividend yield 5.8% 5.8% 6.2%<br />

EPS (adj.) 0.55 0.55 0.63<br />

BVPS 2.84 3.10 3.42<br />

DPS 0.30 0.30 0.32<br />

8.0 vvdsvdvsdy<br />

7.5<br />

7.0<br />

6.5<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

RECORDATI FTSE Italy All Share (Rebased)<br />

Shareholders: Recordati Family 56%;<br />

Analyst(s):<br />

Paola Saglietti, Banca Akros<br />

paola.saglietti@bancaakros.it<br />

+39 02 4344 4287<br />

Q1 12 preview<br />

The facts: Q1 12 results are due out today (Conference call at 4:00 pm CET).<br />

Our analysis: during the annual shareholders‟ meeting in April, the management<br />

already announced that Q1 12 sales recorded a growth of 11.0% Y/Y at EUR<br />

219.6m, especially driven by the growth of the international business (+14.5%).<br />

We expect a steady positive roll-out of Zanipress, pitavastatin and silodosin in<br />

several Western European countries. Furthermore, we expect Recordati to be able<br />

to considerably offset the effects of new Italian regulation thanks to the wide local<br />

product portfolio.<br />

We forecast the profitability to be substantially flat compared to the same period of<br />

the previous year.<br />

The following table shows our sales and profitability forecast.<br />

RECORDATI: Q1 12e preview<br />

Page 69 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

Q1 11a Q1 12e %Chg. FY 12 guidance<br />

Sales 197.8 219.6 +11.0% 810 - 830<br />

EBIT 44.3 45.0 +1.6% 160 - 170<br />

EBIT margin 22.4% 20.5%<br />

Source: Company Data and BANCA AKROS estimates<br />

Conclusion & Action: we are confirming our Accumulate recommendation and<br />

our target price of EUR 7.2 per share calculated based on our DCF Model (WACC<br />

8.6% and 1.2% perpetual growth rate).