Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Casino Guichard-P<br />

France/Food & Drug Retailers Analyser<br />

Casino Guichard-P (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

73.41<br />

84.00<br />

CASP.PA/CO FP<br />

Market capitalisation (EURm) 8,101<br />

Current N° of shares (m) 110<br />

Free float 45%<br />

Daily avg. no. trad. sh. 12 mth 277,380<br />

Daily avg. trad. vol. 12 mth (m) 22<br />

Price high 12 mth (EUR) 75.62<br />

Price low 12 mth (EUR) 52.64<br />

Abs. perf. 1 mth 1.82%<br />

Abs. perf. 3 mth 7.04%<br />

Abs. perf. 12 mth -0.80%<br />

Key financials (EUR) 12/09 12/10e 12/11e<br />

Sales (m) 32,145 34,933 41,402<br />

EBITDA (m) 2,194 2,434 2,849<br />

EBITDA margin 6.8% 7.0% 6.9%<br />

EBIT (m) 1,409 1,580 1,838<br />

EBIT margin 4.4% 4.5% 4.4%<br />

Net Profit (adj.)(m) 701 636 668<br />

ROCE 7.5% 7.9% 7.8%<br />

Net debt/(cash) (m) 5,102 4,800 6,893<br />

Net Debt/Equity 0.5 0.5 0.7<br />

Debt/EBITDA 2.3 2.0 2.4<br />

Int. cover(EBITDA/Fin. int) 5.3 5.6 4.7<br />

EV/Sales 0.6 0.5 0.5<br />

EV/EBITDA 8.6 7.6 6.7<br />

EV/EBITDA (adj.) 8.5 7.6 6.7<br />

EV/EBIT 13.4 11.7 10.4<br />

P/E (adj.) 12.2 15.7 13.3<br />

P/BV 1.1 1.2 1.0<br />

OpFCF yield 11.4% 9.5% 6.2%<br />

Dividend yield 3.6% 3.8% 4.1%<br />

EPS (adj.) 6.18 5.59 5.88<br />

BVPS 69.44 72.20 74.64<br />

DPS 3.18 3.34 3.59<br />

80 vvdsvdvsdy<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

Analyst(s):<br />

CASINO GUICHARD-P Stoxx Food & Drug Retailers (Rebased)<br />

Christian Devismes, CM - CIC Securities<br />

christian.devismes@cmcics.com<br />

+33 1 45 96 77 63<br />

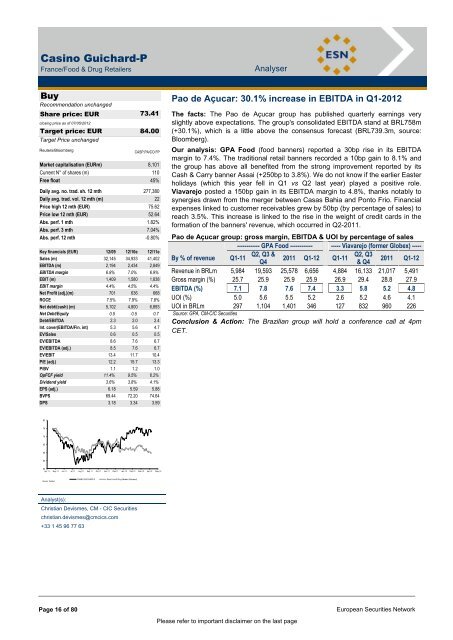

Pao de Açucar: 30.1% increase in EBITDA in Q1-2012<br />

The facts: The Pao de Açucar group has published quarterly earnings very<br />

slightly above expectations. The group's consolidated EBITDA stand at BRL758m<br />

(+30.1%), which is a little above the consensus forecast (BRL739.3m, source:<br />

Bloomberg).<br />

Our analysis: GPA Food (food banners) reported a 30bp rise in its EBITDA<br />

margin to 7.4%. The traditional retail banners recorded a 10bp gain to 8.1% and<br />

the group has above all benefited from the strong improvement reported by its<br />

Cash & Carry banner Assai (+250bp to 3.8%). We do not know if the earlier Easter<br />

holidays (which this year fell in Q1 vs Q2 last year) played a positive role.<br />

Viavarejo posted a 150bp gain in its EBITDA margin to 4.8%, thanks notably to<br />

synergies drawn from the merger between Casas Bahia and Ponto Frio. Financial<br />

expenses linked to customer receivables grew by 50bp (by percentage of sales) to<br />

reach 3.5%. This increase is linked to the rise in the weight of credit cards in the<br />

formation of the banners' revenue, which occurred in Q2-2011.<br />

Pao de Açucar group: gross margin, EBITDA & UOI by percentage of sales<br />

------------ GPA Food ------------ ----- Viavarejo (former Globex) -----<br />

By % of revenue Q1-11<br />

Q2, Q3 &<br />

Q4<br />

2011 Q1-12 Q1-11<br />

Q2, Q3<br />

& Q4<br />

2011 Q1-12<br />

Revenue in BRLm 5,984 19,593 25,578 6,656 4,884 16,133 21,017 5,491<br />

Gross margin (%) 25.7 25.9 25.9 25.9 26.9 29.4 28.8 27.9<br />

EBITDA (%) 7.1 7.8 7.6 7.4 3.3 5.8 5.2 4.8<br />

UOI (%) 5.0 5.6 5.5 5.2 2.6 5.2 4.6 4.1<br />

UOI in BRLm 297 1,104 1,401 346 127 832 960 226<br />

Source: GPA, CM-CIC Securities<br />

Conclusion & Action: The Brazilian group will hold a conference call at 4pm<br />

CET.<br />

Page 16 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page