You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Rcs MediaGroup<br />

Italy/Media Analyser<br />

Rcs MediaGroup (Hold)<br />

Hold<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

0.69<br />

0.85<br />

RCSM.MI/RCS IM<br />

Market capitalisation (EURm) 522<br />

Current N° of shares (m) 762<br />

Free float 14%<br />

Daily avg. no. trad. sh. 12 mth 348,877<br />

Daily avg. trad. vol. 12 mth (m) 0<br />

Price high 12 mth (EUR) 1.27<br />

Price low 12 mth (EUR) 0.61<br />

Abs. perf. 1 mth -9.68%<br />

Abs. perf. 3 mth -8.60%<br />

Abs. perf. 12 mth -45.42%<br />

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 2,075 2,047 2,083<br />

EBITDA (m) 168 199 223<br />

EBITDA margin 8.1% 9.7% 10.7%<br />

EBIT (m) (284) 100 124<br />

EBIT margin nm 4.9% 5.9%<br />

Net Profit (adj.)(m) (180) 38 53<br />

ROCE -9.4% 2.1% 2.6%<br />

Net debt/(cash) (m) 938 869 801<br />

Net Debt/Equity 1.3 1.2 1.0<br />

Debt/EBITDA 5.6 4.4 3.6<br />

Int. cover(EBITDA/Fin. int) 5.4 5.4 6.2<br />

EV/Sales 0.6 0.6 0.6<br />

EV/EBITDA 7.8 6.4 5.4<br />

EV/EBITDA (adj.) 7.3 6.3 5.4<br />

EV/EBIT nm 12.6 9.7<br />

P/E (adj.) nm 14.1 10.1<br />

P/BV 0.8 0.8 0.7<br />

OpFCF yield 29.7% 21.8% 26.9%<br />

Dividend yield 0.0% 4.4% 4.4%<br />

EPS (adj.) (0.23) 0.05 0.07<br />

BVPS 0.84 0.89 0.92<br />

DPS 0.00 0.03 0.03<br />

1.30 vvdsvdvsdy<br />

1.20<br />

1.10<br />

1.00<br />

0.90<br />

0.80<br />

0.70<br />

0.60<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

RCS MEDI<strong>AG</strong>ROUP Stoxx Media (Rebased)<br />

Shareholders: Shareholders' Pact 66%; Pandette fin<br />

8%; Benetton 5%;<br />

Analyst(s):<br />

Andrea Devita, CFA,, Banca Akros<br />

andrea.devita@bancaakros.it<br />

+39 02 4344 4031<br />

Francesco Di Gregorio Banca Akros<br />

francesco.digregorio@bancaakros.it<br />

+39 02 4344 4217<br />

Q1 12 preview: focus on cost-cutting efforts<br />

The facts: RCS will release Q1 2012 results on May 14. We expect declining<br />

sales Y/Y on an organic basis, lower but still positive EBITDA thanks to cost<br />

containment measures, stable debt in the last three months.<br />

Our analysis: In Q1 12, we expect revenues to be down Y/Y in organic terms,<br />

with the reported decline higher due to the de-consolidation of Dada.net (sold in<br />

Apr. 11) and the Yatch&Sail activities disposed of in Q4. Core activities, both in<br />

Italy and Spain, will suffer from the deterioration of the advertising collection and<br />

the structural decline in copies sold. Spain is expected to perform worse than Italy<br />

(according to Infoadex, Spanish adv on daily press fell by 21% in Q1 12 Y/Y vs. -<br />

23% in Q4; this compares with -5% Y/Y drop in the first two months in Italy,<br />

according to NMR).<br />

At the EBITDA level, we don‟t expect the decline in the top-line to<br />

translate into negative figures EBITDA, thanks to significant cost containment<br />

measures: with the Q4 earnings release, RCS announced new savings of around<br />

EUR 70m by the end of 2012 (including EUR 50m already announced in<br />

November); EUR 38m is expected to be achieved in Italy, the remaining EUR 32m<br />

in Spain. Note that, due to the business seasonality, Q1 EBITDA is not a<br />

significant proxy on the annual profitability of the group.<br />

We expect stable net debt as at March 31, compared to EUR 938m at the<br />

end of December, in absence of any cash-out for restructuring costs.<br />

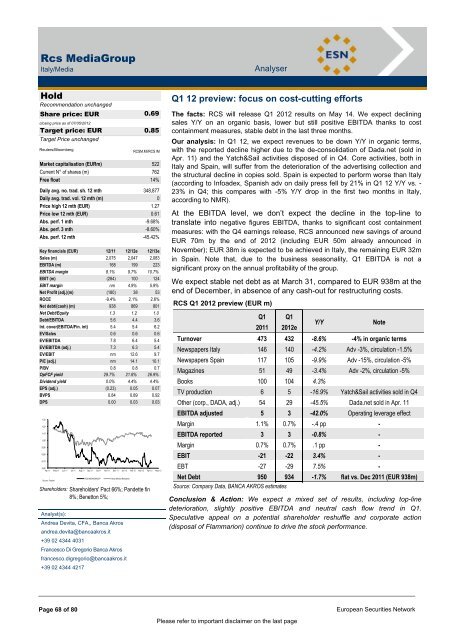

RCS Q1 2012 preview (EUR m)<br />

Page 68 of 80 European Securities Network<br />

Q1<br />

2011<br />

Q1<br />

2012e<br />

Please refer to important disclaimer on the last page<br />

Y/Y Note<br />

Turnover 473 432 -8.6% -4% in organic terms<br />

Newspapers Italy 146 140 -4.2% Adv -3%, circulation -1.5%<br />

Newspapers Spain 117 105 -9.9% Adv -15%, circulation -5%<br />

Magazines 51 49 -3.4% Adv -2%, circulation -5%<br />

Books 100 104 4.3%<br />

TV production 6 5 -16.9% Yatch&Sail activities sold in Q4<br />

Other (corp., DADA, adj.) 54 29 -45.5% Dada.net sold in Apr. 11<br />

EBITDA adjusted 5 3 -42.0% Operating leverage effect<br />

Margin 1.1% 0.7% -.4 pp -<br />

EBITDA reported 3 3 -0.8% -<br />

Margin 0.7% 0.7% .1 pp -<br />

EBIT -21 -22 3.4% -<br />

EBT -27 -29 7.5% -<br />

Net Debt 950 934 -1.7% flat vs. Dec 2011 (EUR 938m)<br />

Source: Company Data, BANCA AKROS estimates<br />

Conclusion & Action: We expect a mixed set of results, including top-line<br />

deterioration, slightly positive EBITDA and neutral cash flow trend in Q1.<br />

Speculative appeal on a potential shareholder reshuffle and corporate action<br />

(disposal of Flammarion) continue to drive the stock performance.