You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

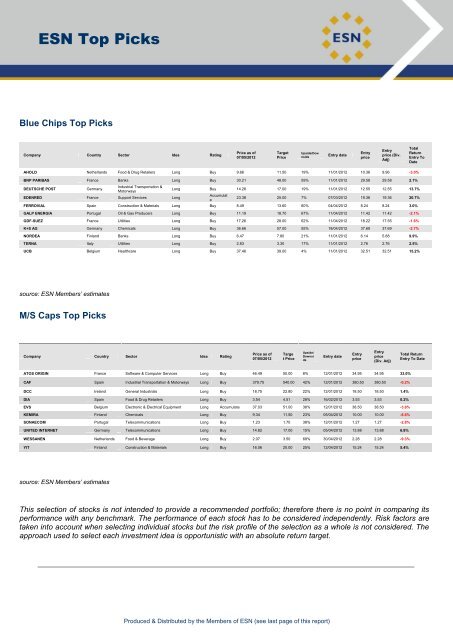

ESN Top Picks<br />

Blue Chips Top Picks<br />

Company Country Sector Idea Rating<br />

Price as of<br />

07/05/2012<br />

Target<br />

Price<br />

Upside/Dow<br />

nside<br />

Produced & Distributed by the Members of ESN (see last page of this report)<br />

Entry date<br />

Entry<br />

price<br />

Entry<br />

price (Div.<br />

Adj)<br />

AHOLD Netherlands Food & Drug Retailers Long Buy 9.66 11.50 19% 11/01/2012 10.36 9.96 -3.0%<br />

BNP PARIBAS France Banks Long Buy 30.21 48.00 59% 11/01/2012 29.58 29.58 2.1%<br />

DEUTSCHE POST Germany<br />

Industrial Transportation &<br />

Motorways<br />

EDENRED France Support Services Long<br />

Long Buy 14.26 17.00 19% 11/01/2012 12.55 12.55 13.7%<br />

Accumulat<br />

e<br />

Total<br />

Return<br />

Entry To<br />

Date<br />

23.38 25.00 7% 07/03/2012 19.36 19.36 20.7%<br />

FERROVIAL Spain Construction & Materials Long Buy 8.49 13.60 60% 04/04/2012 8.24 8.24 3.0%<br />

GALP ENERGIA Portugal Oil & Gas Producers Long Buy 11.19 18.70 67% 11/04/2012 11.42 11.42 -2.1%<br />

GDF-SUEZ France Utilities Long Buy 17.26 28.00 62% 11/04/2012 18.22 17.55 -1.6%<br />

K+S <strong>AG</strong> Germany Chemicals Long Buy 36.66 57.00 55% 18/04/2012 37.69 37.69 -2.7%<br />

NORDEA Finland Banks Long Buy 6.47 7.80 21% 11/01/2012 6.14 5.88 9.9%<br />

TERNA Italy Utilities Long Buy 2.83 3.30 17% 11/01/2012 2.76 2.76 2.5%<br />

UCB Belgium Healthcare Long Buy 37.46 39.00 4% 11/01/2012 32.51 32.51 15.2%<br />

source: ESN Members‟ estimates<br />

M/S Caps Top Picks<br />

Company Country Sector Idea Rating<br />

Price as of<br />

07/05/2012<br />

Targe<br />

t Price<br />

Upside/<br />

Downsi<br />

de<br />

Entry date<br />

Entry<br />

price<br />

Entry<br />

price<br />

(Div. Adj)<br />

ATOS ORIGIN France Software & Computer Services Long Buy 46.49 50.00 8% 12/01/2012 34.95 34.95 33.0%<br />

CAF Spain Industrial Transportation & Motorways Long Buy 379.75 540.00 42% 12/01/2012 380.50 380.50 -0.2%<br />

DCC Ireland General Industrials Long Buy 18.75 22.80 22% 12/01/2012 18.50 18.50 1.4%<br />

DIA Spain Food & Drug Retailers Long Buy 3.54 4.51 28% 16/02/2012 3.53 3.53 0.2%<br />

EVS Belgium Electronic & Electrical Equipment Long Accumulate 37.03 51.00 38% 12/01/2012 38.50 38.50 -3.8%<br />

KEMIRA Finland Chemicals Long Buy 9.34 11.50 23% 05/04/2012 10.00 10.00 -6.6%<br />

SONAECOM Portugal Telecommunications Long Buy 1.23 1.70 38% 12/01/2012 1.27 1.27 -2.8%<br />

UNITED INTERNET Germany Telecommunications Long Buy 14.82 17.00 15% 05/04/2012 13.88 13.88 6.8%<br />

WESSANEN Netherlands Food & Beverage Long Buy 2.07 3.50 69% 30/04/2012 2.28 2.28 -9.3%<br />

YIT Finland Construction & Materials Long Buy 16.06 20.00 25% 12/04/2012 15.24 15.24 5.4%<br />

source: ESN Members‟ estimates<br />

Total Return<br />

Entry To Date<br />

This selection of stocks is not intended to provide a recommended portfolio; therefore there is no point in comparing its<br />

performance with any benchmark. The performance of each stock has to be considered independently. Risk factors are<br />

taken into account when selecting individual stocks but the risk profile of the selection as a whole is not considered. The<br />

approach used to select each investment idea is opportunistic with an absolute return target.