You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ING Group<br />

Netherlands/Banks Analyser<br />

ING Group (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

5.29<br />

9.50<br />

ING.AS/INGA NA<br />

Market capitalisation (EURm) 20,275<br />

Current N° of shares (m) 3,832<br />

Free float 100%<br />

Daily avg. no. trad. sh. 12 mth 30,365,629<br />

Daily avg. trad. vol. 12 mth (m) 196<br />

Price high 12 mth (EUR) 8.96<br />

Price low 12 mth (EUR) 4.49<br />

Abs. perf. 1 mth -8.93%<br />

Abs. perf. 3 mth -27.82%<br />

Abs. perf. 12 mth -41.11%<br />

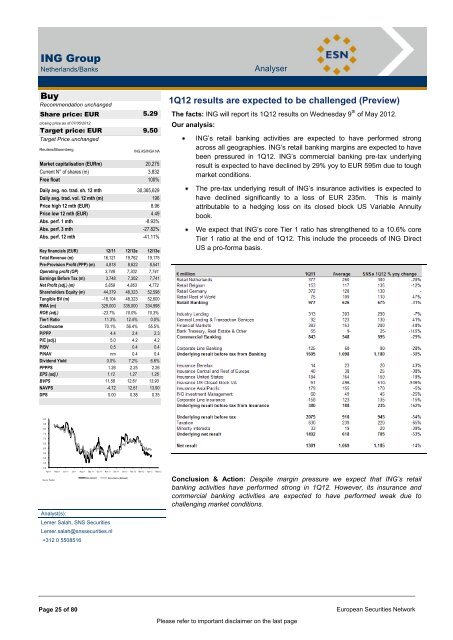

Key financials (EUR) 12/11 12/12e 12/13e<br />

Total Revenue (m) 16,121 19,762 19,175<br />

Pre-Provision Profit (PPP) (m) 4,818 8,622 8,541<br />

Operating profit (OP) 3,748 7,302 7,741<br />

Earnings Before Tax (m) 3,748 7,302 7,741<br />

Net Profit (adj.) (m) 5,859 4,863 4,772<br />

Shareholders Equity (m) 44,379 48,323 52,598<br />

Tangible BV (m) -18,104 48,323 52,600<br />

RWA (m) 329,000 335,000 334,998<br />

ROE (adj.) -23.7% 10.0% 10.3%<br />

Tier1 Ratio 11.3% 12.4% 0.0%<br />

Cost/Income 70.1% 56.4% 55.5%<br />

P/PPP 4.4 2.4 2.3<br />

P/E (adj.) 5.0 4.2 4.2<br />

P/BV 0.5 0.4 0.4<br />

P/NAV nm 0.4 0.4<br />

Dividend Yield 0.0% 7.2% 6.6%<br />

PPPPS 1.26 2.25 2.26<br />

EPS (adj.) 1.12 1.27 1.26<br />

BVPS 11.58 12.61 13.90<br />

NAVPS -4.72 12.61 13.90<br />

DPS 0.00 0.38 0.35<br />

9.0 vvdsvdvsdy<br />

8.5<br />

8.0<br />

7.5<br />

7.0<br />

6.5<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

Shareholders:<br />

Analyst(s):<br />

ING GROUP Stoxx Banks (Rebased)<br />

Lemer Salah, SNS Securities<br />

Lemer.salah@snssecurities.nl<br />

+312 0 5508516<br />

1Q12 results are expected to be challenged (Preview)<br />

The facts: ING will report its 1Q12 results on Wednesday 9 th of May 2012.<br />

Our analysis:<br />

ING‟s retail banking activities are expected to have performed strong<br />

across all geographies. ING‟s retail banking margins are expected to have<br />

been pressured in 1Q12. ING‟s commercial banking pre-tax underlying<br />

result is expected to have declined by 29% yoy to EUR 595m due to tough<br />

market conditions.<br />

The pre-tax underlying result of ING‟s insurance activities is expected to<br />

have declined significantly to a loss of EUR 235m. This is mainly<br />

attributable to a hedging loss on its closed block US Variable Annuity<br />

book.<br />

We expect that ING‟s core Tier 1 ratio has strengthened to a 10.6% core<br />

Tier 1 ratio at the end of 1Q12. This include the proceeds of ING Direct<br />

US a pro-forma basis.<br />

Conclusion & Action: Despite margin pressure we expect that ING‟s retail<br />

banking activities have performed strong in 1Q12. However, its insurance and<br />

commercial banking activities are expected to have performed weak due to<br />

challenging market conditions.<br />

Page 25 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page