You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PostNL<br />

Netherlands/Industrial Transportation & Motorways Analyser<br />

PostNL (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

3.58<br />

5.85<br />

PTNL.AS/PNL NA<br />

Market capitalisation (EURm) 1,450<br />

Current N° of shares (m) 405<br />

Free float 77%<br />

Daily avg. no. trad. sh. 12 mth 3,722,679<br />

Daily avg. trad. vol. 12 mth (m) 15<br />

Price high 12 mth (EUR) 16.42<br />

Price low 12 mth (EUR) 2.03<br />

Abs. perf. 1 mth -19.39%<br />

Abs. perf. 3 mth 15.08%<br />

Abs. perf. 12 mth -77.98%<br />

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 4,297 4,414 4,507<br />

EBITDA (m) 485 552 593<br />

EBITDA margin 11.3% 12.5% 13.2%<br />

EBIT (m) 375 439 479<br />

EBIT margin 8.7% 10.0% 10.6%<br />

Net Profit (adj.)(m) 221 239 233<br />

ROCE 291.8% 189.2% 153.4%<br />

Net debt/(cash) (m) 1,002 (619) (297)<br />

Net Debt/Equity 2.4 -0.5 -0.8<br />

Debt/EBITDA 2.1 -1.1 -0.5<br />

Int. cover(EBITDA/Fin. int) 4.8 5.5 6.1<br />

EV/Sales 0.3 0.2 0.3<br />

EV/EBITDA 2.9 1.8 2.1<br />

EV/EBITDA (adj.) 3.3 2.2 2.7<br />

EV/EBIT 3.8 2.2 2.6<br />

P/E (adj.) 4.0 5.5 5.6<br />

P/BV 2.5 1.1 4.1<br />

OpFCF yield -5.2% -1.2% 1.4%<br />

Dividend yield 5.9% 5.0% 15.1%<br />

EPS (adj.) 0.61 0.65 0.63<br />

BVPS 0.99 3.13 0.86<br />

DPS 0.21 0.18 0.54<br />

18 vvdsvdvsdy<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

POSTNL AEX (Rebased)<br />

Shareholders: Mackenzie 10%; Causeway 7%;<br />

Manning&Napier 6%;<br />

Analyst(s):<br />

Gert Steens, SNS Securities<br />

gert.steens@snssecurities.nl<br />

+312 0 5508639<br />

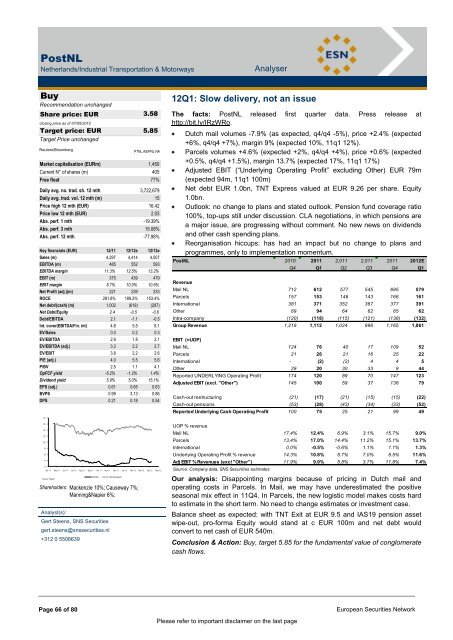

12Q1: Slow delivery, not an issue<br />

The facts: PostNL released first quarter data. Press release at<br />

http://bit.ly/IRzWRo.<br />

Dutch mail volumes -7.9% (as expected, q4/q4 -5%), price +2.4% (expected<br />

+6%, q4/q4 +7%), margin 9% (expected 10%, 11q1 12%).<br />

Parcels volumes +4.6% (expected +2%, q4/q4 +4%), price +0.6% (expected<br />

+0.5%, q4/q4 +1.5%), margin 13.7% (expected 17%, 11q1 17%)<br />

Adjusted EBIT (“Underlying Operating Profit” excluding Other) EUR 79m<br />

(expected 94m, 11q1 100m)<br />

Net debt EUR 1.0bn, TNT Express valued at EUR 9.26 per share. Equity<br />

1.0bn.<br />

Outlook: no change to plans and stated outlook. Pension fund coverage ratio<br />

100%, top-ups still under discussion. CLA negotiations, in which pensions are<br />

a major issue, are progressing without comment. No new news on dividends<br />

and other cash spending plans.<br />

Reorganisation hiccups: has had an impact but no change to plans and<br />

programmes, only to implementation momentum.<br />

PostNL 2010 2011 2,011<br />

Revenue<br />

Mail NL 712<br />

Parcels 157<br />

International 381<br />

Other 89<br />

Intra-company (120)<br />

Group Revenue 1,219<br />

EBIT (=UOP)<br />

Mail NL 124<br />

Parcels 21<br />

International -<br />

Other 29<br />

Reported UNDERLYING Operating Profit 174<br />

Adjusted EBIT (excl. "Other") 145<br />

Cash-out restructuring (21)<br />

Cash-out pensions (53)<br />

Reported Underlying Cash Operating Profit 100<br />

UOP % revenue<br />

Page 66 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

2,011<br />

2011 2012E<br />

Q4 Q1 Q2 Q3 Q4 Q1<br />

612<br />

153<br />

371<br />

94<br />

(118)<br />

1,112<br />

76<br />

26<br />

(2)<br />

20<br />

577 545<br />

146 143<br />

352<br />

64<br />

(115)<br />

1,024<br />

367<br />

62<br />

(121)<br />

996<br />

40 17<br />

21 16<br />

Mail NL 17.4% 12.4% 6.9% 3.1% 15.7% 9.0%<br />

Parcels 13.4% 17.0% 14.4% 11.2% 15.1% 13.7%<br />

International 0.0% -0.5% -0.6% 1.1% 1.1% 1.3%<br />

Underlying Operating Profit % revenue 14.3% 10.8% 8.7% 7.0% 8.5% 11.6%<br />

Adj EBIT % Revenues (excl "Other") 11.9% 9.0% 5.8% 3.7% 11.8% 7.4%<br />

Source: Company data, SNS Securities estimates<br />

Our analysis: Disappointing margins because of pricing in Dutch mail and<br />

operating costs in Parcels. In Mail, we may have underestimated the positive<br />

seasonal mix effect in 11Q4. In Parcels, the new logistic model makes costs hard<br />

to estimate in the short term. No need to change estimates or investment case.<br />

Balance sheet as expected: with TNT Exit at EUR 9.5 and IAS19 pension asset<br />

wipe-out, pro-forma Equity would stand at c EUR 100m and net debt would<br />

convert to net cash of EUR 540m.<br />

Conclusion & Action: Buy, target 5.85 for the fundamental value of conglomerate<br />

cash flows.<br />

120<br />

100<br />

(17)<br />

(28)<br />

75<br />

(2)<br />

30<br />

89<br />

59<br />

(21)<br />

(43)<br />

25<br />

4<br />

33<br />

70<br />

37<br />

(15)<br />

(34)<br />

21<br />

695<br />

166<br />

377<br />

65<br />

(138)<br />

1,165<br />

109<br />

25<br />

4<br />

9<br />

147<br />

138<br />

(15)<br />

(33)<br />

99<br />

579<br />

161<br />

391<br />

62<br />

(132)<br />

1,061<br />

52<br />

22<br />

5<br />

44<br />

123<br />

79<br />

(22)<br />

(52)<br />

49