Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Prelios<br />

Italy/General Industrials Analyser<br />

Prelios (Accumulate)<br />

Accumulate<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

0.14<br />

0.24<br />

PCRE.MI/PRS IM<br />

Market capitalisation (EURm) 117<br />

Current N° of shares (m) 841<br />

Free float 85%<br />

Daily avg. no. trad. sh. 12 mth 9,789,920<br />

Daily avg. trad. vol. 12 mth (m) 2<br />

Price high 12 mth (EUR) 0.54<br />

Price low 12 mth (EUR) 0.07<br />

Abs. perf. 1 mth -3.66%<br />

Abs. perf. 3 mth 22.35%<br />

Abs. perf. 12 mth -73.76%<br />

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 178 170 196<br />

EBITDA (m) (24) 19 33<br />

EBITDA margin nm 11.4% 16.8%<br />

EBIT (m) (219) 19 33<br />

EBIT margin nm 11.4% 16.8%<br />

Net Profit (adj.)(m) (290) 17 34<br />

ROCE 1416.7% -127.4% -209.8%<br />

Net debt/(cash) (m) 488 442 385<br />

Net Debt/Equity 1.5 1.3 1.0<br />

Debt/EBITDA -20.1 22.8 11.7<br />

Int. cover(EBITDA/Fin. int) (4.1) 1.8 3.6<br />

EV/Sales nm nm nm<br />

EV/EBITDA 3.9 nm nm<br />

EV/EBITDA (adj.) 3.9 nm nm<br />

EV/EBIT 0.4 nm nm<br />

P/E (adj.) nm 7.0 3.5<br />

P/BV 0.2 0.3 0.3<br />

OpFCF yield -44.6% -22.1% -20.2%<br />

Dividend yield 0.0% 0.0% 0.0%<br />

EPS (adj.) (0.34) 0.02 0.04<br />

BVPS 0.38 0.40 0.44<br />

DPS 0.00 0.00 0.00<br />

0.55 vvdsvdvsdy<br />

0.50<br />

0.45<br />

0.40<br />

0.35<br />

0.30<br />

0.25<br />

0.20<br />

0.15<br />

0.10<br />

0.05<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

Shareholders: Camfin 15%;<br />

Analyst(s):<br />

PRELIOS FTSE Italy All Share (Rebased)<br />

Francesco Sala, Banca Akros<br />

francesco.sala@bancaakros.it<br />

+39 02 4344 4240<br />

Weak real estate market expected to weigh on Q1 results<br />

The facts: Prelios is due to publish its Q1 12 results today. A conference call is<br />

scheduled today at 3:00pm CET:<br />

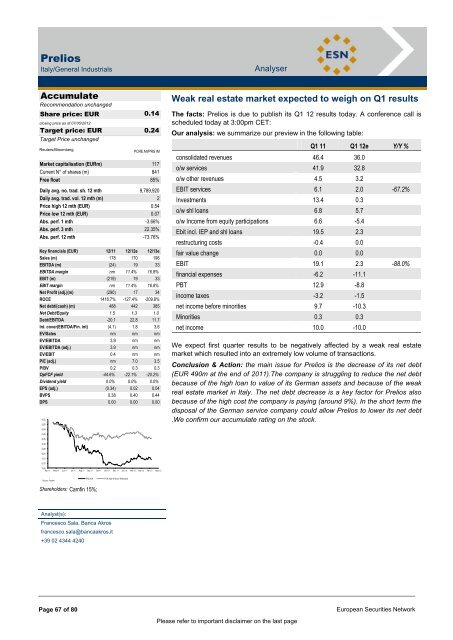

Our analysis: we summarize our preview in the following table:<br />

Page 67 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

Q1 11 Q1 12e Y/Y %<br />

consolidated revenues 46.4 36.0<br />

o/w services 41.9 32.8<br />

o/w other revenues 4.5 3.2<br />

EBIT services 6.1 2.0 -67.2%<br />

Investments 13.4 0.3<br />

o/w shl loans 6.8 5.7<br />

o/w Income from equity participations 6.6 -5.4<br />

Ebit incl. IEP and shl loans 19.5 2.3<br />

restructuring costs -0.4 0.0<br />

fair value change 0.0 0.0<br />

EBIT 19.1 2.3 -88.0%<br />

financial expenses -6.2 -11.1<br />

PBT 12.9 -8.8<br />

income taxes -3.2 -1.5<br />

net income before minorities 9.7 -10.3<br />

Minorities 0.3 0.3<br />

net income 10.0 -10.0<br />

We expect first quarter results to be negatively affected by a weak real estate<br />

market which resulted into an extremely low volume of transactions.<br />

Conclusion & Action: the main issue for Prelios is the decrease of its net debt<br />

(EUR 490m at the end of 2011).The company is struggling to reduce the net debt<br />

because of the high loan to value of its German assets and because of the weak<br />

real estate market in Italy. The net debt decrease is a key factor for Prelios also<br />

because of the high cost the company is paying (around 9%). In the short term the<br />

disposal of the German service company could allow Prelios to lower its net debt<br />

.We confirm our accumulate rating on the stock.