Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TeliaSonera<br />

Finland/Telecommunications Analyser<br />

TeliaSonera (Accumulate)<br />

Accumulate<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

5.09<br />

5.60<br />

TLS1V.HE/TLS1V FH<br />

Market capitalisation (EURm) 22,018<br />

Current N° of shares (m) 4,330<br />

Free float 49%<br />

Daily avg. no. trad. sh. 12 mth 1,173,183<br />

Daily avg. trad. vol. 12 mth (m) 6<br />

Price high 12 mth (EUR) 5.55<br />

Price low 12 mth (EUR) 4.46<br />

Abs. perf. 1 mth 5.67%<br />

Abs. perf. 3 mth -3.33%<br />

Abs. perf. 12 mth -6.70%<br />

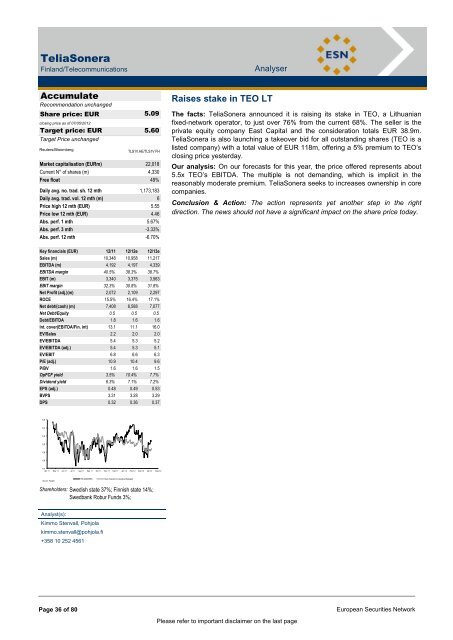

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 10,348 10,958 11,217<br />

EBITDA (m) 4,192 4,197 4,339<br />

EBITDA margin 40.5% 38.3% 38.7%<br />

EBIT (m) 3,340 3,375 3,563<br />

EBIT margin 32.3% 30.8% 31.8%<br />

Net Profit (adj.)(m) 2,072 2,109 2,297<br />

ROCE 15.5% 16.4% 17.1%<br />

Net debt/(cash) (m) 7,408 6,588 7,077<br />

Net Debt/Equity 0.5 0.5 0.5<br />

Debt/EBITDA 1.8 1.6 1.6<br />

Int. cover(EBITDA/Fin. int) 13.1 11.1 16.0<br />

EV/Sales 2.2 2.0 2.0<br />

EV/EBITDA 5.4 5.3 5.2<br />

EV/EBITDA (adj.) 5.4 5.3 5.1<br />

EV/EBIT 6.8 6.6 6.3<br />

P/E (adj.) 10.9 10.4 9.6<br />

P/BV 1.6 1.6 1.5<br />

OpFCF yield 3.5% 10.4% 7.7%<br />

Dividend yield 6.3% 7.1% 7.2%<br />

EPS (adj.) 0.48 0.49 0.53<br />

BVPS 3.31 3.28 3.29<br />

DPS 0.32 0.36 0.37<br />

5.6 vvdsvdvsdy<br />

5.4<br />

5.2<br />

5.0<br />

4.8<br />

4.6<br />

4.4<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

TELIASONERA Stoxx Telecommunications (Rebased)<br />

Shareholders: Swedish state 37%; Finnish state 14%;<br />

Swedbank Robur Funds 3%;<br />

Analyst(s):<br />

Kimmo Stenvall, Pohjola<br />

kimmo.stenvall@pohjola.fi<br />

+358 10 252 4561<br />

Raises stake in TEO LT<br />

The facts: TeliaSonera announced it is raising its stake in TEO, a Lithuanian<br />

fixed-network operator, to just over 76% from the current 68%. The seller is the<br />

private equity company East Capital and the consideration totals EUR 38.9m.<br />

TeliaSonera is also launching a takeover bid for all outstanding shares (TEO is a<br />

listed company) with a total value of EUR 118m, offering a 5% premium to TEO‟s<br />

closing price yesterday.<br />

Our analysis: On our forecasts for this year, the price offered represents about<br />

5.5x TEO‟s EBITDA. The multiple is not demanding, which is implicit in the<br />

reasonably moderate premium. TeliaSonera seeks to increases ownership in core<br />

companies.<br />

Conclusion & Action: The action represents yet another step in the right<br />

direction. The news should not have a significant impact on the share price today.<br />

Page 36 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page