Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Tecnicas Reunidas<br />

Spain/Oil Services Analyser<br />

Tecnicas Reunidas (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

29.34<br />

37.00<br />

TRE.MC/TRE SM<br />

Market capitalisation (EURm) 1,640<br />

Current N° of shares (m) 56<br />

Free float 52%<br />

Daily avg. no. trad. sh. 12 mth 519,719<br />

Daily avg. trad. vol. 12 mth (m) 15<br />

Price high 12 mth (EUR) 42.00<br />

Price low 12 mth (EUR) 22.12<br />

Abs. perf. 1 mth -2.48%<br />

Abs. perf. 3 mth -1.68%<br />

Abs. perf. 12 mth -29.92%<br />

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 2,613 2,751 2,966<br />

EBITDA (m) 160 166 176<br />

EBITDA margin 6.1% 6.0% 5.9%<br />

EBIT (m) 151 158 168<br />

EBIT margin 5.8% 5.7% 5.7%<br />

Net Profit (adj.)(m) 130 141 149<br />

ROCE -32.3% -57.9% -86.8%<br />

Net debt/(cash) (m) (740) (650) (661)<br />

Net Debt/Equity -2.1 -1.6 -1.3<br />

Debt/EBITDA -4.6 -3.9 -3.7<br />

Int. cover(EBITDA/Fin. int) (25.5) (13.4) (14.3)<br />

EV/Sales 0.3 0.4 0.3<br />

EV/EBITDA 5.1 6.0 5.6<br />

EV/EBITDA (adj.) 5.1 6.0 5.6<br />

EV/EBIT 5.4 6.3 5.9<br />

P/E (adj.) 12.0 11.6 11.0<br />

P/BV 4.6 4.0 3.4<br />

OpFCF yield 21.4% -0.3% 5.7%<br />

Dividend yield 4.6% 4.6% 4.8%<br />

EPS (adj.) 2.32 2.53 2.67<br />

BVPS 6.09 7.28 8.61<br />

DPS 1.34 1.34 1.40<br />

42 vvdsvdvsdy<br />

40<br />

38<br />

36<br />

34<br />

32<br />

30<br />

28<br />

26<br />

24<br />

22<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

TECNICAS REUNIDAS IBEX 35 (Rebased)<br />

Shareholders: Lladó Family 37%; BBVA 8%;<br />

Analyst(s):<br />

Iñigo Recio Pascual, Bankia Bolsa<br />

irecio@bankia.com<br />

+34 91 436 7814<br />

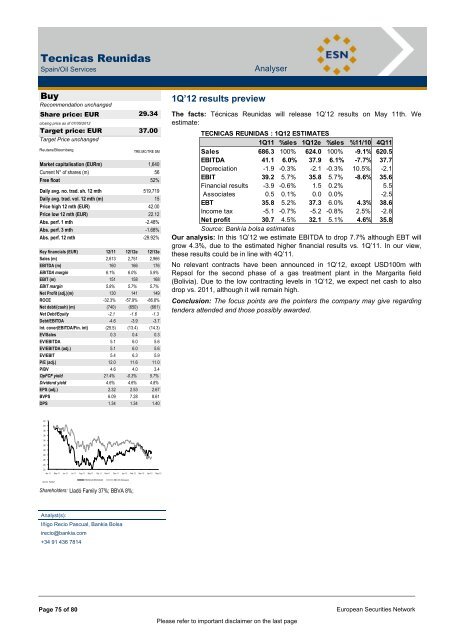

1Q’12 results preview<br />

The facts: Técnicas Reunidas will release 1Q‟12 results on May 11th. We<br />

estimate:<br />

TECNICAS REUNIDAS : 1Q12 ESTIMATES<br />

1Q11 %sles 1Q12e %sles %11/10 4Q11<br />

Sales 686.3 100% 624.0 100% -9.1% 620.5<br />

EBITDA 41.1 6.0% 37.9 6.1% -7.7% 37.7<br />

Depreciation -1.9 -0.3% -2.1 -0.3% 10.5% -2.1<br />

EBIT 39.2 5.7% 35.8 5.7% -8.6% 35.6<br />

Financial results -3.9 -0.6% 1.5 0.2% 5.5<br />

Associates 0.5 0.1% 0.0 0.0% -2.5<br />

EBT 35.8 5.2% 37.3 6.0% 4.3% 38.6<br />

Income tax -5.1 -0.7% -5.2 -0.8% 2.5% -2.8<br />

Net profit 30.7 4.5% 32.1 5.1% 4.6% 35.8<br />

Source: Bankia bolsa estimates<br />

Our analysis: In this 1Q‟12 we estimate EBITDA to drop 7.7% although EBT will<br />

grow 4.3%, due to the estimated higher financial results vs. 1Q‟11. In our view,<br />

these results could be in line with 4Q‟11.<br />

No relevant contracts have been announced in 1Q‟12, except USD100m with<br />

Repsol for the second phase of a gas treatment plant in the Margarita field<br />

(Bolivia). Due to the low contracting levels in 1Q‟12, we expect net cash to also<br />

drop vs. 2011, although it will remain high.<br />

Conclusion: The focus points are the pointers the company may give regarding<br />

tenders attended and those possibly awarded.<br />

Page 75 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page