Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Henkel<br />

Germany/Chemicals Analyser<br />

Henkel (Hold)<br />

Hold<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

55.49<br />

52.00<br />

HNKG_p.DE/HEN3 GY<br />

Market capitalisation (EURm) 24,067<br />

Current N° of shares (m) 434<br />

Free float 67%<br />

Daily avg. no. trad. sh. 12 mth 849,665<br />

Daily avg. trad. vol. 12 mth (m) 39<br />

Price high 12 mth (EUR) 56.71<br />

Price low 12 mth (EUR) 36.90<br />

Abs. perf. 1 mth 3.39%<br />

Abs. perf. 3 mth 18.18%<br />

Abs. perf. 12 mth 13.36%<br />

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 15,605 16,286 17,020<br />

EBITDA (m) 2,261 2,456 2,570<br />

EBITDA margin 14.5% 15.1% 15.1%<br />

EBIT (m) 1,857 2,052 2,158<br />

EBIT margin 11.9% 12.6% 12.7%<br />

Net Profit (adj.)(m) 1,357 1,477 1,499<br />

ROCE 11.7% 12.3% 12.2%<br />

Net debt/(cash) (m) 1,933 1,002 (132)<br />

Net Debt/Equity 0.2 0.1 0.0<br />

Debt/EBITDA 0.9 0.4 -0.1<br />

Int. cover(EBITDA/Fin. int) 14.6 15.9 24.3<br />

EV/Sales 1.4 1.6 1.5<br />

EV/EBITDA 9.8 10.6 9.7<br />

EV/EBITDA (adj.) 9.1 10.1 9.7<br />

EV/EBIT 11.9 12.7 11.5<br />

P/E (adj.) 14.3 16.3 16.1<br />

P/BV 2.2 2.5 2.2<br />

OpFCF yield 8.0% 7.0% 8.0%<br />

Dividend yield 1.4% 1.6% 1.6%<br />

EPS (adj.) 3.13 3.40 3.46<br />

BVPS 19.92 22.34 24.94<br />

DPS 0.80 0.86 0.88<br />

60 vvdsvdvsdy<br />

55<br />

50<br />

45<br />

40<br />

35<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

HENKEL Stoxx Chemicals (Rebased)<br />

Shareholders: Henkel family 32%; Treasury shares<br />

1.10%;<br />

Analyst(s):<br />

Nadeshda Demidova, Equinet Bank<br />

nadeshda.demidova@equinet-ag.de<br />

+49 69 58997 434<br />

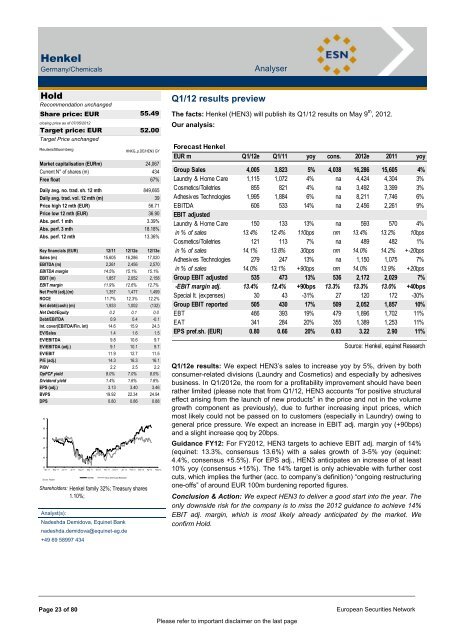

Q1/12 results preview<br />

The facts: Henkel (HEN3) will publish its Q1/12 results on May 9 th , 2012.<br />

Our analysis:<br />

Forecast Henkel<br />

EUR m Q1/12e Q1/11 yoy cons. 2012e 2011 yoy<br />

Group Sales 4,005 3,823 5% 4,038 16,286 15,605 4%<br />

Laundry & Home Care 1,115 1,072 4% na 4,424 4,304 3%<br />

Cosmetics/Toiletries 855 821 4% na 3,492 3,399 3%<br />

Adhesives Technologies 1,995 1,884 6% na 8,211 7,746 6%<br />

EBITDA 606 533 14% na 2,456 2,261 9%<br />

EBIT adjusted<br />

Laundry & Home Care 150 133 13% na 593 570 4%<br />

in % of sales 13.4% 12.4% 110bps nm 13.4% 13.2% 10bps<br />

Cosmetics/Toiletries 121 113 7% na 489 482 1%<br />

in % of sales 14.1% 13.8% 30bps nm 14.0% 14.2% +-20bps<br />

Adhesives Technologies 279 247 13% na 1,150 1,075 7%<br />

in % of sales 14.0% 13.1% +90bps nm 14.0% 13.9% +20bps<br />

Group EBIT adjusted 535 473 13% 536 2,172 2,029 7%<br />

-EBIT margin adj. 13.4% 12.4% +90bps 13.3% 13.3% 13.0% +40bps<br />

Special It. (expenses) 30 43 -31% 27 120 172 -30%<br />

Group EBIT reported 505 430 17% 509 2,052 1,857 10%<br />

EBT 466 393 19% 479 1,896 1,702 11%<br />

EAT 341 284 20% 355 1,389 1,253 11%<br />

EPS pref.sh. (EUR) 0.80 0.66 20% 0.83 3.22 2.90 11%<br />

Q1/12e results: We expect HEN3‟s sales to increase yoy by 5%, driven by both<br />

consumer-related divisions (Laundry and Cosmetics) and especially by adhesives<br />

business. In Q1/2012e, the room for a profitability improvement should have been<br />

rather limited (please note that from Q1/12, HEN3 accounts “for positive structural<br />

effect arising from the launch of new products” in the price and not in the volume<br />

growth component as previously), due to further increasing input prices, which<br />

most likely could not be passed on to customers (especially in Laundry) owing to<br />

general price pressure. We expect an increase in EBIT adj. margin yoy (+90bps)<br />

and a slight increase qoq by 20bps.<br />

Guidance FY12: For FY2012, HEN3 targets to achieve EBIT adj. margin of 14%<br />

(equinet: 13.3%, consensus 13.6%) with a sales growth of 3-5% yoy (equinet:<br />

4.4%, consensus +5.5%). For EPS adj., HEN3 anticipates an increase of at least<br />

10% yoy (consensus +15%). The 14% target is only achievable with further cost<br />

cuts, which implies the further (acc. to company‟s definition) “ongoing restructuring<br />

one-offs” of around EUR 100m burdening reported figures.<br />

Conclusion & Action: We expect HEN3 to deliver a good start into the year. The<br />

only downside risk for the company is to miss the 2012 guidance to achieve 14%<br />

EBIT adj. margin, which is most likely already anticipated by the market. We<br />

confirm Hold.<br />

Page 23 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

Source: Henkel, equinet Research