Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Rheinmetall<br />

Germany/Aerospace & Defence Analyser<br />

$nomcompagnie$ (Accumulate)<br />

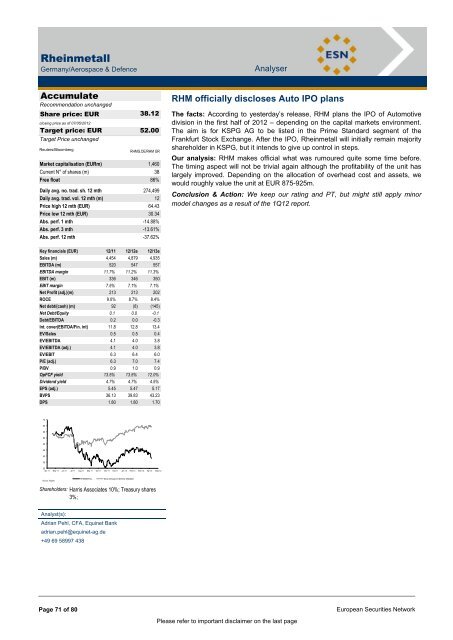

Accumulate<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

38.12<br />

52.00<br />

RHMG.DE/RHM GR<br />

Market capitalisation (EURm) 1,460<br />

Current N° of shares (m) 38<br />

Free float 86%<br />

Daily avg. no. trad. sh. 12 mth 274,499<br />

Daily avg. trad. vol. 12 mth (m) 12<br />

Price high 12 mth (EUR) 64.43<br />

Price low 12 mth (EUR) 30.34<br />

Abs. perf. 1 mth -14.88%<br />

Abs. perf. 3 mth -13.61%<br />

Abs. perf. 12 mth -37.62%<br />

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 4,454 4,879 4,935<br />

EBITDA (m) 520 547 557<br />

EBITDA margin 11.7% 11.2% 11.3%<br />

EBIT (m) 336 346 350<br />

EBIT margin 7.5% 7.1% 7.1%<br />

Net Profit (adj.)(m) 213 213 202<br />

ROCE 9.0% 8.7% 8.4%<br />

Net debt/(cash) (m) 92 (8) (145)<br />

Net Debt/Equity 0.1 0.0 -0.1<br />

Debt/EBITDA 0.2 0.0 -0.3<br />

Int. cover(EBITDA/Fin. int) 11.8 12.8 13.4<br />

EV/Sales 0.5 0.5 0.4<br />

EV/EBITDA 4.1 4.0 3.8<br />

EV/EBITDA (adj.) 4.1 4.0 3.8<br />

EV/EBIT 6.3 6.4 6.0<br />

P/E (adj.) 6.3 7.0 7.4<br />

P/BV 0.9 1.0 0.9<br />

OpFCF yield 13.5% 13.5% 12.0%<br />

Dividend yield 4.7% 4.7% 4.5%<br />

EPS (adj.) 5.45 5.47 5.17<br />

BVPS 36.13 39.83 43.23<br />

DPS 1.80 1.80 1.70<br />

70 vvdsvdvsdy<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

RHEINMETALL Stoxx Aerospace & Defense (Rebased)<br />

Shareholders: Harris Associates 10%; Treasury shares<br />

3%;<br />

Analyst(s):<br />

Adrian Pehl, CFA, Equinet Bank<br />

adrian.pehl@equinet-ag.de<br />

+49 69 58997 438<br />

RHM officially discloses Auto IPO plans<br />

The facts: According to yesterday‟s release, RHM plans the IPO of Automotive<br />

division in the first half of 2012 – depending on the capital markets environment.<br />

The aim is for KSPG <strong>AG</strong> to be listed in the Prime Standard segment of the<br />

Frankfurt Stock Exchange. After the IPO, Rheinmetall will initially remain majority<br />

shareholder in KSPG, but it intends to give up control in steps.<br />

Our analysis: RHM makes official what was rumoured quite some time before.<br />

The timing aspect will not be trivial again although the profitability of the unit has<br />

largely improved. Depending on the allocation of overhead cost and assets, we<br />

would roughly value the unit at EUR 875-925m.<br />

Conclusion & Action: We keep our rating and PT, but might still apply minor<br />

model changes as a result of the 1Q12 report.<br />

Page 71 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page