Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Zurich Financial Services<br />

Switzerland/Insurance Analyser<br />

Zurich Financial Services (Accumulate)<br />

Accumulate<br />

Recommendation unchanged<br />

Share price: CHF<br />

closing price as of 07/05/2012<br />

Target price: CHF<br />

from Target Price: CHF<br />

Reuters/Bloomberg<br />

221.10<br />

260.00<br />

241.78<br />

ZURZn.S/ZURN VX<br />

Market capitalisation (CHFm) 32,587<br />

Current N° of shares (m) 147<br />

Free float 100%<br />

Daily avg. no. trad. sh. 12 mth 740,681<br />

Daily avg. trad. vol. 12 mth (m) 157<br />

Price high 12 mth (CHF) 227.90<br />

Price low 12 mth (CHF) 134.75<br />

Abs. perf. 1 mth 0.18%<br />

Abs. perf. 3 mth 3.60%<br />

Abs. perf. 12 mth 1.09%<br />

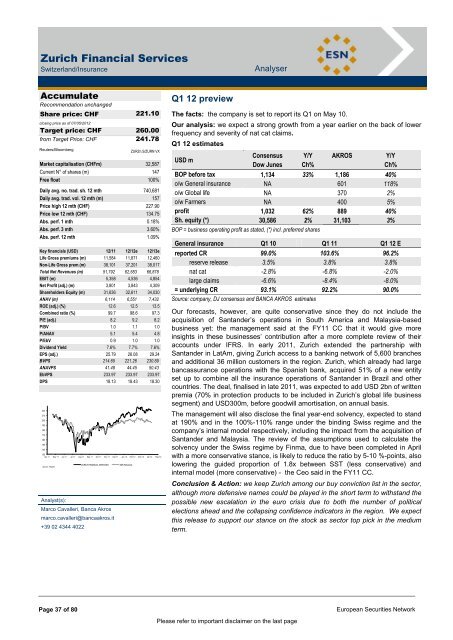

Key financials (USD) 12/11 12/12e 12/13e<br />

Life Gross premiums (m) 11,584 11,871 12,460<br />

Non-Life Gross prem.(m) 38,101 37,201 38,017<br />

Total Net Revenues (m) 51,792 62,583 66,878<br />

EBIT (m) 5,358 4,536 4,854<br />

Net Profit (adj.) (m) 3,801 3,843 4,309<br />

Shareholders Equity (m) 31,636 32,611 34,030<br />

ANAV (m) 6,114 6,551 7,432<br />

ROE (adj.) (%) 12.6 12.5 13.5<br />

Combined ratio (%) 99.7 98.6 97.3<br />

P/E (adj.) 8.2 9.2 8.2<br />

P/BV 1.0 1.1 1.0<br />

P/ANAV 5.1 5.4 4.8<br />

P/EbV 0.9 1.0 1.0<br />

Dividend Yield 7.6% 7.7% 7.6%<br />

EPS (adj.) 25.79 26.08 29.24<br />

BVPS 214.65 221.26 230.89<br />

ANAVPS 41.48 44.45 50.43<br />

EbVPS 233.97 233.97 233.97<br />

DPS 18.13 18.43 18.30<br />

220<br />

210<br />

200<br />

190<br />

180<br />

170<br />

160<br />

150<br />

140<br />

vvdsvdvsdy<br />

130<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

Shareholders:<br />

Analyst(s):<br />

ZURICH FINANCIAL SERVICES SMI (Rebased)<br />

Marco Cavalleri, Banca Akros<br />

marco.cavalleri@bancaakros.it<br />

+39 02 4344 4022<br />

Q1 12 preview<br />

The facts: the company is set to report its Q1 on May 10.<br />

Our analysis: we expect a strong growth from a year earlier on the back of lower<br />

frequency and severity of nat cat claims.<br />

Q1 12 estimates<br />

USD m<br />

Consensus<br />

Dow Junes<br />

Page 37 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

Y/Y<br />

Ch%<br />

AKROS<br />

Y/Y<br />

Ch%<br />

BOP before tax 1,134 33% 1,186 40%<br />

o/w General insurance NA 601 118%<br />

o/w Global life NA 370 2%<br />

o/w Farmers NA 400 5%<br />

profit 1,032 62% 889 40%<br />

Sh. equity (*) 30,586 2% 31,103 3%<br />

BOP = business operating profit as stated, (*) incl. preferred shares<br />

General insurance Q1 10 Q1 11 Q1 12 E<br />

reported CR 99.0% 103.6% 96.2%<br />

reserve release 3.5% 3.8% 3.8%<br />

nat cat -2.8% -6.8% -2.0%<br />

large claims -6.6% -8.4% -8.0%<br />

= underlying CR 93.1% 92.2% 90.0%<br />

Source: company, DJ consensus and BANCA AKROS estimates<br />

Our forecasts, however, are quite conservative since they do not include the<br />

acquisition of Santander‟s operations in South America and Malaysia-based<br />

business yet: the management said at the FY11 CC that it would give more<br />

insights in these businesses‟ contribution after a more complete review of their<br />

accounts under IFRS. In early 2011, Zurich extended the partnership with<br />

Santander in LatAm, giving Zurich access to a banking network of 5,600 branches<br />

and additional 36 million customers in the region. Zurich, which already had large<br />

bancassurance operations with the Spanish bank, acquired 51% of a new entity<br />

set up to combine all the insurance operations of Santander in Brazil and other<br />

countries. The deal, finalised in late 2011, was expected to add USD 2bn of written<br />

premia (70% in protection products to be included in Zurich‟s global life business<br />

segment) and USD300m, before goodwill amortisation, on annual basis.<br />

The management will also disclose the final year-end solvency, expected to stand<br />

at 190% and in the 100%-110% range under the binding Swiss regime and the<br />

company‟s internal model respectively, including the impact from the acquisition of<br />

Santander and Malaysia. The review of the assumptions used to calculate the<br />

solvency under the Swiss regime by Finma, due to have been completed in April<br />

with a more conservative stance, is likely to reduce the ratio by 5-10 %-points, also<br />

lowering the guided proportion of 1.8x between SST (less conservative) and<br />

internal model (more conservative) - the Ceo said in the FY11 CC.<br />

Conclusion & Action: we keep Zurich among our buy conviction list in the sector,<br />

although more defensive names could be played in the short term to withstand the<br />

possible new escalation in the euro crisis due to both the number of political<br />

elections ahead and the collapsing confidence indicators in the region. We expect<br />

this release to support our stance on the stock as sector top pick in the medium<br />

term.