You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fcc<br />

Spain/Construction & Materials Analyser<br />

Fcc (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

12.73<br />

27.90<br />

FCC.MC/FCC SM<br />

Market capitalisation (EURm) 1,620<br />

Current N° of shares (m) 127<br />

Free float 32%<br />

Daily avg. no. trad. sh. 12 mth 514,077<br />

Daily avg. trad. vol. 12 mth (m) 9<br />

Price high 12 mth (EUR) 21.86<br />

Price low 12 mth (EUR) 12.14<br />

Abs. perf. 1 mth -18.85%<br />

Abs. perf. 3 mth -32.06%<br />

Abs. perf. 12 mth -44.05%<br />

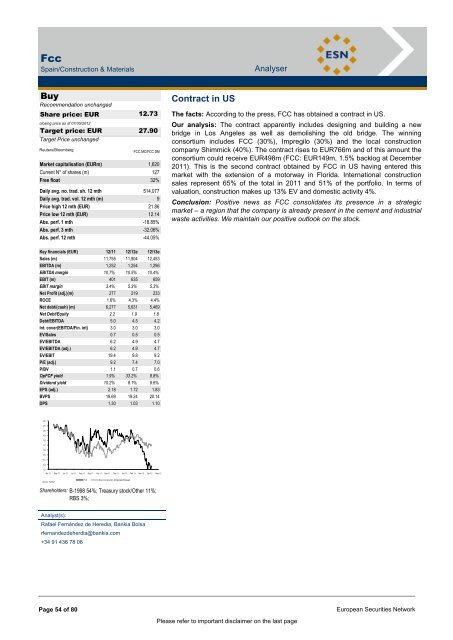

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 11,755 11,904 12,453<br />

EBITDA (m) 1,252 1,254 1,296<br />

EBITDA margin 10.7% 10.5% 10.4%<br />

EBIT (m) 401 635 659<br />

EBIT margin 3.4% 5.3% 5.3%<br />

Net Profit (adj.)(m) 277 219 233<br />

ROCE 1.6% 4.3% 4.4%<br />

Net debt/(cash) (m) 6,277 5,631 5,469<br />

Net Debt/Equity 2.2 1.9 1.8<br />

Debt/EBITDA 5.0 4.5 4.2<br />

Int. cover(EBITDA/Fin. int) 3.0 3.0 3.0<br />

EV/Sales 0.7 0.5 0.5<br />

EV/EBITDA 6.2 4.9 4.7<br />

EV/EBITDA (adj.) 6.2 4.9 4.7<br />

EV/EBIT 19.4 9.8 9.2<br />

P/E (adj.) 9.2 7.4 7.0<br />

P/BV 1.1 0.7 0.6<br />

OpFCF yield 1.9% 33.2% 8.8%<br />

Dividend yield 10.2% 8.1% 8.6%<br />

EPS (adj.) 2.18 1.72 1.83<br />

BVPS 18.69 19.24 20.14<br />

DPS 1.30 1.03 1.10<br />

22 vvdsvdvsdy<br />

21<br />

20<br />

19<br />

18<br />

17<br />

16<br />

15<br />

14<br />

13<br />

12<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

FCC Stoxx Construction & Materials (Rebased)<br />

Shareholders: B-1998 54%; Treasury stock/Other 11%;<br />

RBS 3%;<br />

Analyst(s):<br />

Rafael Fernández de Heredia, Bankia Bolsa<br />

rfernandezdeherdia@bankia.com<br />

+34 91 436 78 08<br />

Contract in US<br />

The facts: According to the press, FCC has obtained a contract in US.<br />

Our analysis: The contract apparently includes designing and building a new<br />

bridge in Los Angeles as well as demolishing the old bridge. The winning<br />

consortium includes FCC (30%), Impregilo (30%) and the local construction<br />

company Shimmick (40%). The contract rises to EUR766m and of this amount the<br />

consortium could receive EUR498m (FCC: EUR149m, 1.5% backlog at December<br />

2011). This is the second contract obtained by FCC in US having entered this<br />

market with the extension of a motorway in Florida. International construction<br />

sales represent 65% of the total in 2011 and 51% of the portfolio. In terms of<br />

valuation, construction makes up 13% EV and domestic activity 4%.<br />

Conclusion: Positive news as FCC consolidates its presence in a strategic<br />

market – a region that the company is already present in the cement and industrial<br />

waste activities. We maintain our positive outlook on the stock.<br />

Page 54 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page