You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Augusta Technologie <strong>AG</strong><br />

Germany/Electronic & Electrical Equipment Analyser<br />

Augusta Technologie <strong>AG</strong> (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

23.61<br />

28.00<br />

ABE1.DE/ABE1 GR<br />

Market capitalisation (EURm) 180<br />

Current N° of shares (m) 8<br />

Free float 70%<br />

Daily avg. no. trad. sh. 12 mth 23,568<br />

Daily avg. trad. vol. 12 mth (m) 0<br />

Price high 12 mth (EUR) 23.78<br />

Price low 12 mth (EUR) 13.01<br />

Abs. perf. 1 mth 10.17%<br />

Abs. perf. 3 mth 47.42%<br />

Abs. perf. 12 mth 21.11%<br />

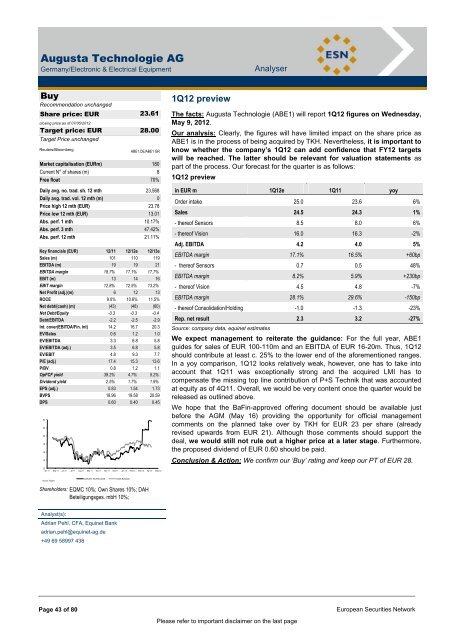

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 101 110 119<br />

EBITDA (m) 19 19 21<br />

EBITDA margin 18.7% 17.1% 17.7%<br />

EBIT (m) 13 14 16<br />

EBIT margin 12.8% 12.5% 13.2%<br />

Net Profit (adj.)(m) 6 12 13<br />

ROCE 9.0% 10.6% 11.5%<br />

Net debt/(cash) (m) (43) (48) (60)<br />

Net Debt/Equity -0.3 -0.3 -0.4<br />

Debt/EBITDA -2.2 -2.5 -2.9<br />

Int. cover(EBITDA/Fin. int) 14.2 16.7 20.3<br />

EV/Sales 0.6 1.2 1.0<br />

EV/EBITDA 3.3 6.8 5.8<br />

EV/EBITDA (adj.) 3.5 6.8 5.8<br />

EV/EBIT 4.8 9.3 7.7<br />

P/E (adj.) 17.4 15.3 13.6<br />

P/BV 0.8 1.2 1.1<br />

OpFCF yield 39.2% 4.7% 5.2%<br />

Dividend yield 2.5% 1.7% 1.9%<br />

EPS (adj.) 0.83 1.54 1.73<br />

BVPS 18.96 19.58 20.59<br />

DPS 0.60 0.40 0.45<br />

24 vvdsvdvsdy<br />

22<br />

20<br />

18<br />

16<br />

14<br />

12<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

AUGUSTA TECHNOLOGIE CDAX (Rebased)<br />

Shareholders: EQMC 10%; Own Shares 10%; DAH<br />

Beteiligungsges. mbH 10%;<br />

Analyst(s):<br />

Adrian Pehl, CFA, Equinet Bank<br />

adrian.pehl@equinet-ag.de<br />

+49 69 58997 438<br />

1Q12 preview<br />

The facts: Augusta Technologie (ABE1) will report 1Q12 figures on Wednesday,<br />

May 9, 2012.<br />

Our analysis: Clearly, the figures will have limited impact on the share price as<br />

ABE1 is in the process of being acquired by TKH. Nevertheless, it is important to<br />

know whether the company’s 1Q12 can add confidence that FY12 targets<br />

will be reached. The latter should be relevant for valuation statements as<br />

part of the process. Our forecast for the quarter is as follows:<br />

1Q12 preview<br />

in EUR m 1Q12e 1Q11 yoy<br />

Order intake 25.0 23.6 6%<br />

Sales 24.5 24.3 1%<br />

- thereof Sensors 8.5 8.0 6%<br />

- thereof Vision 16.0 16.3 -2%<br />

Adj. EBITDA 4.2 4.0 5%<br />

EBITDA margin 17.1% 16.5% +60bp<br />

- thereof Sensors 0.7 0.5 48%<br />

EBITDA margin 8.2% 5.9% +230bp<br />

- thereof Vision 4.5 4.8 -7%<br />

EBITDA margin 28.1% 29.6% -150bp<br />

- thereof Consolidation/Holding -1.0 -1.3 -23%<br />

Rep. net result 2.3 3.2 -27%<br />

Source: company data, equinet estimates<br />

We expect management to reiterate the guidance: For the full year, ABE1<br />

guides for sales of EUR 100-110m and an EBITDA of EUR 16-20m. Thus, 1Q12<br />

should contribute at least c. 25% to the lower end of the aforementioned ranges.<br />

In a yoy comparison, 1Q12 looks relatively weak, however, one has to take into<br />

account that 1Q11 was exceptionally strong and the acquired LMI has to<br />

compensate the missing top line contribution of P+S Technik that was accounted<br />

at equity as of 4Q11. Overall, we would be very content once the quarter would be<br />

released as outlined above.<br />

We hope that the BaFin-approved offering document should be available just<br />

before the <strong>AG</strong>M (May 16) providing the opportunity for official management<br />

comments on the planned take over by TKH for EUR 23 per share (already<br />

revised upwards from EUR 21). Although those comments should support the<br />

deal, we would still not rule out a higher price at a later stage. Furthermore,<br />

the proposed dividend of EUR 0.60 should be paid.<br />

Conclusion & Action: We confirm our „Buy‟ rating and keep our PT of EUR 28.<br />

Page 43 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page