You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Süss MicroTec<br />

Germany/Semiconductors Analyser<br />

$nomcompagnie$ (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

10.19<br />

13.00<br />

SMHNn.DE/SMH GY<br />

Market capitalisation (EURm) 193<br />

Current N° of shares (m) 19<br />

Free float 100%<br />

Daily avg. no. trad. sh. 12 mth 188,007<br />

Daily avg. trad. vol. 12 mth (m) 2<br />

Price high 12 mth (EUR) 11.93<br />

Price low 12 mth (EUR) 5.57<br />

Abs. perf. 1 mth -1.74%<br />

Abs. perf. 3 mth 25.03%<br />

Abs. perf. 12 mth -13.64%<br />

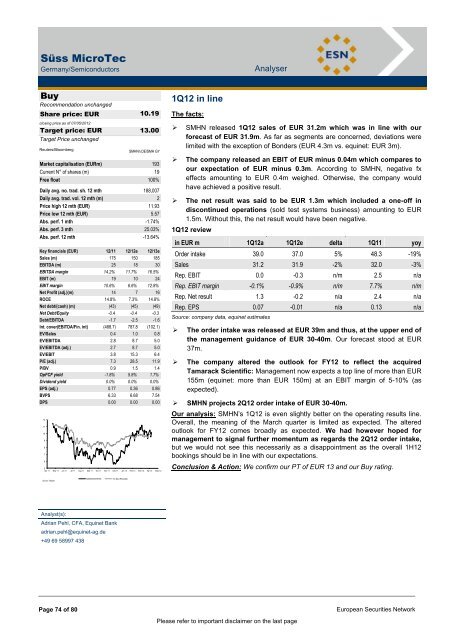

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 175 150 185<br />

EBITDA (m) 25 18 30<br />

EBITDA margin 14.2% 11.7% 16.5%<br />

EBIT (m) 19 10 24<br />

EBIT margin 10.6% 6.6% 12.8%<br />

Net Profit (adj.)(m) 14 7 16<br />

ROCE 14.8% 7.3% 14.8%<br />

Net debt/(cash) (m) (43) (45) (49)<br />

Net Debt/Equity -0.4 -0.4 -0.3<br />

Debt/EBITDA -1.7 -2.5 -1.6<br />

Int. cover(EBITDA/Fin. int) (488.7) 787.8 (102.1)<br />

EV/Sales 0.4 1.0 0.8<br />

EV/EBITDA 2.8 8.7 5.0<br />

EV/EBITDA (adj.) 2.7 8.7 5.0<br />

EV/EBIT 3.8 15.3 6.4<br />

P/E (adj.) 7.3 28.5 11.9<br />

P/BV 0.9 1.5 1.4<br />

OpFCF yield -1.8% 5.8% 1.7%<br />

Dividend yield 0.0% 0.0% 0.0%<br />

EPS (adj.) 0.77 0.36 0.86<br />

BVPS 6.33 6.68 7.54<br />

DPS 0.00 0.00 0.00<br />

12 vvdsvdvsdy<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

Shareholders:<br />

Analyst(s):<br />

SUESS MICROTEC Tec Dax (Rebased)<br />

Adrian Pehl, CFA, Equinet Bank<br />

adrian.pehl@equinet-ag.de<br />

+49 69 58997 438<br />

1Q12 in line<br />

The facts:<br />

� SMHN released 1Q12 sales of EUR 31.2m which was in line with our<br />

forecast of EUR 31.9m. As far as segments are concerned, deviations were<br />

limited with the exception of Bonders (EUR 4.3m vs. equinet: EUR 3m).<br />

� The company released an EBIT of EUR minus 0.04m which compares to<br />

our expectation of EUR minus 0.3m. According to SMHN, negative fx<br />

effects amounting to EUR 0.4m weighed. Otherwise, the company would<br />

have achieved a positive result.<br />

� The net result was said to be EUR 1.3m which included a one-off in<br />

discontinued operations (sold test systems business) amounting to EUR<br />

1.5m. Without this, the net result would have been negative.<br />

1Q12 review<br />

in EUR m 1Q12a 1Q12e delta 1Q11 yoy<br />

Order intake 39.0 37.0 5% 48.3 -19%<br />

Sales 31.2 31.9 -2% 32.0 -3%<br />

Rep. EBIT 0.0 -0.3 n/m 2.5 n/a<br />

Rep. EBIT margin -0.1% -0.9% n/m 7.7% n/m<br />

Rep. Net result 1.3 -0.2 n/a 2.4 n/a<br />

Rep. EPS 0.07 -0.01 n/a 0.13 n/a<br />

Source: company data, equinet estimates<br />

� The order intake was released at EUR 39m and thus, at the upper end of<br />

the management guidance of EUR 30-40m. Our forecast stood at EUR<br />

37m.<br />

� The company altered the outlook for FY12 to reflect the acquired<br />

Tamarack Scientific: Management now expects a top line of more than EUR<br />

155m (equinet: more than EUR 150m) at an EBIT margin of 5-10% (as<br />

expected).<br />

� SMHN projects 2Q12 order intake of EUR 30-40m.<br />

Our analysis: SMHN‟s 1Q12 is even slightly better on the operating results line.<br />

Overall, the meaning of the March quarter is limited as expected. The altered<br />

outlook for FY12 comes broadly as expected. We had however hoped for<br />

management to signal further momentum as regards the 2Q12 order intake,<br />

but we would not see this necessarily as a disappointment as the overall 1H12<br />

bookings should be in line with our expectations.<br />

Conclusion & Action: We confirm our PT of EUR 13 and our Buy rating.<br />

Page 74 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page