You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Epigenomics <strong>AG</strong><br />

Germany/Biotechnology Analyser<br />

Epigenomics <strong>AG</strong> (Buy)<br />

Buy<br />

Recommendation unchanged<br />

Share price: EUR<br />

closing price as of 07/05/2012<br />

Target price: EUR<br />

Target Price unchanged<br />

Reuters/Bloomberg<br />

1.83<br />

5.50<br />

ECX.DE/ECX GR<br />

Market capitalisation (EURm) 16<br />

Current N° of shares (m) 9<br />

Free float 61%<br />

Daily avg. no. trad. sh. 12 mth 15,618<br />

Daily avg. trad. vol. 12 mth (m) 0<br />

Price high 12 mth (EUR) 8.10<br />

Price low 12 mth (EUR) 1.21<br />

Abs. perf. 1 mth -18.67%<br />

Abs. perf. 3 mth -8.55%<br />

Abs. perf. 12 mth -77.34%<br />

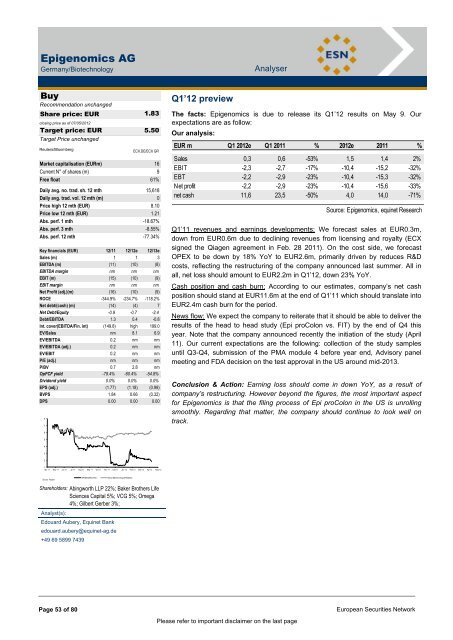

Key financials (EUR) 12/11 12/12e 12/13e<br />

Sales (m) 1 1 3<br />

EBITDA (m) (11) (10) (8)<br />

EBITDA margin nm nm nm<br />

EBIT (m) (15) (10) (9)<br />

EBIT margin nm nm nm<br />

Net Profit (adj.)(m) (16) (10) (9)<br />

ROCE -344.9% -234.7% -118.2%<br />

Net debt/(cash) (m) (14) (4) 7<br />

Net Debt/Equity -0.9 -0.7 -2.4<br />

Debt/EBITDA 1.3 0.4 -0.8<br />

Int. cover(EBITDA/Fin. int) (149.8) high 199.0<br />

EV/Sales nm 8.1 6.9<br />

EV/EBITDA 0.2 nm nm<br />

EV/EBITDA (adj.) 0.2 nm nm<br />

EV/EBIT 0.2 nm nm<br />

P/E (adj.) nm nm nm<br />

P/BV 0.7 2.8 nm<br />

OpFCF yield -79.4% -60.4% -54.8%<br />

Dividend yield 0.0% 0.0% 0.0%<br />

EPS (adj.) (1.77) (1.18) (0.99)<br />

BVPS 1.84 0.66 (0.32)<br />

DPS 0.00 0.00 0.00<br />

vvdsvdvsdy 8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

Apr 11 May 11 Jun 11 Jul 11 Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Mar 12 Apr 12 May 12<br />

Source: Factset<br />

EPIGENOMICS <strong>AG</strong> Stoxx Biotechnology (Rebased)<br />

Shareholders: Abingworth LLP 22%; Baker Brothers Life<br />

Sciences Capital 5%; VCG 5%; Omega<br />

4%; Gilbert Gerber 3%;<br />

Analyst(s):<br />

Edouard Aubery, Equinet Bank<br />

edouard.aubery@equinet-ag.de<br />

+49 69 5899 7439<br />

Q1’12 preview<br />

The facts: Epigenomics is due to release its Q1‟12 results on May 9. Our<br />

expectations are as follow:<br />

Our analysis:<br />

EUR m Q1 2012e Q1 2011 % 2012e 2011 %<br />

Sales 0,3 0,6 -53% 1,5 1,4 2%<br />

EBIT -2,3 -2,7 -17% -10,4 -15,2 -32%<br />

EBT -2,2 -2,9 -23% -10,4 -15,3 -32%<br />

Net profit -2,2 -2,9 -23% -10,4 -15,6 -33%<br />

net cash 11,6 23,5 -50% 4,0 14,0 -71%<br />

Q1‟11 revenues and earnings developments: We forecast sales at EUR0.3m,<br />

down from EUR0.6m due to declining revenues from licensing and royalty (ECX<br />

signed the Qiagen agreement in Feb. 28 2011). On the cost side, we forecast<br />

OPEX to be down by 18% YoY to EUR2.6m, primarily driven by reduces R&D<br />

costs, reflecting the restructuring of the company announced last summer. All in<br />

all, net loss should amount to EUR2.2m in Q1‟12, down 23% YoY.<br />

Cash position and cash burn: According to our estimates, company‟s net cash<br />

position should stand at EUR11.6m at the end of Q1‟11 which should translate into<br />

EUR2.4m cash burn for the period.<br />

News flow: We expect the company to reiterate that it should be able to deliver the<br />

results of the head to head study (Epi proColon vs. FIT) by the end of Q4 this<br />

year. Note that the company announced recently the initiation of the study (April<br />

11). Our current expectations are the following: collection of the study samples<br />

until Q3-Q4, submission of the PMA module 4 before year end, Advisory panel<br />

meeting and FDA decision on the test approval in the US around mid-2013.<br />

Conclusion & Action: Earning loss should come in down YoY, as a result of<br />

company‟s restructuring. However beyond the figures, the most important aspect<br />

for Epigenomics is that the filing process of Epi proColon in the US is unrolling<br />

smoothly. Regarding that matter, the company should continue to look well on<br />

track.<br />

Page 53 of 80 European Securities Network<br />

Please refer to important disclaimer on the last page<br />

Source: Epigenomics, equinet Research