Annual Report 2010 - Enel.com

Annual Report 2010 - Enel.com

Annual Report 2010 - Enel.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

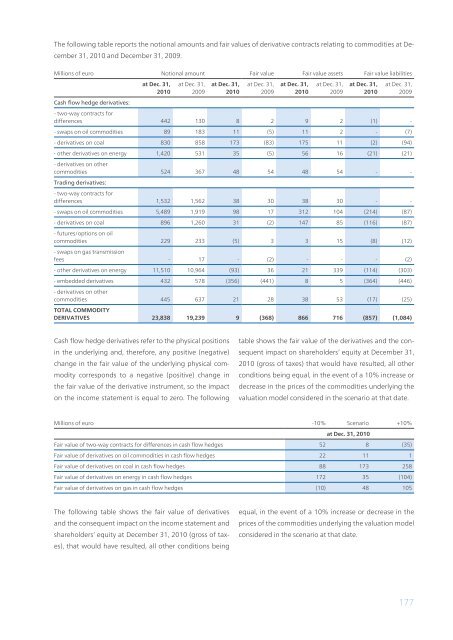

The following table reports the notional amounts and fair values of derivative contracts relating to <strong>com</strong>modities at December<br />

31, <strong>2010</strong> and December 31, 2009.<br />

Millions of euro Notional amount Fair value Fair value assets Fair value liabilities<br />

at Dec. 31,<br />

<strong>2010</strong><br />

at Dec. 31,<br />

2009<br />

at Dec. 31,<br />

<strong>2010</strong><br />

at Dec. 31,<br />

2009<br />

at Dec. 31,<br />

<strong>2010</strong><br />

at Dec. 31,<br />

2009<br />

at Dec. 31,<br />

<strong>2010</strong><br />

at Dec. 31,<br />

2009<br />

Cash flow hedge derivatives:<br />

- two-way contracts for<br />

differences 442 130 8 2 9 2 (1) -<br />

- swaps on oil <strong>com</strong>modities 89 183 11 (5) 11 2 - (7)<br />

- derivatives on coal 830 858 173 (83) 175 11 (2) (94)<br />

- other derivatives on energy 1,420 531 35 (5) 56 16 (21) (21)<br />

- derivatives on other<br />

<strong>com</strong>modities 524 367 48 54 48 54 - -<br />

Trading derivatives:<br />

- two-way contracts for<br />

differences 1,532 1,562 38 30 38 30 - -<br />

- swaps on oil <strong>com</strong>modities 5,489 1,919 98 17 312 104 (214) (87)<br />

- derivatives on coal 896 1,260 31 (2) 147 85 (116) (87)<br />

- futures/options on oil<br />

<strong>com</strong>modities 229 233 (5) 3 3 15 (8) (12)<br />

- swaps on gas transmission<br />

fees - 17 - (2) - - - (2)<br />

- other derivatives on energy 11,510 10,964 (93) 36 21 339 (114) (303)<br />

- embedded derivatives 432 578 (356) (441) 8 5 (364) (446)<br />

- derivatives on other<br />

<strong>com</strong>modities 445 637 21 28 38 53 (17) (25)<br />

TOTAL COMMODITY<br />

DERIVATIVES 23,838 19,239 9 (368) 866 716 (857) (1,084)<br />

Cash flow hedge derivatives refer to the physical positions<br />

in the underlying and, therefore, any positive (negative)<br />

change in the fair value of the underlying physical <strong>com</strong>modity<br />

corresponds to a negative (positive) change in<br />

the fair value of the derivative instrument, so the impact<br />

on the in<strong>com</strong>e statement is equal to zero. The following<br />

table shows the fair value of the derivatives and the consequent<br />

impact on shareholders’ equity at December 31,<br />

<strong>2010</strong> (gross of taxes) that would have resulted, all other<br />

conditions being equal, in the event of a 10% increase or<br />

decrease in the prices of the <strong>com</strong>modities underlying the<br />

valuation model considered in the scenario at that date.<br />

Millions of euro -10% Scenario<br />

at Dec. 31, <strong>2010</strong><br />

+10%<br />

Fair value of two-way contracts for differences in cash flow hedges 52 8 (35)<br />

Fair value of derivatives on oil <strong>com</strong>modities in cash flow hedges 22 11 1<br />

Fair value of derivatives on coal in cash flow hedges 88 173 258<br />

Fair value of derivatives on energy in cash flow hedges 172 35 (104)<br />

Fair value of derivatives on gas in cash flow hedges (10) 48 105<br />

The following table shows the fair value of derivatives<br />

and the consequent impact on the in<strong>com</strong>e statement and<br />

shareholders’ equity at December 31, <strong>2010</strong> (gross of taxes),<br />

that would have resulted, all other conditions being<br />

equal, in the event of a 10% increase or decrease in the<br />

prices of the <strong>com</strong>modities underlying the valuation model<br />

considered in the scenario at that date.<br />

177