Annual Report 2010 - Enel.com

Annual Report 2010 - Enel.com

Annual Report 2010 - Enel.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

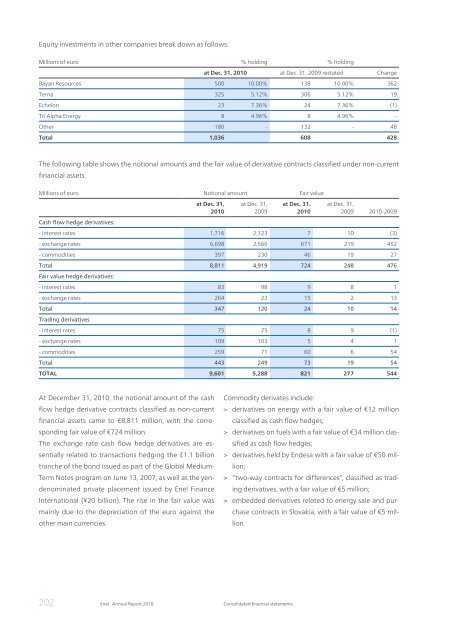

Equity investments in other <strong>com</strong>panies break down as follows:<br />

Millions of euro % holding % holding<br />

202 <strong>Enel</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> Consolidated financial statements<br />

at Dec. 31, <strong>2010</strong> at Dec. 31, 2009 restated Change<br />

Bayan Resources 500 10.00% 138 10.00% 362<br />

Terna 325 5.12% 306 5.12% 19<br />

Echelon 23 7.36% 24 7.36% (1)<br />

Tri Alpha Energy 8 4.96% 8 4.96% -<br />

Other 180 - 132 - 48<br />

Total 1,036 608 428<br />

The following table shows the notional amounts and the fair value of derivative contracts classified under non-current<br />

financial assets.<br />

Millions of euro Notional amount Fair value<br />

at Dec. 31,<br />

<strong>2010</strong><br />

at Dec. 31,<br />

2009<br />

at Dec. 31,<br />

<strong>2010</strong><br />

at Dec. 31,<br />

2009 <strong>2010</strong>-2009<br />

Cash flow hedge derivatives:<br />

- interest rates 1,716 2,123 7 10 (3)<br />

- exchange rates 6,698 2,566 671 219 452<br />

- <strong>com</strong>modities 397 230 46 19 27<br />

Total<br />

Fair value hedge derivatives:<br />

8,811 4,919 724 248 476<br />

- interest rates 83 98 9 8 1<br />

- exchange rates 264 22 15 2 13<br />

Total<br />

Trading derivatives<br />

347 120 24 10 14<br />

- interest rates 75 75 8 9 (1)<br />

- exchange rates 109 103 5 4 1<br />

- <strong>com</strong>modities 259 71 60 6 54<br />

Total 443 249 73 19 54<br />

TOTAL 9,601 5,288 821 277 544<br />

At December 31, <strong>2010</strong>, the notional amount of the cash<br />

flow hedge derivative contracts classified as non-current<br />

financial assets came to €8,811 million, with the corresponding<br />

fair value of €724 million.<br />

The exchange rate cash flow hedge derivatives are essentially<br />

related to transactions hedging the £1.1 billion<br />

tranche of the bond issued as part of the Global Medium-<br />

Term Notes program on June 13, 2007, as well as the yendenominated<br />

private placement issued by <strong>Enel</strong> Finance<br />

International (¥20 billion). The rise in the fair value was<br />

mainly due to the depreciation of the euro against the<br />

other main currencies.<br />

Commodity derivates include:<br />

> derivatives on energy with a fair value of €12 million<br />

classified as cash flow hedges;<br />

> derivatives on fuels with a fair value of €34 million classified<br />

as cash flow hedges;<br />

> derivatives held by Endesa with a fair value of €50 million;<br />

> “two-way contracts for differences”, classified as trading<br />

derivatives, with a fair value of €5 million;<br />

> embedded derivatives related to energy sale and purchase<br />

contracts in Slovakia, with a fair value of €5 million.