Annual Report 2010 - Enel.com

Annual Report 2010 - Enel.com

Annual Report 2010 - Enel.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

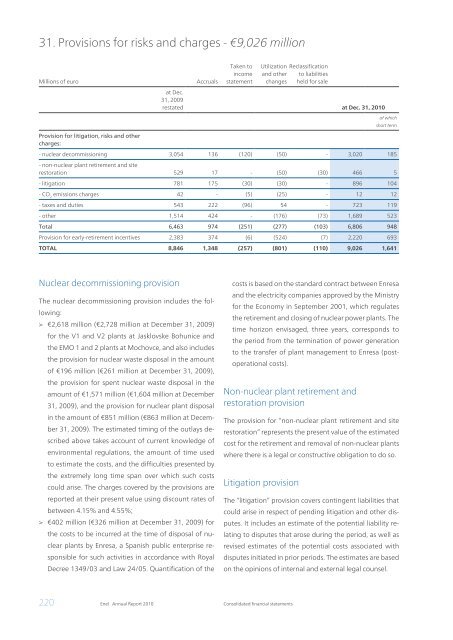

31. Provisions for risks and charges - €9,026 million<br />

Millions of euro Accruals<br />

Taken to<br />

in<strong>com</strong>e<br />

statement<br />

Utilization<br />

and other<br />

changes<br />

220 <strong>Enel</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> Consolidated financial statements<br />

Reclassification<br />

to liabilities<br />

held for sale<br />

at Dec.<br />

31, 2009<br />

restated at Dec. 31, <strong>2010</strong><br />

of which<br />

short term<br />

Provision for litigation, risks and other<br />

charges:<br />

- nuclear de<strong>com</strong>missioning<br />

- non-nuclear plant retirement and site<br />

3,054 136 (120) (50) - 3,020 185<br />

restoration 529 17 - (50) (30) 466 5<br />

- litigation 781 175 (30) (30) - 896 104<br />

- CO 2 emissions charges 42 - (5) (25) - 12 12<br />

- taxes and duties 543 222 (96) 54 - 723 119<br />

- other 1,514 424 - (176) (73) 1,689 523<br />

Total 6,463 974 (251) (277) (103) 6,806 948<br />

Provision for early-retirement incentives 2,383 374 (6) (524) (7) 2,220 693<br />

TOTAL 8,846 1,348 (257) (801) (110) 9,026 1,641<br />

Nuclear de<strong>com</strong>missioning provision<br />

The nuclear de<strong>com</strong>missioning provision includes the following:<br />

> €2,618 million (€2,728 million at December 31, 2009)<br />

for the V1 and V2 plants at Jasklovske Bohunice and<br />

the EMO 1 and 2 plants at Mochovce, and also includes<br />

the provision for nuclear waste disposal in the amount<br />

of €196 million (€261 million at December 31, 2009),<br />

the provision for spent nuclear waste disposal in the<br />

amount of €1,571 million (€1,604 million at December<br />

31, 2009), and the provision for nuclear plant disposal<br />

in the amount of €851 million (€863 million at December<br />

31, 2009). The estimated timing of the outlays described<br />

above takes account of current knowledge of<br />

environmental regulations, the amount of time used<br />

to estimate the costs, and the difficulties presented by<br />

the extremely long time span over which such costs<br />

could arise. The charges covered by the provisions are<br />

reported at their present value using discount rates of<br />

between 4.15% and 4.55%;<br />

> €402 million (€326 million at December 31, 2009) for<br />

the costs to be incurred at the time of disposal of nuclear<br />

plants by Enresa, a Spanish public enterprise responsible<br />

for such activities in accordance with Royal<br />

Decree 1349/03 and Law 24/05. Quantification of the<br />

costs is based on the standard contract between Enresa<br />

and the electricity <strong>com</strong>panies approved by the Ministry<br />

for the Economy in September 2001, which regulates<br />

the retirement and closing of nuclear power plants. The<br />

time horizon envisaged, three years, corresponds to<br />

the period from the termination of power generation<br />

to the transfer of plant management to Enresa (postoperational<br />

costs).<br />

Non-nuclear plant retirement and<br />

restoration provision<br />

The provision for “non-nuclear plant retirement and site<br />

restoration” represents the present value of the estimated<br />

cost for the retirement and removal of non-nuclear plants<br />

where there is a legal or constructive obligation to do so.<br />

Litigation provision<br />

The “litigation” provision covers contingent liabilities that<br />

could arise in respect of pending litigation and other disputes.<br />

It includes an estimate of the potential liability relating<br />

to disputes that arose during the period, as well as<br />

revised estimates of the potential costs associated with<br />

disputes initiated in prior periods. The estimates are based<br />

on the opinions of internal and external legal counsel.