- Page 1:

Annual Report 2010

- Page 4 and 5:

Contents Enel Annual Report 2010 Re

- Page 7 and 8:

Report on operations

- Page 9 and 10:

Iberia and Latin America Endesa Int

- Page 11 and 12:

operates in the end-user market for

- Page 13 and 14:

Powers Board of Directors The Board

- Page 15 and 16:

The contribution of the operating D

- Page 17 and 18:

The Spanish market saw a turnaround

- Page 19 and 20:

30.8% of its shares are listed on t

- Page 21 and 22:

of 21.4%). More specifically, the p

- Page 23 and 24:

Millions of euro Operating assets O

- Page 25 and 26:

21 10 January Acquisition of Padoma

- Page 27 and 28:

19 April €10 billion revolving li

- Page 29 and 30:

1 July Sale of power transmission n

- Page 31 and 32:

11 10 November Enel and Kepco sign

- Page 33 and 34:

of industrial economies (such as Ge

- Page 35 and 36:

inventories at their highest level

- Page 37 and 38:

Italy The electricity market Domest

- Page 39 and 40:

gradually increasing use, as from 2

- Page 41 and 42:

information on customers who have f

- Page 43 and 44:

Following the hearing of February 1

- Page 45 and 46:

With Resolution ARG/elt no. 211/10,

- Page 47 and 48:

Gas transport and metering rates Wi

- Page 49 and 50:

With Resolution VIS no. 162/10, the

- Page 51 and 52:

Developments in prices in the main

- Page 53 and 54:

lished on January 26, 2011, the Min

- Page 55 and 56:

On July 2, 2010, the CNC had undert

- Page 57 and 58:

ANEEL resolution also provides for

- Page 59 and 60:

daily wholesale market. Specificall

- Page 61 and 62:

the ARENH price will be set with a

- Page 63 and 64:

leading to a final 2010 system cost

- Page 65 and 66:

electricity from hydroelectric plan

- Page 67 and 68:

National renewable energy action pl

- Page 69 and 70:

were held in 2010. Plants with a to

- Page 71 and 72:

USA Carbon regulation On May 12, 20

- Page 73 and 74:

cial receivables in respect of the

- Page 75 and 76:

The performance and balance sheet f

- Page 77 and 78:

Costs Millions of euro 2010 2009 re

- Page 79 and 80:

Analysis of the Group’s financial

- Page 81 and 82:

Sundry provisions, totaling €17,2

- Page 83 and 84:

in long-term financial receivables

- Page 85 and 86:

eceivable in respect of the sale to

- Page 87 and 88:

(1) (2) 2009 results restated Milli

- Page 89 and 90:

1 Sales The Sales Division is respo

- Page 91 and 92:

the free market, which benefited fr

- Page 93 and 94:

Revenues for 2010 totaled €17,540

- Page 95 and 96:

of the International Division, rela

- Page 97 and 98:

Capital expenditure Millions of eur

- Page 99 and 100:

Net efficient generation capacity M

- Page 101 and 102:

an increase of €971 million in th

- Page 103 and 104:

Contribution to gross thermal gener

- Page 105 and 106:

The table below shows performance b

- Page 107 and 108:

Operations Net electricity generati

- Page 109 and 110:

prior-year items recognized in 2009

- Page 111 and 112:

Services and Other Activities The p

- Page 113 and 114:

its generation mix towards the use

- Page 115 and 116:

Country risk By now, some 50% of th

- Page 117 and 118:

Sustainability

- Page 119 and 120:

Sustainability in Enel Providing su

- Page 121 and 122:

Sustainability reporting Since 2002

- Page 123 and 124:

which is needed in order to rationa

- Page 125 and 126:

project, which resulted in hiring a

- Page 127 and 128:

The Nine Points project was one of

- Page 129 and 130:

well as in light of the recent reca

- Page 131 and 132:

sustainability by following the Blu

- Page 133 and 134:

tainability and governance help bus

- Page 135 and 136:

mapping of production sites located

- Page 137 and 138:

Zero-emission thermal power generat

- Page 139 and 140:

developing low-cost distributed pow

- Page 141 and 142:

Electric mobility The “Electric M

- Page 143:

Reconciliation of shareholders’ e

- Page 146 and 147:

Consolidated Income Statement Milli

- Page 148 and 149:

Consolidated Balance Sheet Millions

- Page 150 and 151: Statement of Changes in Consolidate

- Page 152 and 153: Consolidated Statement of Cash Flow

- Page 154 and 155: 2 Accounting policies and measureme

- Page 156 and 157: esposibilities, and their close rel

- Page 158 and 159: and completed before that date are

- Page 160 and 161: Investment property Investment prop

- Page 162 and 163: Financial liabilities Financial lia

- Page 164 and 165: For more information on the estimat

- Page 166 and 167: incorporating the guidelines contai

- Page 168 and 169: classified as equity if (and only i

- Page 170 and 171: Millions of euro LIABILITIES AND SH

- Page 172 and 173: are conducted within the framework

- Page 174 and 175: Expected cash flows from interest r

- Page 176 and 177: The following table reports the cas

- Page 178 and 179: Millions of euro -10% Scenario +10%

- Page 180 and 181: disposal, on September 23, 2009, of

- Page 182 and 183: Segment information for 2010 and 20

- Page 184 and 185: The following table reconciles segm

- Page 186 and 187: The table below gives a breakdown o

- Page 188 and 189: 9.c Personnel - €4,907 million Mi

- Page 190 and 191: Net income/(charges) from commodity

- Page 192 and 193: Financial expense Millions of euro

- Page 194 and 195: Information on the Consolidated Bal

- Page 196 and 197: subsequently sold in December 2010;

- Page 198 and 199: expected future cash flows and appl

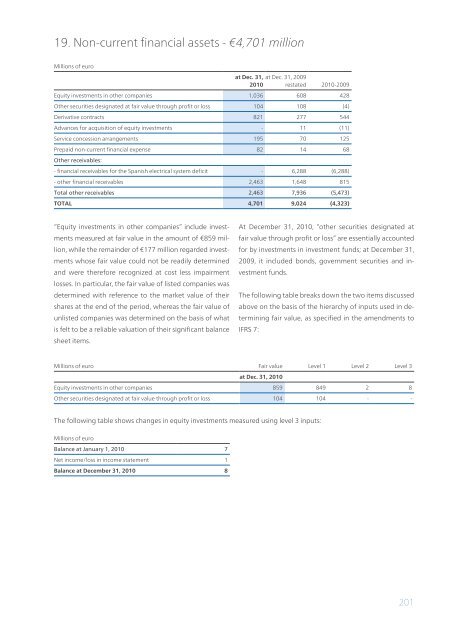

- Page 202 and 203: Equity investments in other compani

- Page 204 and 205: 20. Other non-current assets - €1

- Page 206 and 207: addition to direct reimbursement) b

- Page 208 and 209: Assets held for sale 27. Assets hel

- Page 210 and 211: Non-current liabilities 29. Long-te

- Page 212 and 213: issue of bonds for retail investors

- Page 214 and 215: Current portion of long-term loans

- Page 216 and 217: failure to make payment, breach of

- Page 218 and 219: Millions of euro Pension benefits O

- Page 220 and 221: 31. Provisions for risks and charge

- Page 222 and 223: Commodity derivatives mainly relate

- Page 224 and 225: 36. Current financial liabilities -

- Page 226 and 227: Liabilities held for sale 38. Liabi

- Page 228 and 229: 40. Contractual commitments and gua

- Page 230 and 231: Developments in the inquiries of th

- Page 232 and 233: provisionally enforceable, held the

- Page 234 and 235: creditor rights in respect of CELF

- Page 236 and 237: 43. Stock incentive plans Between 2

- Page 238 and 239: of the dividend (for 2004) of €0.

- Page 240 and 241: that of a specific benchmark index

- Page 242 and 243: Compensation of Directors, members

- Page 245 and 246: Corporate governance

- Page 247 and 248: Major shareholdings and shareholder

- Page 249 and 250: prescribed by the Unified Financial

- Page 251 and 252:

C) The revolving credit facility ag

- Page 253 and 254:

structure, internal auditing system

- Page 255 and 256:

listed companies), distinctly menti

- Page 257 and 258:

University, in Syracuse, New York (

- Page 259 and 260:

The Directors perform their duties

- Page 261 and 262:

letter b) above, have assets exceed

- Page 263 and 264:

sufficient to ensure that their jud

- Page 265 and 266:

compensation of the Chief Executive

- Page 267 and 268:

the power - which may also be exerc

- Page 269 and 270:

Conte is concerned, the Board of St

- Page 271 and 272:

in December 2006, the Board of Dire

- Page 273 and 274:

“independent” monitoring, entru

- Page 275 and 276:

conditions, and those whose conside

- Page 277 and 278:

of the Company’s website (www.ene

- Page 279 and 280:

Ethics consists of: > general princ

- Page 281 and 282:

“Zero Tolerance of Corruption”

- Page 283 and 284:

In principle, unless there are spec

- Page 285:

Internal control Has the Company ap

- Page 288 and 289:

Declaration of the Chief Executive

- Page 291 and 292:

Attachments

- Page 293 and 294:

Subsidiaries consolidated on a line

- Page 295 and 296:

Company name Registered office Coun

- Page 297 and 298:

Company name Registered office Coun

- Page 299 and 300:

Company name Registered office Coun

- Page 301 and 302:

Company name Registered office Coun

- Page 303 and 304:

Company name Registered office Coun

- Page 305 and 306:

Company name Registered office Coun

- Page 307 and 308:

Company name Registered office Coun

- Page 309 and 310:

Company name Registered office Coun

- Page 311 and 312:

Company name Registered office Coun

- Page 313 and 314:

Company name Registered office Coun

- Page 315 and 316:

Company name International Endesa B

- Page 317 and 318:

Enel SpA companies consolidated on

- Page 319 and 320:

Company name Companhia Térmica Rib

- Page 321 and 322:

Company name Registered office Coun

- Page 323 and 324:

Endesa SA companies consolidated on

- Page 325 and 326:

Associated companies accounted for

- Page 327 and 328:

Company name Registered office Coun

- Page 329 and 330:

Company name Registered office Coun

- Page 331 and 332:

Company name P.N. Endesa SA Central

- Page 333 and 334:

Other significant equity investment

- Page 337 and 338:

Reports

- Page 342:

Concept design Inarea - Rome Publis