Annual Report 2009-2010 - Department of Agriculture & Co-operation

Annual Report 2009-2010 - Department of Agriculture & Co-operation

Annual Report 2009-2010 - Department of Agriculture & Co-operation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Crop Insurance<br />

8.11 National Agricultural Insurance Scheme<br />

(NAIS): The National Agricultural Insurance<br />

Scheme (NAIS), with increased coverage <strong>of</strong><br />

farmers, crops, and risk commitment, was<br />

introduced in the country from Rabi 1999-2000,<br />

replacing the erstwhile <strong>Co</strong>mprehensive Crop<br />

Insurance Scheme (CCIS). The main objective <strong>of</strong><br />

the scheme is to protect farmers against crop<br />

losses suffered on account <strong>of</strong> natural calamities,<br />

such as drought, flood, hail-storms, cyclone,<br />

pests, and diseases. The scheme is being<br />

implemented by the <strong>Agriculture</strong> Insurance<br />

<strong>Co</strong>mpany <strong>of</strong> India, Ltd. (AIC).<br />

8.12 The scheme is available to all farmersloanee<br />

and non-loanee-irrespective <strong>of</strong> their size<br />

<strong>of</strong> holding. It envisages coverage <strong>of</strong> all food crops<br />

(cereals, millets, and pulses), oilseeds, and<br />

annual commercial/horticultural crops, in respect<br />

<strong>of</strong> which past yield data is available for an<br />

adequate number <strong>of</strong> years. Among the annual<br />

commercial/horticultural crops-sugarcane,<br />

potato, cotton, ginger, onion, turmeric, chillies,<br />

pineapple, annual banana, jute, tapioca,<br />

coriander, cumin, and garlic, have already been<br />

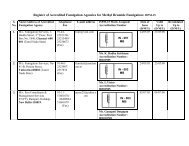

Table 8.1: States/UTs implementing NAIS<br />

covered under the scheme. All other annual<br />

commercial/horticultural crops are stipulated to<br />

be placed under insurance cover in due course<br />

<strong>of</strong> time, subject to the availability <strong>of</strong> past yield<br />

data. The scheme is operating on the 'Area<br />

Approach' basis, i.e., with defined areas for each<br />

notified crop.<br />

8.13 The premium rates are 3.5 per cent (<strong>of</strong><br />

the sum insured) for bajra and oilseeds, 2.5 per<br />

cent for other Kharif crops, 1.5 per cent for wheat,<br />

and 2 per cent for other Rabi crops. In the case<br />

<strong>of</strong> commercial/horticultural crops, actuarial rates<br />

are being charged. Under the scheme, small and<br />

marginal farmers were originally provided a<br />

subsidy <strong>of</strong> 50 per cent <strong>of</strong> the premium charged<br />

from them. The subsidy on premiums has now<br />

been phased out over a period <strong>of</strong> five years. At<br />

present, a 10 per cent subsidy on premiums is<br />

available to small and marginal farmers, which<br />

is to be shared equally by the Centre and state<br />

governments.<br />

8.14 The scheme is optional for states/UTs. At<br />

present, the scheme is being implemented by<br />

the following 25 states and two UTs, given in<br />

Table 8.1:<br />

1. Andhra Pradesh 2. Assam 3. Bihar<br />

4. Chhattisgarh 5. Goa 6. Gujarat<br />

7. Haryana 8. Himachal Pradesh 9. Jammu and Kashmir<br />

10. Jharkhand 11. Karnataka 12. Kerala<br />

13. Madhya Pradesh 14. Maharashtra 15. Manipur<br />

16. Meghalaya 17. Mizoram 18. Orissa<br />

19. Rajasthan 20. Sikkim 21. Tamil Nadu<br />

22. Tripura 23. Uttar Pradesh 24. Uttarakhand<br />

25. West Bengal 26. Andaman and Nicobar Islands 27. Puducherry<br />

Season-wise details <strong>of</strong> farmers covered, the area<br />

covered, sum insured, and insurance charges<br />

under NAIS during the last 19 crop seasons (i.e.,<br />

from Rabi 1999-2000 to Rabi 2008-09) are given<br />

in Table 8.2:<br />

Agricultural Credit and Crop Insurance<br />

47