Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4.10 Value of different production plants 99<br />

45<br />

40<br />

Investment<br />

Operating<br />

Fuel<br />

35<br />

30<br />

$/MWh<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Gas turbine Coal plant Nuclear plant<br />

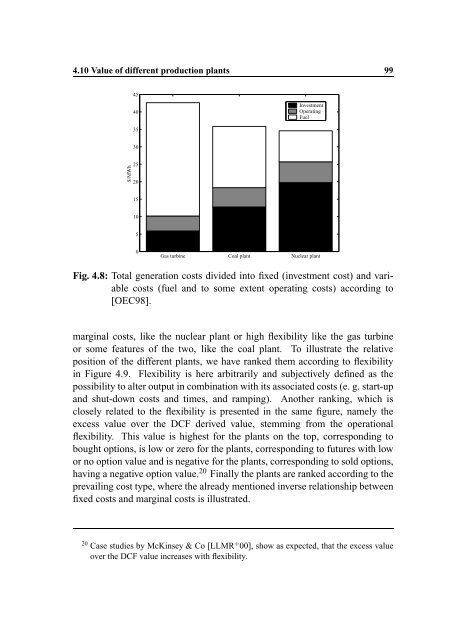

Fig. 4.8: Total generation costs divided into fixed (investment cost) <strong>and</strong> variable<br />

costs (fuel <strong>and</strong> to some extent operating costs) according to<br />

[OEC98].<br />

marginal costs, like the nuclear plant or high flexibility like the gas turbine<br />

or some features of the two, like the coal plant. To illustrate the relative<br />

position of the different plants, we have ranked them according to flexibility<br />

in Figure 4.9. Flexibility is here arbitrarily <strong>and</strong> subjectively defined as the<br />

possibility to alter output in combination with its associated costs (e. g. start-up<br />

<strong>and</strong> shut-down costs <strong>and</strong> times, <strong>and</strong> ramping). Another ranking, which is<br />

closely related to the flexibility is presented in the same figure, namely the<br />

excess value over the DCF derived value, stemming from the operational<br />

flexibility. This value is highest for the plants on the top, corresponding to<br />

bought options, is low or zero for the plants, corresponding to futures with low<br />

or no option value <strong>and</strong> is negative for the plants, corresponding to sold options,<br />

having a negative option value. 20 Finally the plants are ranked according to the<br />

prevailing cost type, where the already mentioned inverse relationship between<br />

fixed costs <strong>and</strong> marginal costs is illustrated.<br />

20 Case studies by McKinsey & Co [LLMR¼ 00], show as expected, that the excess value<br />

over the DCF value increases with flexibility.