Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F Û 0Ü 3Ý<br />

í<br />

è<br />

F Û 0Ü 1Ý?Ü í xë3<br />

í x ì1 á<br />

6.6 Power portfolio optimization with CVaR 153<br />

Future price<br />

+<br />

F(0,3)<br />

*<br />

F(0,7)<br />

*<br />

F(0,5)<br />

*<br />

F(0,1)<br />

*<br />

2 3 4 5 6 7<br />

' ( ) & % $ 1#<br />

Period<br />

"<br />

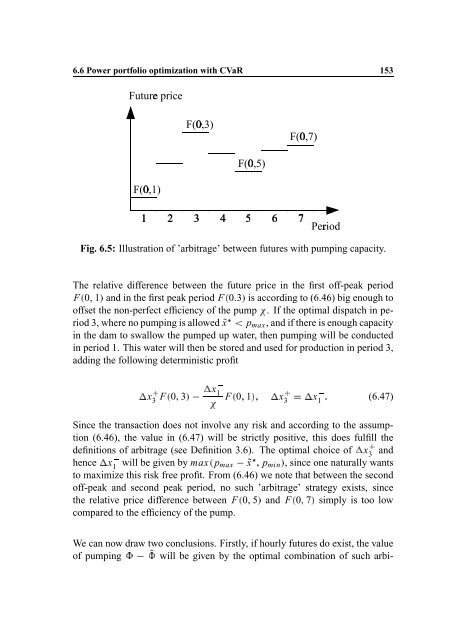

Fig. 6.5: Illustration of ’arbitrage’ between futures with pumping capacity.<br />

The relative difference between the future price in the first off-peak period<br />

Û 0Ü 1Ý F <strong>and</strong> in the first peak period Û F 0 3Ý is according to (6.46) big enough to<br />

offset the non-perfect efficiency of the pump è á . If the optimal dispatch in period<br />

3, where no pumping is xú é allowed p max , <strong>and</strong> if there is enough capacity<br />

in the dam to swallow the pumped up water, then pumping will be conducted<br />

in period 1. This water will then be stored <strong>and</strong> used for production in period 3,<br />

adding the following deterministic profit<br />

í xë3<br />

x ì1<br />

(6.47)<br />

Since the transaction does not involve any risk <strong>and</strong> according to the assumption<br />

(6.46), the value in (6.47) will be strictly positive, this does fulfill the<br />

definitions of arbitrage (see Definition 3.6). The optimal choice í of xë3<br />

<strong>and</strong><br />

í hence x ì1 will be given by max p max xú?Ü p min Ý , since one naturally wants<br />

to maximize this risk free profit. From (6.46) we note that between the second<br />

off-peak <strong>and</strong> second peak period, no such ’arbitrage’ strategy exists, since<br />

Û<br />

the relative price difference between Û 0Ü 5Ý F <strong>and</strong> Û 0Ü 7Ý F simply is too low<br />

compared to the efficiency of the pump.<br />

We can now draw two conclusions. Firstly, if hourly futures do exist, the value<br />

of pumping ! ! will be given by the optimal combination of such arbi-