Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

04<br />

04<br />

2.7 <strong>Electricity</strong> contracts 29<br />

Price<br />

3<br />

Price<br />

3<br />

Price<br />

3<br />

Floa1 ting<br />

2<br />

Time<br />

2<br />

Time<br />

2<br />

Time<br />

With cap With cap <strong>and</strong> floor<br />

5<br />

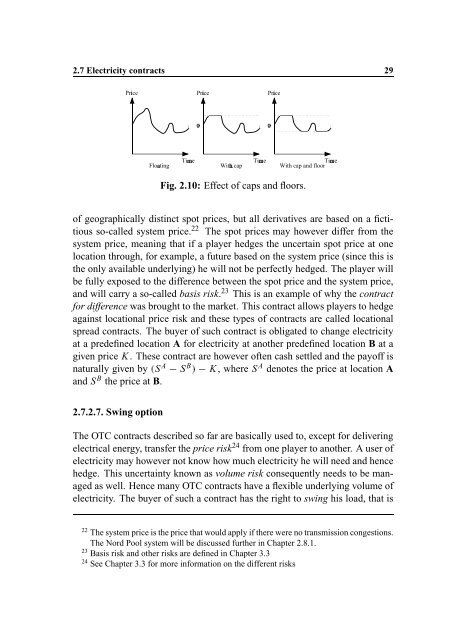

Fig. 2.10: Effect of caps <strong>and</strong> floors.<br />

of geographically distinct spot prices, but all derivatives are based on a fictitious<br />

so-called system price. 22 The spot prices may however differ from the<br />

system price, meaning that if a player hedges the uncertain spot price at one<br />

location through, for example, a future based on the system price (since this is<br />

the only available underlying) he will not be perfectly hedged. The player will<br />

be fully exposed to the difference between the spot price <strong>and</strong> the system price,<br />

<strong>and</strong> will carry a so-called basis risk. 23 This is an example of why the contract<br />

for difference was brought to the market. This contract allows players to hedge<br />

against locational price risk <strong>and</strong> these types of contracts are called locational<br />

spread contracts. The buyer of such contract is obligated to change electricity<br />

at a predefined location A for electricity at another predefined location B at a<br />

given price K . These contract are however often cash settled <strong>and</strong> the payoff is<br />

naturally given , by S A S B K , where S A denotes the price at location A<br />

-<br />

<strong>and</strong> S B the price at B.<br />

2.7.2.7. Swing option<br />

The OTC contracts described so far are basically used to, except for delivering<br />

electrical energy, transfer the price risk 24 from one player to another. A user of<br />

electricity may however not know how much electricity he will need <strong>and</strong> hence<br />

hedge. This uncertainty known as volume risk consequently needs to be managed<br />

as well. Hence many OTC contracts have a flexible underlying volume of<br />

electricity. The buyer of such a contract has the right to swing his load, that is<br />

22 The system price is the price that would apply if there were no transmission congestions.<br />

The Nord Pool system will be discussed further in Chapter 2.8.1.<br />

23 Basis risk <strong>and</strong> other risks are defined in Chapter 3.3<br />

24 See Chapter 3.3 for more information on the different risks