Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

“<br />

3.7 Valuation models 73<br />

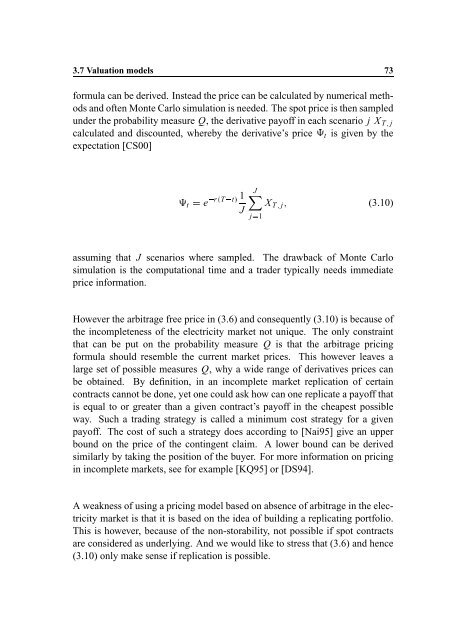

formula can be derived. Instead the price can be calculated by numerical methods<br />

<strong>and</strong> often Monte Carlo simulation is needed. The spot price is then sampled<br />

under the probability measure Q, the derivative payoff in each scenario j X Tg j<br />

calculated <strong>and</strong> discounted, whereby the derivative’s price “ t is given by the<br />

expectation [CS00]<br />

t<br />

e I r H<br />

T I tL<br />

1<br />

J<br />

J<br />

j… 1<br />

X Tg j G (3.10)<br />

assuming that J scenarios where sampled. The drawback of Monte Carlo<br />

simulation is the computational time <strong>and</strong> a trader typically needs immediate<br />

price information.<br />

However the arbitrage free price in (3.6) <strong>and</strong> consequently (3.10) is because of<br />

the incompleteness of the electricity market not unique. The only constraint<br />

that can be put on the probability measure Q is that the arbitrage pricing<br />

formula should resemble the current market prices. This however leaves a<br />

large set of possible measures Q, why a wide range of derivatives prices can<br />

be obtained. By definition, in an incomplete market replication of certain<br />

contracts cannot be done, yet one could ask how can one replicate a payoff that<br />

is equal to or greater than a given contract’s payoff in the cheapest possible<br />

way. Such a trading strategy is called a minimum cost strategy for a given<br />

payoff. The cost of such a strategy does according to [Nai95] give an upper<br />

bound on the price of the contingent claim. A lower bound can be derived<br />

similarly by taking the position of the buyer. For more information on pricing<br />

in incomplete markets, see for example [KQ95] or [DS94].<br />

A weakness of using a pricing model based on absence of arbitrage in the electricity<br />

market is that it is based on the idea of building a replicating portfolio.<br />

This is however, because of the non-storability, not possible if spot contracts<br />

are considered as underlying. And we would like to stress that (3.6) <strong>and</strong> hence<br />

(3.10) only make sense if replication is possible.