Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34 The electricity market<br />

1800<br />

1600<br />

Physical<br />

Financial<br />

Bilateral clearing<br />

1400<br />

1200<br />

TWh<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

1993 1994 1995 1996 1997 1998 1999 2000<br />

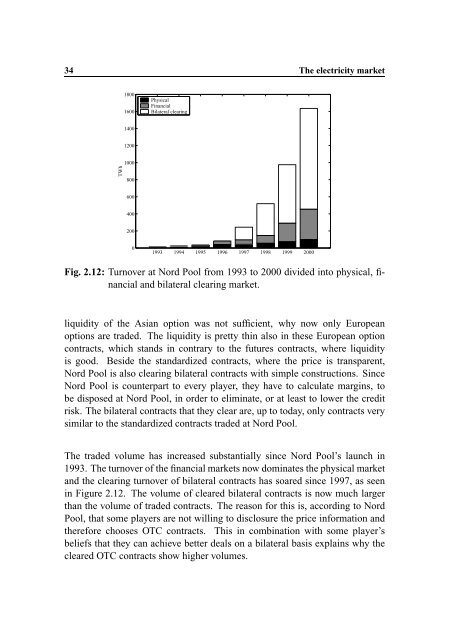

Fig. 2.12: Turnover at Nord Pool from 1993 to 2000 divided into physical, financial<br />

<strong>and</strong> bilateral clearing market.<br />

liquidity of the Asian option was not sufficient, why now only European<br />

options are traded. The liquidity is pretty thin also in these European option<br />

contracts, which st<strong>and</strong>s in contrary to the futures contracts, where liquidity<br />

is good. Beside the st<strong>and</strong>ardized contracts, where the price is transparent,<br />

Nord Pool is also clearing bilateral contracts with simple constructions. Since<br />

Nord Pool is counterpart to every player, they have to calculate margins, to<br />

be disposed at Nord Pool, in order to eliminate, or at least to lower the credit<br />

risk. The bilateral contracts that they clear are, up to today, only contracts very<br />

similar to the st<strong>and</strong>ardized contracts traded at Nord Pool.<br />

The traded volume has increased substantially since Nord Pool’s launch in<br />

1993. The turnover of the financial markets now dominates the physical market<br />

<strong>and</strong> the clearing turnover of bilateral contracts has soared since 1997, as seen<br />

in Figure 2.12. The volume of cleared bilateral contracts is now much larger<br />

than the volume of traded contracts. The reason for this is, according to Nord<br />

Pool, that some players are not willing to disclosure the price information <strong>and</strong><br />

therefore chooses OTC contracts. This in combination with some player’s<br />

beliefs that they can achieve better deals on a bilateral basis explains why the<br />

cleared OTC contracts show higher volumes.