Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

170 Case study<br />

Spot price process<br />

d<br />

1.5 [CHF/MWh]<br />

2.2 [-] 2<br />

amp<br />

y 5.6 [CHF/MWh]<br />

3<br />

û<br />

90 [CHF/MWh]<br />

Dem<strong>and</strong> process<br />

2000 [-] 2 39 [CHF/MWh]<br />

<br />

0.45 [-] 2<br />

amp<br />

ò<br />

d<br />

150 [MWh]<br />

2.3 [-] 2<br />

amp<br />

y 418 [MWh]<br />

û<br />

2000 [-] 2 1650 [MWh]<br />

<br />

0.15 [-] 2<br />

amp<br />

ò<br />

3<br />

3000 [MWh]<br />

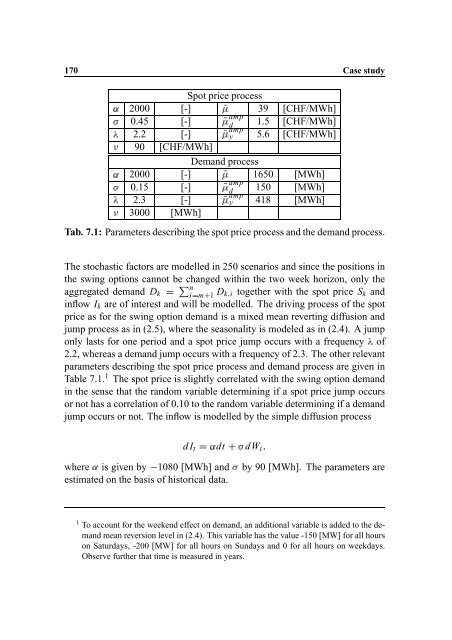

Tab. 7.1: Parameters describing the spot price process <strong>and</strong> the dem<strong>and</strong> process.<br />

The stochastic factors are modelled in 250 scenarios <strong>and</strong> since the positions in<br />

the swing options cannot be changed within the two week horizon, only the<br />

n<br />

aggregated dem<strong>and</strong> D k<br />

m 1 D kã i together with the spot price S iâ k <strong>and</strong><br />

inflow I<br />

ë<br />

k are of interest <strong>and</strong> will be modelled. The driving process of the spot<br />

price as for the swing option dem<strong>and</strong> is a mixed mean reverting diffusion <strong>and</strong><br />

jump process as in (2.5), where the seasonality is modeled as in (2.4). A jump<br />

only lasts for one period <strong>and</strong> a spot price jump occurs with û<br />

a frequency of<br />

2.2, whereas a dem<strong>and</strong> jump occurs with a frequency of 2.3. The other relevant<br />

parameters describing the spot price process <strong>and</strong> dem<strong>and</strong> process are given in<br />

Table 7.1. 1 The spot price is slightly correlated with the swing option dem<strong>and</strong><br />

in the sense that the r<strong>and</strong>om variable determining if a spot price jump occurs<br />

or not has a correlation of 0.10 to the r<strong>and</strong>om variable determining if a dem<strong>and</strong><br />

jump occurs or not. The inflow is modelled by the simple diffusion process<br />

d I t dt ò dW t Ü<br />

where is given by 1080 [MWh] <strong>and</strong> ò by 90 [MWh]. The parameters are<br />

estimated on the basis of historical data.<br />

1 To account for the weekend effect on dem<strong>and</strong>, an additional variable is added to the dem<strong>and</strong><br />

mean reversion level in (2.4). This variable has the value -150 [MW] for all hours<br />

on Saturdays, -200 [MW] for all hours on Sundays <strong>and</strong> 0 for all hours on weekdays.<br />

Observe further that time is measured in years.