- Page 1:

Diss. ETH No. 14727 Hedging Strateg

- Page 5 and 6:

Abstract This thesis studies risk m

- Page 7 and 8:

Zusammenfassung Die vorliegende Sch

- Page 9 and 10:

Contents Acknowledgements ¡ ¢ ¡

- Page 11 and 12:

Contents xi 5.1 Overview . . . . .

- Page 13 and 14:

List of Figures 2.1 Illustration of

- Page 15 and 16:

List of Figures xv 7.6 Marginal val

- Page 17 and 18:

List of Tables 2.1 Spot market bid.

- Page 19 and 20:

Chapter 1 Introduction 1.1. Motivat

- Page 21 and 22:

1.3 Structure of the thesis 5 hedge

- Page 23 and 24:

Chapter 2 The electricity market 2.

- Page 25 and 26:

2.1 Overview 9 Generation ¥ Distri

- Page 27 and 28:

2.2 Liberalization of the electrici

- Page 29 and 30:

duction cost Marginal pro © 2.3 Su

- Page 31 and 32:

2.4 Transmission costs 15 10 Peak l

- Page 33 and 34:

2.4 Transmission costs 17 destinati

- Page 35 and 36:

2.5 Demand 19 2.5. Demand Compared

- Page 37 and 38:

2.6 Special characteristics of elec

- Page 39 and 40:

2.7 Electricity contracts 23 tions.

- Page 41 and 42:

0& K $ 0& K K % + $ 2.7 Electricity

- Page 43 and 44:

2.7 Electricity contracts 27 2.7.2.

- Page 45 and 46:

04 04 2.7 Electricity contracts 29

- Page 47 and 48:

2.8 Power exchanges and pricing mec

- Page 49 and 50:

2.8 Power exchanges and pricing mec

- Page 51 and 52:

S 0 eH aIKJ 2.9 Price dynamic 35 To

- Page 53 and 54:

2.9 Price dynamic 37 400 2000 350 1

- Page 55 and 56:

2.9 Price dynamic 39 simple sinus f

- Page 57 and 58:

2.9 Price dynamic 41 1800 1800 1600

- Page 59 and 60:

2.10 Summary 43 To deal with the un

- Page 61 and 62:

Chapter 3 Risk management 3.1. Over

- Page 63 and 64:

3.3 The risks in the electricity ma

- Page 65 and 66:

3.3 The risks in the electricity ma

- Page 67 and 68:

3.4 Traditional risk management mod

- Page 69 and 70:

3.4 Traditional risk management mod

- Page 71 and 72:

3.4 Traditional risk management mod

- Page 73 and 74:

3.4 Traditional risk management mod

- Page 75 and 76:

l H xg yLihkjml f 3.5 The need for

- Page 77 and 78:

3.5 The need for a new risk measure

- Page 79 and 80:

R S x GaRKV is convex and continuou

- Page 81 and 82:

R P 3.6 Multi period risk managemen

- Page 83 and 84:

“ “ “ 3.7 Valuation models 67

- Page 85 and 86:

3.7 Valuation models 69 storability

- Page 87 and 88:

3.7 Valuation models 71 by introduc

- Page 89 and 90:

“ 3.7 Valuation models 73 formula

- Page 91 and 92:

Chapter 4 Contract engineering 4.1.

- Page 93 and 94:

4.2 Gas turbine 77 2000 1800 1600 1

- Page 95 and 96:

4.2 Gas turbine 79 220 200 Capped l

- Page 97 and 98:

4.3 Hydro storage plant 81 facilita

- Page 99 and 100:

¢ 4.3 Hydro storage plant 83 I k L

- Page 101 and 102:

x k xœk x «k š xœk 0 š x «k 0

- Page 103 and 104:

4.4 Coal plant and oil plant 87 4.4

- Page 105 and 106:

4.4 Coal plant and oil plant 89 cor

- Page 107 and 108:

4.5 Nuclear plant 91 of 1000 MW. Ov

- Page 109 and 110:

4.7 All production plants 93 possib

- Page 111 and 112:

4.8 Transmission lines 95 Unit type

- Page 113 and 114:

4.9 Real option theory 97 The scien

- Page 115 and 116:

4.10 Value of different production

- Page 117 and 118:

4.12 Summary 101 like the capped sp

- Page 119 and 120: Chapter 5 Hedging strategies 5.1. O

- Page 121 and 122: È È È È È 5.2 Traditional hedg

- Page 123 and 124: É È É È Ì 5.2 Traditional hedg

- Page 125 and 126: 5.3 Relevance for electricity hedgi

- Page 127 and 128: 5.4 Best Hedge 111 that the expecte

- Page 129 and 130: 5.4 Best Hedge 113 that they alread

- Page 131 and 132: Chapter 6 Power portfolio optimizat

- Page 133 and 134: 6.3 Power portfolio optimization in

- Page 135 and 136: 6.3 Power portfolio optimization in

- Page 137 and 138: 6.4 Modeling of plants and their op

- Page 139 and 140: 6.4 Modeling of plants and their op

- Page 141 and 142: x k xëk x ìk Ü xë k 0Ü x ìk 0

- Page 143 and 144: 6.4 Modeling of plants and their op

- Page 145 and 146: gìi Û S í SÜ D í DÜ I a í I

- Page 147 and 148: õ õ 6.5 Analysis of optimal dispa

- Page 149 and 150: õ Ü r á 6.5 Analysis of optimal

- Page 151 and 152: ¢ é á 6.5 Analysis of optimal di

- Page 153 and 154: ìj Û 1 bë j Ý?Ü j 1Ü á?á@á

- Page 155 and 156: u ¦ j Ü è è aëj ¦ bë j u j

- Page 157 and 158: õ õ õ á á 6.5 Analysis of opti

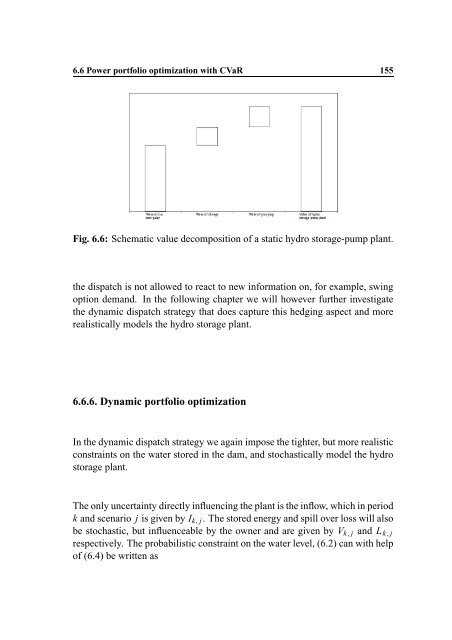

- Page 159 and 160: 6.6 Power portfolio optimization wi

- Page 161 and 162: è á 6.6 Power portfolio optimizat

- Page 163 and 164: x Û x p Ü x c Ý Û xë1 Ü á@á

- Page 165 and 166: 6.6 Power portfolio optimization wi

- Page 167 and 168: ááá ááá ááá ááá ááá

- Page 169: F Û 0Ü 3Ý í è F Û 0Ü 1Ý?Ü

- Page 173 and 174: ö 6.6 Power portfolio optimization

- Page 175 and 176: ö Ü 6.6 Power portfolio optimizat

- Page 177 and 178: ö S kã j á 6.6 Power portfolio o

- Page 179 and 180: ¢ ¢ 6.6 Power portfolio optimizat

- Page 181 and 182: î yú1 î é yú1 á ¢ 6.6 Power

- Page 183 and 184: 6.7 Summary 167 opportunity set wou

- Page 185 and 186: Chapter 7 Case study In this chapte

- Page 187 and 188: 171 3200 140 3000 2800 120 2600 240

- Page 189 and 190: S7 D7 min 8 0 if S i or D p otherwi

- Page 191 and 192: 175 Production Spot price Demand [C

- Page 193 and 194: 7.1 Efficient frontier 177 lG x 6 9

- Page 195 and 196: 7.2 Spot position 179 of the old po

- Page 197 and 198: 7.3 Hedging value of water 181 The

- Page 199 and 200: 7.4 Value decomposition 183 expecte

- Page 201 and 202: MWh CHF/ P 7.4 Value decomposition

- Page 203 and 204: 7.6 Summary 187 2500 2000 Dispatch

- Page 205 and 206: 7.6 Summary 189 We have quantified

- Page 207 and 208: Chapter 8 Conclusions The special c

- Page 209 and 210: a4q V a4q G 1 V H a4q 6 Appendix A

- Page 211 and 212: 8 _ 195 Proof The results follow im

- Page 213 and 214: g b4i d G9:7j b4 j G 1 9j7j H b4 j

- Page 215 and 216: Ax 3 V AxK1 G 1 V H AxK2 V b 1 G 1

- Page 217 and 218: Bibliography [ABA98] [AD80] [ADEH97

- Page 219 and 220: Bibliography 203 [BS73] [BS98] [BT0

- Page 221 and 222:

Bibliography 205 [GR92] H. Gravelle

- Page 223 and 224:

Bibliography 207 [Mer76] R. C. Mert

- Page 225 and 226:

Bibliography 209 [SC89] [Sch90] [Sc

- Page 227:

Curriculum Vitae Personal Data Name