Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

0&<br />

K<br />

$<br />

0&<br />

K<br />

K %<br />

+<br />

$<br />

2.7 <strong>Electricity</strong> contracts 25<br />

Payoff<br />

!<br />

Payoff<br />

!<br />

0<br />

Average spot<br />

price in [T ,T ]<br />

1# 2<br />

0<br />

Average spot<br />

price in [T ,T ]<br />

1# 2<br />

Long position<br />

Short p" osition<br />

Fig. 2.7: Payoffs from future contracts.<br />

Pay( off<br />

Pay( off<br />

%<br />

K<br />

F(T,T ,T' )<br />

F(T,T ' ,T )<br />

2<br />

+ 1* 2<br />

1*<br />

Bought call<br />

)<br />

Bought put<br />

)<br />

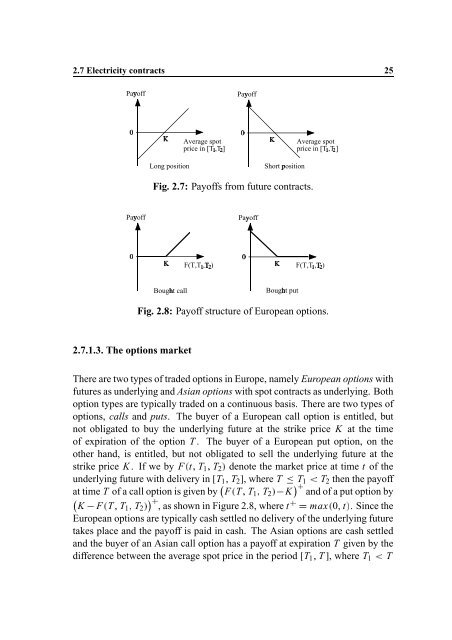

Fig. 2.8: Payoff structure of European options.<br />

2.7.1.3. The options market<br />

There are two types of traded options in Europe, namely European options with<br />

futures as underlying <strong>and</strong> Asian options with spot contracts as underlying. Both<br />

option types are typically traded on a continuous basis. There are two types of<br />

options, calls <strong>and</strong> puts. The buyer of a European call option is entitled, but<br />

not obligated to buy the underlying future at the strike price K at the time<br />

of expiration of the option T . The buyer of a European put option, on the<br />

other h<strong>and</strong>, is entitled, but not obligated to sell the underlying future at the<br />

strike price K . If we by , F t T 1 T 2- denote the market price at time t of the<br />

underlying future with delivery in T 1 T 2 , where T T 1 T . 2 then the payoff<br />

at time T of a call option is given by , F T T 1 T 2- / K <strong>and</strong> of a put option by<br />

K , F T T 1 T / 2- , as shown in Figure 2.8, t/ where , 0 t- max . Since the<br />

European options are typically cash settled no delivery of the underlying future<br />

takes place <strong>and</strong> the payoff is paid in cash. The Asian options are cash settled<br />

<strong>and</strong> the buyer of an Asian call option has a payoff at expiration T given by the<br />

difference between the average spot price in the period T 1 T , where T 1 . T