Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

120 Power portfolio optimization<br />

Inflow<br />

Portfolio optimization<br />

Dem<strong>and</strong><br />

Production portfolio<br />

<strong>Contract</strong> portfolio<br />

Availability<br />

Marginal costs<br />

Strike<br />

Exercise flexibility<br />

Fixed costs<br />

Flexibility<br />

Interaction<br />

Volume flexibility<br />

Interruptability<br />

<strong>Contract</strong> engineering &<br />

Portfolio optimization<br />

Optimal dispatch strategy<br />

<strong>Engineering</strong> thinking<br />

Portfolio optimization<br />

Optimal contract portfolio<br />

Financial thinking<br />

Fuel prices<br />

Spot prices<br />

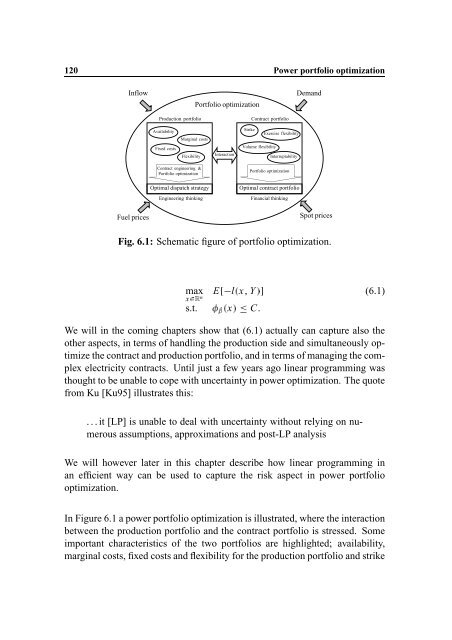

Fig. 6.1: Schematic figure of portfolio optimization.<br />

max E lÛ x Ü Y Ý<br />

xÙmÚ<br />

n<br />

xÝ s.t. ÞOßàÛ C.<br />

(6.1)<br />

We will in the coming chapters show that (6.1) actually can capture also the<br />

other aspects, in terms of h<strong>and</strong>ling the production side <strong>and</strong> simultaneously optimize<br />

the contract <strong>and</strong> production portfolio, <strong>and</strong> in terms of managing the complex<br />

electricity contracts. Until just a few years ago linear programming was<br />

thought to be unable to cope with uncertainty in power optimization. The quote<br />

from Ku [Ku95] illustrates this:<br />

. . . it [LP] is unable to deal with uncertainty without relying on numerous<br />

assumptions, approximations <strong>and</strong> post-LP analysis<br />

We will however later in this chapter describe how linear programming in<br />

an efficient way can be used to capture the risk aspect in power portfolio<br />

optimization.<br />

In Figure 6.1 a power portfolio optimization is illustrated, where the interaction<br />

between the production portfolio <strong>and</strong> the contract portfolio is stressed. Some<br />

important characteristics of the two portfolios are highlighted; availability,<br />

marginal costs, fixed costs <strong>and</strong> flexibility for the production portfolio <strong>and</strong> strike