Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.8 Power exchanges <strong>and</strong> pricing mechanisms 33<br />

Price<br />

B<br />

Supply<br />

C<br />

S p<br />

Dem<strong>and</strong><br />

D<br />

Volume<br />

E<br />

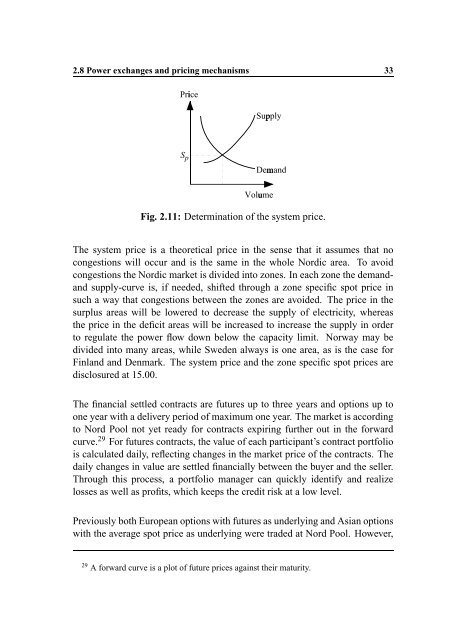

Fig. 2.11: Determination of the system price.<br />

The system price is a theoretical price in the sense that it assumes that no<br />

congestions will occur <strong>and</strong> is the same in the whole Nordic area. To avoid<br />

congestions the Nordic market is divided into zones. In each zone the dem<strong>and</strong><strong>and</strong><br />

supply-curve is, if needed, shifted through a zone specific spot price in<br />

such a way that congestions between the zones are avoided. The price in the<br />

surplus areas will be lowered to decrease the supply of electricity, whereas<br />

the price in the deficit areas will be increased to increase the supply in order<br />

to regulate the power flow down below the capacity limit. Norway may be<br />

divided into many areas, while Sweden always is one area, as is the case for<br />

Finl<strong>and</strong> <strong>and</strong> Denmark. The system price <strong>and</strong> the zone specific spot prices are<br />

disclosured at 15.00.<br />

The financial settled contracts are futures up to three years <strong>and</strong> options up to<br />

one year with a delivery period of maximum one year. The market is according<br />

to Nord Pool not yet ready for contracts expiring further out in the forward<br />

curve. 29 For futures contracts, the value of each participant’s contract portfolio<br />

is calculated daily, reflecting changes in the market price of the contracts. The<br />

daily changes in value are settled financially between the buyer <strong>and</strong> the seller.<br />

Through this process, a portfolio manager can quickly identify <strong>and</strong> realize<br />

losses as well as profits, which keeps the credit risk at a low level.<br />

Previously both European options with futures as underlying <strong>and</strong> Asian options<br />

with the average spot price as underlying were traded at Nord Pool. However,<br />

29 A forward curve is a plot of future prices against their maturity.