Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

32 The electricity market<br />

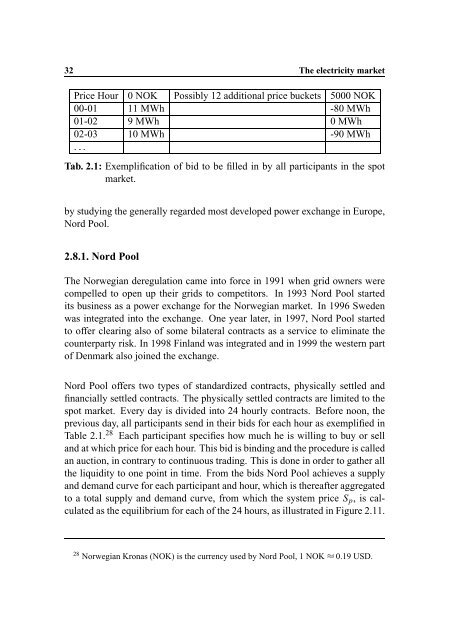

Price Hour 0 NOK Possibly 12 additional price buckets 5000 NOK<br />

00-01 11 MWh -80 MWh<br />

01-02 9 MWh 0 MWh<br />

02-03 10 MWh -90 MWh<br />

? @<br />

Tab. 2.1: Exemplification of bid to be filled in by all participants in the spot<br />

market.<br />

by studying the generally regarded most developed power exchange in Europe,<br />

Nord Pool.<br />

2.8.1. Nord Pool<br />

The Norwegian deregulation came into force in 1991 when grid owners were<br />

compelled to open up their grids to competitors. In 1993 Nord Pool started<br />

its business as a power exchange for the Norwegian market. In 1996 Sweden<br />

was integrated into the exchange. One year later, in 1997, Nord Pool started<br />

to offer clearing also of some bilateral contracts as a service to eliminate the<br />

counterparty risk. In 1998 Finl<strong>and</strong> was integrated <strong>and</strong> in 1999 the western part<br />

of Denmark also joined the exchange.<br />

Nord Pool offers two types of st<strong>and</strong>ardized contracts, physically settled <strong>and</strong><br />

financially settled contracts. The physically settled contracts are limited to the<br />

spot market. Every day is divided into 24 hourly contracts. Before noon, the<br />

previous day, all participants send in their bids for each hour as exemplified in<br />

Table 2.1. 28 Each participant specifies how much he is willing to buy or sell<br />

<strong>and</strong> at which price for each hour. This bid is binding <strong>and</strong> the procedure is called<br />

an auction, in contrary to continuous trading. This is done in order to gather all<br />

the liquidity to one point in time. From the bids Nord Pool achieves a supply<br />

<strong>and</strong> dem<strong>and</strong> curve for each participant <strong>and</strong> hour, which is thereafter aggregated<br />

to a total supply <strong>and</strong> dem<strong>and</strong> curve, from which the system price S p , is calculated<br />

as the equilibrium for each of the 24 hours, as illustrated in Figure 2.11.<br />

28 Norwegian Kronas (NOK) is the currency used by Nord Pool, 1 NOK A 0.19 USD.