Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

78 <strong>Contract</strong> engineering<br />

1800<br />

1600<br />

1400<br />

1200<br />

NOK/MWh<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

1 7 13 19 1 7 13 19<br />

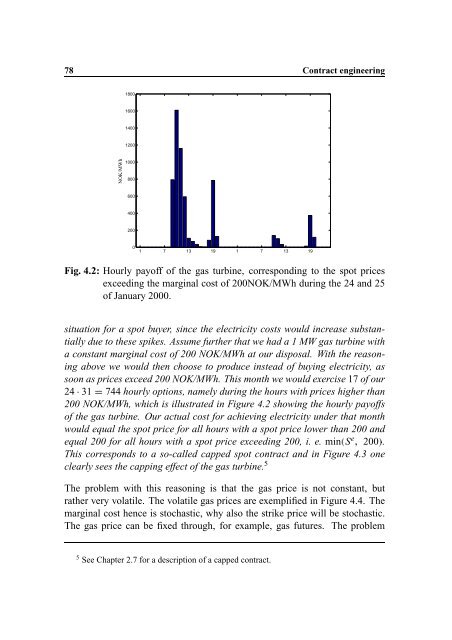

Fig. 4.2: Hourly payoff of the gas turbine, corresponding to the spot prices<br />

exceeding the marginal cost of 200NOK/MWh during the 24 <strong>and</strong> 25<br />

of January 2000.<br />

situation for a spot buyer, since the electricity costs would increase substantially<br />

due to these spikes. Assume further that we had a 1 MW gas turbine with<br />

a constant marginal cost of 200 NOK/MWh at our disposal. With the reasoning<br />

above we would then choose to produce instead of buying electricity, as<br />

soon as prices exceed 200 NOK/MWh. This month we would exercise 17 of our<br />

24 31 744 hourly options, namely during the hours with prices higher than<br />

200 NOK/MWh, which is illustrated in Figure 4.2 showing the hourly payoffs<br />

of the gas turbine. Our actual cost for achieving electricity under that month<br />

would equal the spot price for all hours with a spot price lower than 200 <strong>and</strong><br />

equal 200 for all hours with a spot price exceeding 200, i. e. min S eš 200› .<br />

This corresponds to a so-called capped spot contract <strong>and</strong> in Figure 4.3 one<br />

clearly sees the capping effect of the gas turbine. 5<br />

The problem with this reasoning is that the gas price is not constant, but<br />

rather very volatile. The volatile gas prices are exemplified in Figure 4.4. The<br />

marginal cost hence is stochastic, why also the strike price will be stochastic.<br />

The gas price can be fixed through, for example, gas futures. The problem<br />

5 See Chapter 2.7 for a description of a capped contract.