Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

duction cost<br />

Marginal pro<br />

Y<br />

^<br />

^<br />

[<br />

D 2G<br />

\<br />

40 The electricity market<br />

D<br />

2<br />

[<br />

1] D<br />

Total production<br />

Z<br />

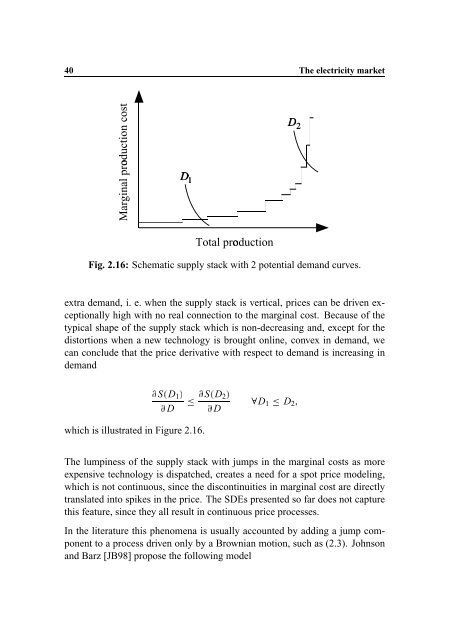

Fig. 2.16: Schematic supply stack with 2 potential dem<strong>and</strong> curves.<br />

extra dem<strong>and</strong>, i. e. when the supply stack is vertical, prices can be driven exceptionally<br />

high with no real connection to the marginal cost. Because of the<br />

typical shape of the supply stack which is non-decreasing <strong>and</strong>, except for the<br />

distortions when a new technology is brought online, convex in dem<strong>and</strong>, we<br />

can conclude that the price derivative with respect to dem<strong>and</strong> is increasing in<br />

dem<strong>and</strong><br />

D 1V SS<br />

^<br />

D<br />

D 2V SS<br />

^<br />

D<br />

D 1<br />

which is illustrated in Figure 2.16.<br />

The lumpiness of the supply stack with jumps in the marginal costs as more<br />

expensive technology is dispatched, creates a need for a spot price modeling,<br />

which is not continuous, since the discontinuities in marginal cost are directly<br />

translated into spikes in the price. The SDEs presented so far does not capture<br />

this feature, since they all result in continuous price processes.<br />

In the literature this phenomena is usually accounted by adding a jump component<br />

to a process driven only by a Brownian motion, such as (2.3). Johnson<br />

<strong>and</strong> Barz [JB98] propose the following model