Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

Hedging Strategy and Electricity Contract Engineering - IFOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

100 <strong>Contract</strong> engineering<br />

Flexibility<br />

Á<br />

Corresponding<br />

contracts<br />

Excess value<br />

(over DCF)<br />

Prevailing cost<br />

Ã<br />

Hydro storage plant<br />

Gas turbine<br />

¿<br />

High<br />

Bought options<br />

¿<br />

High<br />

Marginal cost<br />

(shadow cost)<br />

CCGT<br />

Oil plant<br />

Coal plant<br />

Ä<br />

Mixed<br />

Nuclear plant<br />

½<br />

Low<br />

¾<br />

Futures<br />

½<br />

Low<br />

Run river plant<br />

Wind plant<br />

Solar plant<br />

À<br />

Negative<br />

Sold<br />

½o<br />

ptions<br />

À<br />

Negative<br />

Fixed cost<br />

Â<br />

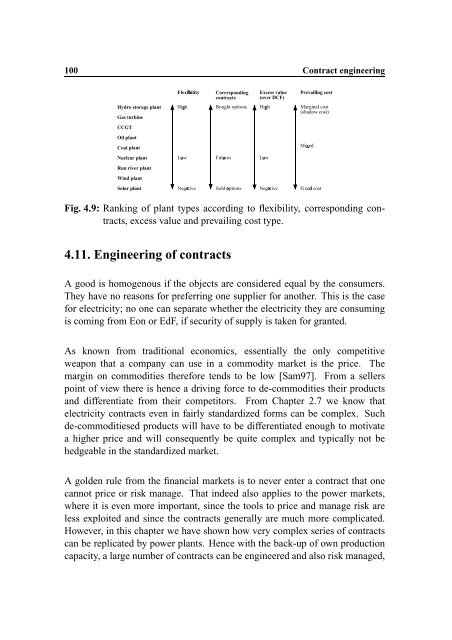

Fig. 4.9: Ranking of plant types according to flexibility, corresponding contracts,<br />

excess value <strong>and</strong> prevailing cost type.<br />

4.11. <strong>Engineering</strong> of contracts<br />

A good is homogenous if the objects are considered equal by the consumers.<br />

They have no reasons for preferring one supplier for another. This is the case<br />

for electricity; no one can separate whether the electricity they are consuming<br />

is coming from Eon or EdF, if security of supply is taken for granted.<br />

As known from traditional economics, essentially the only competitive<br />

weapon that a company can use in a commodity market is the price. The<br />

margin on commodities therefore tends to be low [Sam97]. From a sellers<br />

point of view there is hence a driving force to de-commodities their products<br />

<strong>and</strong> differentiate from their competitors. From Chapter 2.7 we know that<br />

electricity contracts even in fairly st<strong>and</strong>ardized forms can be complex. Such<br />

de-commoditiesed products will have to be differentiated enough to motivate<br />

a higher price <strong>and</strong> will consequently be quite complex <strong>and</strong> typically not be<br />

hedgeable in the st<strong>and</strong>ardized market.<br />

A golden rule from the financial markets is to never enter a contract that one<br />

cannot price or risk manage. That indeed also applies to the power markets,<br />

where it is even more important, since the tools to price <strong>and</strong> manage risk are<br />

less exploited <strong>and</strong> since the contracts generally are much more complicated.<br />

However, in this chapter we have shown how very complex series of contracts<br />

can be replicated by power plants. Hence with the back-up of own production<br />

capacity, a large number of contracts can be engineered <strong>and</strong> also risk managed,