PSA COUV page . page RA GB - PEUGEOT Presse

PSA COUV page . page RA GB - PEUGEOT Presse

PSA COUV page . page RA GB - PEUGEOT Presse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Growth Strategy<br />

Corporate<br />

Governance<br />

Business Review<br />

Corporate Policies<br />

Management’s<br />

Discussion<br />

and Analysis<br />

Statistics<br />

Total financing revenues break down as follows:<br />

(in millions of euros) 2002 2001 2000<br />

From third parties 1,530 1,375 1,203<br />

Intercompany 170 212 184<br />

Total Banque <strong>PSA</strong> Finance 1,700 1,587 1,387<br />

Revenues climbed 7.1% in 2002, after rising<br />

14.4% in 2001. These strong rates of<br />

growth were directly attributable to<br />

expansion of the loan portfolio and rapidly<br />

growing revenues from sales of maintenance,<br />

insurance and other financing-related<br />

services. Revenues from these services<br />

climbed 13% in 2002 to €111 million,<br />

building on a 19% gain in 2001.<br />

3. OPE<strong>RA</strong>TING MARGIN<br />

The Group’s business and earnings targets<br />

for 2002 were set in February 2002 based<br />

on two possible scenarios for the European<br />

automobile market – flat or a 2-4% decline<br />

compared with 2001. Assuming a flat<br />

market, the Group set as its target an<br />

operating margin of €2,900 million,<br />

including a 5% margin for the Automobile<br />

Division. Assuming a 2-4% decline, the<br />

targets were set at €2,800 million and<br />

4.8% respectively. Although the European<br />

automobile market contracted by 3% -<br />

corresponding to the second scenario –<br />

the Group succeeded in achieving the<br />

targets set under the first, more optimistic<br />

scenario. Total operating margin came in<br />

at €2,913 million, while the Automobile<br />

Division margin represented 5% of sales.<br />

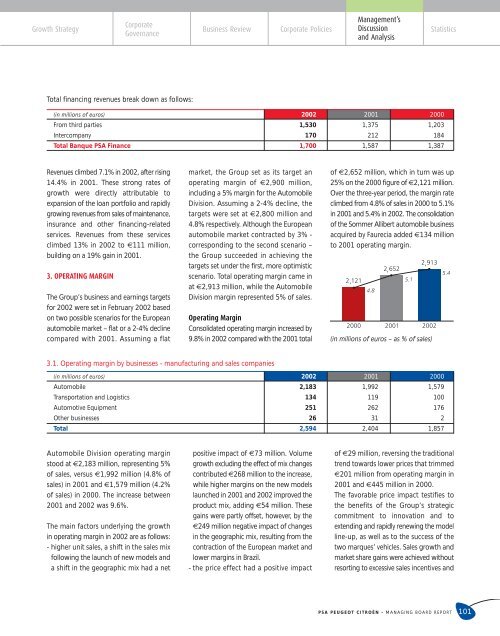

Operating Margin<br />

Consolidated operating margin increased by<br />

9.8% in 2002 compared with the 2001 total<br />

of €2,652 million, which in turn was up<br />

25% on the 2000 figure of €2,121 million.<br />

Over the three-year period, the margin rate<br />

climbed from 4.8% of sales in 2000 to 5.1%<br />

in 2001 and 5.4% in 2002. The consolidation<br />

of the Sommer Allibert automobile business<br />

acquired by Faurecia added €134 million<br />

to 2001 operating margin.<br />

(in millions of euros – as % of sales)<br />

3.1. Operating margin by businesses - manufacturing and sales companies<br />

(in millions of euros) 2002 2001 2000<br />

Automobile 2,183 1,992 1,579<br />

Transportation and Logistics 134 119 100<br />

Automotive Equipment 251 262 176<br />

Other businesses 26 31 2<br />

Total 2,594 2,404 1,857<br />

Automobile Division operating margin<br />

stood at €2,183 million, representing 5%<br />

of sales, versus €1,992 million (4.8% of<br />

sales) in 2001 and €1,579 million (4.2%<br />

of sales) in 2000. The increase between<br />

2001 and 2002 was 9.6%.<br />

The main factors underlying the growth<br />

in operating margin in 2002 are as follows:<br />

- higher unit sales, a shift in the sales mix<br />

following the launch of new models and<br />

a shift in the geographic mix had a net<br />

positive impact of €73 million. Volume<br />

growth excluding the effect of mix changes<br />

contributed €268 million to the increase,<br />

while higher margins on the new models<br />

launched in 2001 and 2002 improved the<br />

product mix, adding €54 million. These<br />

gains were partly offset, however, by the<br />

€249 million negative impact of changes<br />

in the geographic mix, resulting from the<br />

contraction of the European market and<br />

lower margins in Brazil.<br />

-the price effect had a positive impact<br />

of €29 million, reversing the traditional<br />

trend towards lower prices that trimmed<br />

€201 million from operating margin in<br />

2001 and €445 million in 2000.<br />

The favorable price impact testifies to<br />

the benefits of the Group’s strategic<br />

commitment to innovation and to<br />

extending and rapidly renewing the model<br />

line-up, as well as to the success of the<br />

two marques’ vehicles. Sales growth and<br />

market share gains were achieved without<br />

resorting to excessive sales incentives and<br />

<strong>PSA</strong> <strong>PEUGEOT</strong> CITROËN - MANAGING BOARD REPORT 101