PSA COUV page . page RA GB - PEUGEOT Presse

PSA COUV page . page RA GB - PEUGEOT Presse

PSA COUV page . page RA GB - PEUGEOT Presse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Growth Strategy<br />

Corporate<br />

Governance<br />

Business Review<br />

Corporate Policies<br />

Management’s<br />

Discussion<br />

and Analysis<br />

Statistics<br />

Automotive Equipment working capital<br />

declined by €84 million in 2002, after<br />

increasing by €127 million in 2001 (on a<br />

comparable basis) and €37 million in 2000.<br />

3.2. Cash flows from operating activities<br />

– finance companies<br />

Net cash provided by operating activities<br />

of the finance companies totaled<br />

€796 million in 2002 versus €1,820 million<br />

in 2001.<br />

Working capital provided by operations –<br />

corresponding more or less to net income<br />

– amounted to €239 million in 2002,<br />

€160 million in 2001 and €222 million in<br />

2000. Changes in operating assets and<br />

liabilities had a positive impact of<br />

€557 million in 2002 and €1,660 million<br />

in 2001. These figures correspond to the<br />

combined effect of changes in outstanding<br />

loans and the related refinancing, and to a<br />

lesser extent, to changes in other operating<br />

receivables and payables. As such, they<br />

primarily reflect Banque <strong>PSA</strong> Finance’s drive<br />

to build up cash reserves, in accordance<br />

with its financing strategy (see section<br />

1 above).<br />

3.3. Cash flows from investing activities<br />

In 2002, gross capital expenditure amounted<br />

to €2,802 million. This was slightly below<br />

the 2001 amount of €2,947 million, which<br />

in turn was close to the 2000 figure of<br />

€2,932 million. Capital expenditure over<br />

the last three years is in line with the<br />

Group’s medium-term target of capping<br />

capital budgets at €3,000 million per year.<br />

The main programs concern new product<br />

launches and the extension of the Group’s<br />

international presence. Capital expenditure,<br />

like R&D spending, has been contained<br />

thanks to the effectiveness of the platform<br />

strategy, which allows plant and tooling<br />

dedicated to a platform to be reused for<br />

all vehicles developed on the platform<br />

concerned.<br />

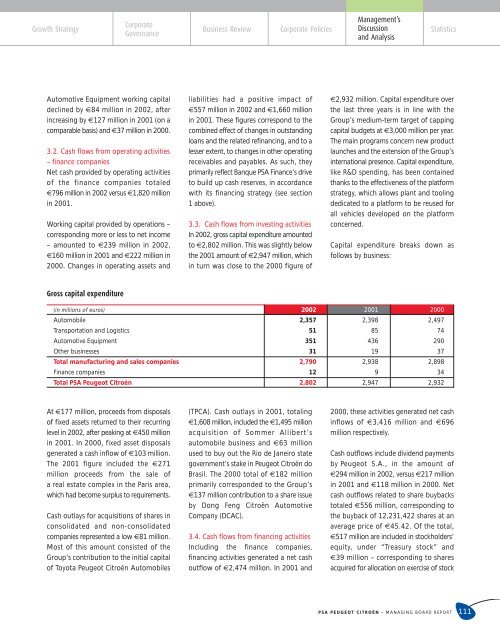

Capital expenditure breaks down as<br />

follows by business:<br />

Gross capital expenditure<br />

(in millions of euros) 2002 2001 2000<br />

Automobile 2,357 2,398 2,497<br />

Transportation and Logistics 51 85 74<br />

Automotive Equipment 351 436 290<br />

Other businesses 31 19 37<br />

Total manufacturing and sales companies 2,790 2,938 2,898<br />

Finance companies 12 9 34<br />

Total <strong>PSA</strong> Peugeot Citroën 2,802 2,947 2,932<br />

At €177 million, proceeds from disposals<br />

of fixed assets returned to their recurring<br />

level in 2002, after peaking at €450 million<br />

in 2001. In 2000, fixed asset disposals<br />

generated a cash inflow of €103 million.<br />

The 2001 figure included the €271<br />

million proceeds from the sale of<br />

a real estate complex in the Paris area,<br />

which had become surplus to requirements.<br />

Cash outlays for acquisitions of shares in<br />

consolidated and non-consolidated<br />

companies represented a low €81 million.<br />

Most of this amount consisted of the<br />

Group’s contribution to the initial capital<br />

of Toyota Peugeot Citroën Automobiles<br />

(TPCA). Cash outlays in 2001, totaling<br />

€1,608 million, included the €1,495 million<br />

acquisition of Sommer Allibert’s<br />

automobile business and €63 million<br />

used to buy out the Rio de Janeiro state<br />

government’s stake in Peugeot Citroën do<br />

Brasil. The 2000 total of €182 million<br />

primarily corresponded to the Group’s<br />

€137 million contribution to a share issue<br />

by Dong Feng Citroën Automotive<br />

Company (DCAC).<br />

3.4. Cash flows from financing activities<br />

Including the finance companies,<br />

financing activities generated a net cash<br />

outflow of €2,474 million. In 2001 and<br />

2000, these activities generated net cash<br />

inflows of €3,416 million and €696<br />

million respectively.<br />

Cash outflows include dividend payments<br />

by Peugeot S.A., in the amount of<br />

€294 million in 2002, versus €217 million<br />

in 2001 and €118 million in 2000. Net<br />

cash outflows related to share buybacks<br />

totaled €556 million, corresponding to<br />

the buyback of 12,231,422 shares at an<br />

average price of €45.42. Of the total,<br />

€517 million are included in stockholders’<br />

equity, under “Treasury stock” and<br />

€39 million – corresponding to shares<br />

acquired for allocation on exercise of stock<br />

<strong>PSA</strong> <strong>PEUGEOT</strong> CITROËN - MANAGING BOARD REPORT 111