PSA COUV page . page RA GB - PEUGEOT Presse

PSA COUV page . page RA GB - PEUGEOT Presse

PSA COUV page . page RA GB - PEUGEOT Presse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- A new defined contribution supplementary pension plan was set up<br />

on July 1, 2002.<br />

Under this plan, eligible employees will be entitled to supplementary<br />

pension benefits if their compensation exceeds the ceiling for social<br />

security contributions during all or part of their remaining service lives<br />

from the date on which the plan was set up. The rights of eligible<br />

employees corresponding to the defined contributions will vest<br />

immediately. Two-thirds of the contributions are paid by the employer<br />

and one-third by the employee.<br />

Since it is a defined contribution plan, the Group has no future<br />

obligations towards employees under the plan. The cost of the plan is<br />

charged to income when the contributions are paid.<br />

4. Periodic pension cost<br />

The total obligation is determined at each year-end as explained above.<br />

The periodic pension cost each year corresponds to:<br />

- service cost, representing the benefit entitlements earned by<br />

employees during the year,<br />

- interest cost, corresponding to adjustments to the discounted present<br />

value of the opening projected benefit obligation,<br />

- amortization of deferred items.<br />

The periodic pension cost is partially offset by the return on external<br />

funds, calculated on the basis of a standard rate of return on long term<br />

investments (8 % up to 1999, 7.5% as from 2000). The difference<br />

between the standard rate of return and the actual return on external<br />

funds (for French funds, (2.59%) in 2002, (0.9%) in 2001, 3.3 % in<br />

2000) is deducted from or added to the unamortized net obligation.<br />

The periodic pension cost is included in payroll costs except for the<br />

€82 million net exceptional cost arising from the June 2002 change in<br />

the Group’s supplementary pension plans. It can be analyzed as follows:<br />

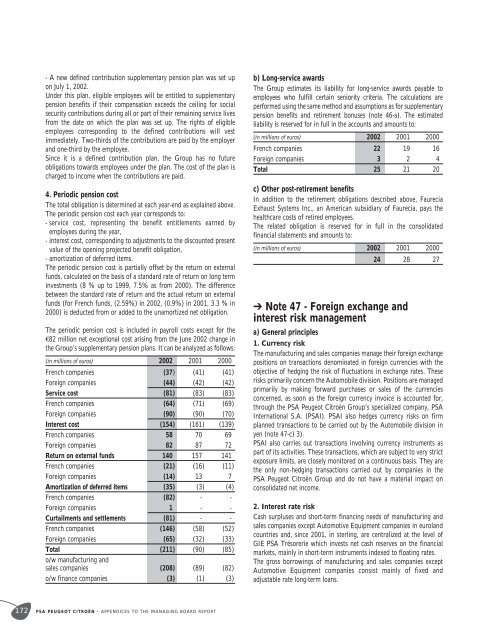

(in millions of euros) 2002 2001 2000<br />

French companies (37) (41) (41)<br />

Foreign companies (44) (42) (42)<br />

Service cost (81) (83) (83)<br />

French companies (64) (71) (69)<br />

Foreign companies (90) (90) (70)<br />

Interest cost (154) (161) (139)<br />

French companies 58 70 69<br />

Foreign companies 82 87 72<br />

Return on external funds 140 157 141<br />

French companies (21) (16) (11)<br />

Foreign companies (14) 13 7<br />

Amortization of deferred items (35) (3) (4)<br />

French companies (82) - -<br />

Foreign companies 1 - -<br />

Curtailments and settlements (81) - -<br />

French companies (146) (58) (52)<br />

Foreign companies (65) (32) (33)<br />

Total (211) (90) (85)<br />

o/w manufacturing and<br />

sales companies (208) (89) (82)<br />

o/w finance companies (3) (1) (3)<br />

b) Long-service awards<br />

The Group estimates its liability for long-service awards payable to<br />

employees who fulfill certain seniority criteria. The calculations are<br />

performed using the same method and assumptions as for supplementary<br />

pension benefits and retirement bonuses (note 46-a). The estimated<br />

liability is reserved for in full in the accounts and amounts to:<br />

(in millions of euros) 2002 2001 2000<br />

French companies 22 19 16<br />

Foreign companies 3 2 4<br />

Total 25 21 20<br />

c) Other post-retirement benefits<br />

In addition to the retirement obligations described above, Faurecia<br />

Exhaust Systems Inc., an American subsidiary of Faurecia, pays the<br />

healthcare costs of retired employees.<br />

The related obligation is reserved for in full in the consolidated<br />

financial statements and amounts to:<br />

(in millions of euros) 2002 2001 2000<br />

24 28 27<br />

➔ Note 47 - Foreign exchange and<br />

interest risk management<br />

a) General principles<br />

1. Currency risk<br />

The manufacturing and sales companies manage their foreign exchange<br />

positions on transactions denominated in foreign currencies with the<br />

objective of hedging the risk of fluctuations in exchange rates. These<br />

risks primarily concern the Automobile division. Positions are managed<br />

primarily by making forward purchases or sales of the currencies<br />

concerned, as soon as the foreign currency invoice is accounted for,<br />

through the <strong>PSA</strong> Peugeot Citroën Group's specialized company, <strong>PSA</strong><br />

International S.A. (<strong>PSA</strong>I). <strong>PSA</strong>I also hedges currency risks on firm<br />

planned transactions to be carried out by the Automobile division in<br />

yen (note 47-c) 3).<br />

<strong>PSA</strong>I also carries out transactions involving currency instruments as<br />

part of its activities. These transactions, which are subject to very strict<br />

exposure limits, are closely monitored on a continuous basis. They are<br />

the only non-hedging transactions carried out by companies in the<br />

<strong>PSA</strong> Peugeot Citroën Group and do not have a material impact on<br />

consolidated net income.<br />

2. Interest rate risk<br />

Cash surpluses and short-term financing needs of manufacturing and<br />

sales companies except Automotive Equipment companies in euroland<br />

countries and, since 2001, in sterling, are centralized at the level of<br />

GIE <strong>PSA</strong> Trésorerie which invests net cash reserves on the financial<br />

markets, mainly in short-term instruments indexed to floating rates.<br />

The gross borrowings of manufacturing and sales companies except<br />

Automotive Equipment companies consist mainly of fixed and<br />

adjustable rate long-term loans.<br />

172<br />

<strong>PSA</strong> <strong>PEUGEOT</strong> CITROËN - APPENDICES TO THE MANAGING BOARD REPORT