Report - London Borough of Hillingdon

Report - London Borough of Hillingdon

Report - London Borough of Hillingdon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

huge benefits <strong>of</strong> public access and the education opportunities cannot easily be<br />

dismissed.<br />

Corporate Finance Services<br />

25. The capital cost <strong>of</strong> purchasing The Barn is likely to rise to the £1.6m identified<br />

by the consultants in their condition report in the medium term, with further costs<br />

arising over the long term. In addition, revenue costs <strong>of</strong> maintaining the site are<br />

projected to rise to £172k by 2015/16. Both <strong>of</strong> these growth items should be<br />

considered in the context <strong>of</strong> the severe constraints on both revenue and capital<br />

resources. Additionally, the HIP Asset Management Strategy is attempting to reduce<br />

the authority’s property maintenance backlog <strong>of</strong> £18m (which excludes the Civic<br />

Centre). Reducing the number <strong>of</strong> expensive to maintain buildings is a significant part<br />

<strong>of</strong> this strategy. This purchase without at the same time securing the relevant<br />

external funding would increase both the maintenance backlog and the number <strong>of</strong><br />

expensive to maintain buildings. In this context the purchase <strong>of</strong> the barn would not<br />

appear to be a prudent use <strong>of</strong> resources. However, this financial case needs to be<br />

weighed against the benefits to the community that might result from its purchase.<br />

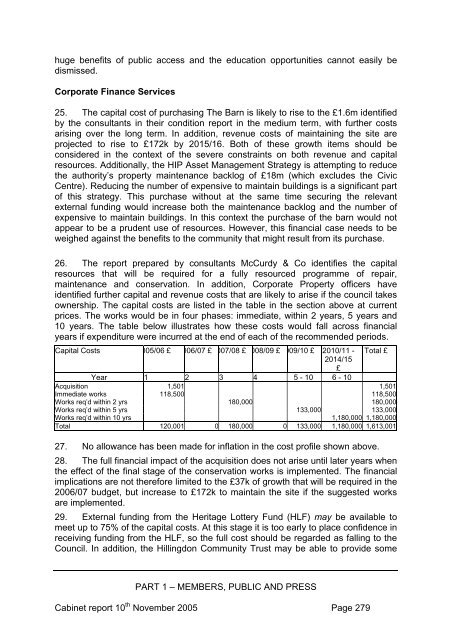

26. The report prepared by consultants McCurdy & Co identifies the capital<br />

resources that will be required for a fully resourced programme <strong>of</strong> repair,<br />

maintenance and conservation. In addition, Corporate Property <strong>of</strong>ficers have<br />

identified further capital and revenue costs that are likely to arise if the council takes<br />

ownership. The capital costs are listed in the table in the section above at current<br />

prices. The works would be in four phases: immediate, within 2 years, 5 years and<br />

10 years. The table below illustrates how these costs would fall across financial<br />

years if expenditure were incurred at the end <strong>of</strong> each <strong>of</strong> the recommended periods.<br />

Capital Costs 005/06 £ 006/07 £ 007/08 £ 008/09 £ 009/10 £ 2010/11 - Total £<br />

2014/15<br />

£<br />

Year 1 2 3 4 5 - 10 6 - 10<br />

Acquisition 1,501 1,501<br />

Immediate works 118,500 118,500<br />

Works req’d within 2 yrs 180,000 180,000<br />

Works req’d within 5 yrs 133,000 133,000<br />

Works req’d within 10 yrs 1,180,000 1,180,000<br />

Total 120,001 0 180,000 0 133,000 1,180,000 1,613,001<br />

27. No allowance has been made for inflation in the cost pr<strong>of</strong>ile shown above.<br />

28. The full financial impact <strong>of</strong> the acquisition does not arise until later years when<br />

the effect <strong>of</strong> the final stage <strong>of</strong> the conservation works is implemented. The financial<br />

implications are not therefore limited to the £37k <strong>of</strong> growth that will be required in the<br />

2006/07 budget, but increase to £172k to maintain the site if the suggested works<br />

are implemented.<br />

29. External funding from the Heritage Lottery Fund (HLF) may be available to<br />

meet up to 75% <strong>of</strong> the capital costs. At this stage it is too early to place confidence in<br />

receiving funding from the HLF, so the full cost should be regarded as falling to the<br />

Council. In addition, the <strong>Hillingdon</strong> Community Trust may be able to provide some<br />

PART 1 – MEMBERS, PUBLIC AND PRESS<br />

Cabinet report 10 th November 2005 Page 279