Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Annual Report 2011 - Ford Motor Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

NOTE 2. SUMMARY OF ACCOUNTING POLICIES (Continued)<br />

Labor Costs<br />

On October 26, <strong>2011</strong>, we signed a new national labor agreement with the UAW covering approximately 41,000<br />

employees in the United States ("Agreement"). Among other things, the Agreement sets wages and benefits for the<br />

covered employees for a four-year period expiring in September 2015.<br />

The Agreement provided for a ratification bonus of $6,000 to most of the covered employees. These bonuses were<br />

paid, and the full amount of the expense recorded, in the fourth quarter of <strong>2011</strong>.<br />

Covered employees also will receive four annual operational performance bonuses of up to $250 per year beginning<br />

in December <strong>2011</strong>, and four annual inflation protection lump sum payments in the amount of $1,500 per year beginning in<br />

June 2012. The first operational performance bonus in the amount of $250 was paid and expensed in the fourth quarter<br />

of <strong>2011</strong>. The subsequent operational performance bonuses will be expensed over the twelve-month period leading up to<br />

each payment date. The first inflation protection lump sum payment will be expensed over the eight-month period leading<br />

up to the June 2012 payment date; each subsequent lump sum payment will be expensed over the twelve-month period<br />

leading up to the respective June payment date.<br />

The Agreement also modifies the method for calculating payment to covered employees under our profit sharing plan.<br />

Planned profit sharing payments are accrued throughout the year in which the payment is earned. Each quarter, we<br />

evaluate and adjust as necessary the year to date accrual to ensure that it is consistent with our expected full year profit<br />

and current profit sharing plan in place at the end of the quarter. We generally make any payment under the profit sharing<br />

plan in the first quarter subsequent to the year in which it is earned. We made a partial payment in the fourth quarter of<br />

<strong>2011</strong>, based on first half <strong>2011</strong> <strong>Ford</strong> North America profits, with the remainder of the <strong>2011</strong> profit sharing payment to be<br />

made in the first quarter of 2012.<br />

Payments made pursuant to the Agreement are recognized in Automotive cost of sales.<br />

Selected Other Costs<br />

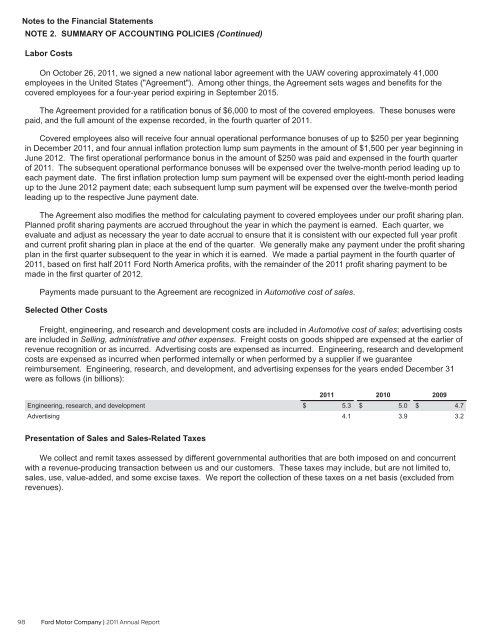

Freight, engineering, and research and development costs are included in Automotive cost of sales; advertising costs<br />

are included in Selling, administrative and other expenses. Freight costs on goods shipped are expensed at the earlier of<br />

revenue recognition or as incurred. Advertising costs are expensed as incurred. Engineering, research and development<br />

costs are expensed as incurred when performed internally or when performed by a supplier if we guarantee<br />

reimbursement. Engineering, research, and development, and advertising expenses for the years ended December 31<br />

were as follows (in billions):<br />

Engineering, research, and development<br />

Advertising<br />

Presentation of Sales and Sales-Related Taxes<br />

98 <strong>Ford</strong> <strong>Motor</strong> <strong>Company</strong> | <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

<strong>2011</strong><br />

$ 5.3<br />

4.1<br />

2010<br />

$ 5.0<br />

3.9<br />

2009<br />

$ 4.7<br />

3.2<br />

We collect and remit taxes assessed by different governmental authorities that are both imposed on and concurrent<br />

with a revenue-producing transaction between us and our customers. These taxes may include, but are not limited to,<br />

sales, use, value-added, and some excise taxes. We report the collection of these taxes on a net basis (excluded from<br />

revenues).